Quality Compounder Down -45% 💎

Quality business with exposure to AI, data centers, and hyperscalers 🚀

Hi Investor! 👋

Today, we’ll analyze Arista Networks (ANET 0.00%↑), a tech giant providing the infrastructure required for the AI cloud computing surge.

Arista is a prominent leader within the Artificial intelligence sphere. The business works behind the scenes and is not discussed as frequently as Nvidia or the different AI models, but their products and services are essential to building and scaling these AI systems.

Let’s discuss if it’s worth your money in today’s climate.

Investment Thesis

Arista Networks is uniquely positioned and benefits directly from artificial intelligence's explosive growth. Data centers and cloud computing are other areas experiencing massive growth.

Arista maintains a strong foothold due to technological leadership and recurring streams of revenue. Moreover, the business is also financially disciplined and has a cutting-edge EOS. Over the years, it has developed some deep partnerships with industry-leading hyperscalers such as Meta and Microsoft.

A Net Promoter Score of 87 clearly indicates its dedication to customer service. It has various multi-year contracts, which help it remain profitable with a loyal customer base. As a result, Arista has high gross margins at nearly 64%, no long-term debt, and great financials.

Reasons to Own Arista

The main reason for investing in Arista is its high potential for growth in the near future. While there might be volatility here and there, the forecasts indicate a 17% annual growth rate.

The volatility at one end is caused by the spending cycles in technology. Whereas, stability is brought about by the structured demand for AI infrastructure.

More About Arista’s Business

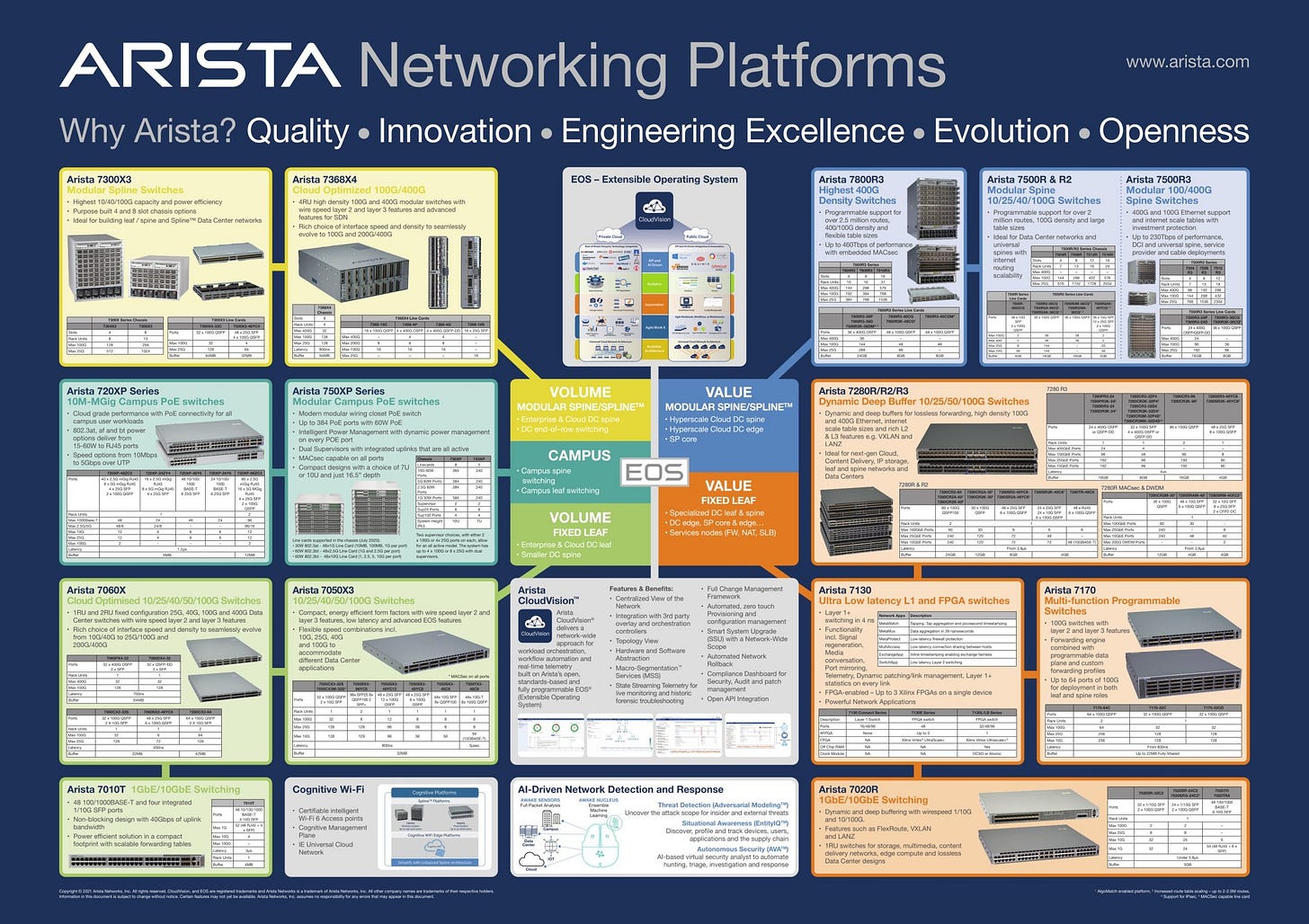

Headquartered in Santa Clara, it primarily designs and sells the following:

Multilayer network switches

Software

Hardware for large-scale data centers

High-performance computing environments

Cloud-based infrastructures

Ever since its launch in 2004, it has expanded its product line to include networking software, 800G routers, Ethernet switches, and more. Furthermore, what sets it apart is its EOS or Extensible Operating System.

It’s a software layer that’s not only programmable but also scalable. Thus, offering reliability, speed, and flexibility.

Main Revenue Streams

How does Arista make money? Well, Arista Networks primarily profits from sales of high-performance Ethernet switches and routers. The software licenses (including its EOS operating system) and post-sale services, such as technical support and maintenance, also contribute greatly.

Its key customers include:

Hyperscale Cloud Providers: Meta, Microsoft Azure, Google Cloud Platform, AWS, etc.

Enterprises: Goldman Sachs, Deutsche Bank, and more.

Service Providers: Comcast, AT&T, etc.

The AI infrastructure offered by Arista is rapidly gaining traction. Moreover, the explosion of generative AI and large language models has generously helped. Due to the high demand for cloud-based services, data centers are now scaling at an unprecedented pace.

A 29% CAGR in data creation will drive the demand for data centers:

The Financials of Arista

Now, let’s crunch the numbers. So far, the financial performance has been nothing short of excellent. Further, the projections are looking even better at a 17% increase for 2025.

2024: The year 2024 ended with $7.003 billion in revenue, a massive 19.5% jump from 2023.

4th Quarter 2024: Analyzing fourth-quarter results, it ended with a revenue of $1.930 billion, a 6.6% increase from that of quarter three.

Gross Margin: Arista has consistently maintained gross margins of 60 %+.

The main factor behind these great figures is the high-value hardware offerings. It generates quite a lot of free cash flow. That FCF is utilized by the ANET for stock buybacks and strategic investments.

5-year financial performance

Arista Networks’ financial performance over the past 5 years has been nothing but amazing:

Revenue per share +30.7% CAGR

EPS Diluted +45.3%

Free cash flow per share +50%

ROIC from 42.6% → 57%

Stock Performance

The current price of ANET stands at around $68.17. The stock has significantly outperformed the S&P 500 over the last five years. Also, it has climbed over 400% since 2020.

Arista’s Competitive Edge

The most prominent advantage of ANET is its hold over cloud data center networking. This is in comparison to the major competitors such as Cisco Systems and Juniper Networks. New Entrants such as Nvidia are also among the key competitors in the field.

Even though Cisco is a giant in traditional enterprise IT markets, Arista has taken over next-gen networking. It has effectively carved out a high-margin, high-growth niche for itself.

Here are some other noteworthy advantages of ANET:

Cloud-native Environment Stronghold: Arista has now become the go-to vendor for greenfield. These are AI-optimized data centers.

Collaborations with Hyperscalers: The clientele includes Microsoft Azure and Meta, amongst others.

Superior Software Stack: The Arista EOS offers modularity and programmability. This is something that traditional networking vendors can’t match.

Some Impressive Strategic Decisions

Lately, Arista has been expanding its reach and entering other fields. These are beyond its cloud data center markets:

Campus Networking: With competitors like Cisco.

AI Ethernet Fabrics: Provides AI training workload solutions.

Security: Making use of powerful acquisitions like Awake Security. Offering advanced network detection and response (NDR) tools.

Risks To Consider

All’s not rosy, even for Arista. Before investing, you must properly analyze the following risks:

Reliance on Big Clients: Meta and Microsoft make up the majority of the customers. They collectively contribute to around 35% of revenue.

Valuation: The soaring expectations are factored into the valuation. A slowdown might cause a pullback.

High Competition: Powerful competitors such as Nvidia and Cisco are constantly looking to outperform Arista.

The Valuation: Our Verdict