Q2 2023 Portfolio Update

Sharing my performance, moves and thoughts about Q2 23

Sharing my 3 most popular write-ups from Q2 23:

Q2 2023 Performance

2023 has been good for my portfolios, providing a total YTD return of 45%. Although my Scandinavian investments had a pause this quarter, my US investments continue to perform well, providing a satisfactory result for Q2 (That said, I don’t care at all about a few quarters’ performance).

SPY -0.45%↓ did 7.45% in Q2 2023

KLP Global Index did 9.27% in Q2 2023 (What I would invest in if I went 100% index)

How did I do in Q2 23?

First off, I have 2 different portfolios for tax purposes:

“Nordic Compounders” and “International Compounders”

NC holds Scandinavian stocks only

IC holds global stocks (US, Canada, Netherlands, and some Scandinavian stocks because I refuse to sell and pay transaction fees)

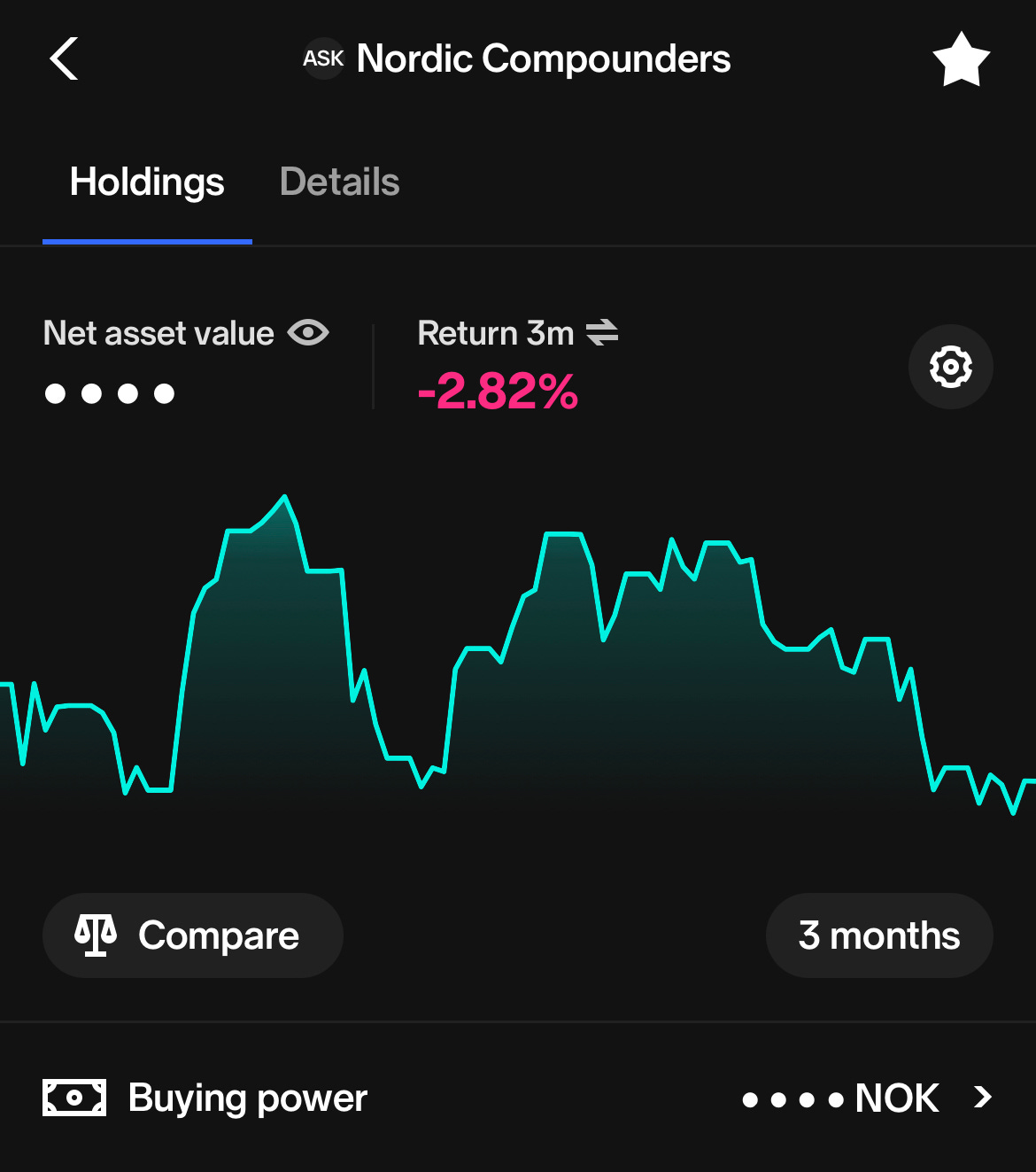

Nordic Compounders

My top holding is Evolution Gaming $EVO.ST which contracted by ~1.8% in the quarter, after a solid 36,71% run in Q1 23

I’ve also had negative FX effects in Q2, subtracting the value of my Swedish investments by ~3%.

My Nordic Compounder portfolio is highly concentrated and the Scandinavian names I hold are:

Evolution Gaming $EVO.ST (-1.8% Q2)

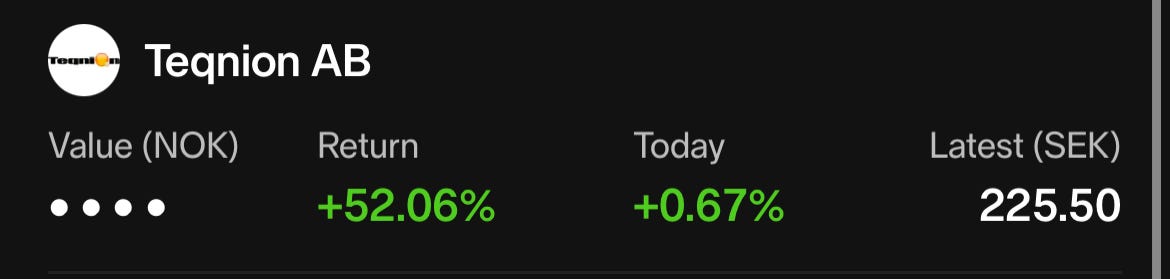

Teqnion (+23% Q2) $TEQ.ST Added in Q2

AF Gruppen (+13% Q2) $AFG.OL Added in Q2

Admicom (-6% Q2) - $ADMCM.HE Added in Q2

I did not sell or trim any positions in Q2.

Nordic Coumpounders Q2 Performance -2.82%:

Nordic Compounders YTD performance +34.81%:

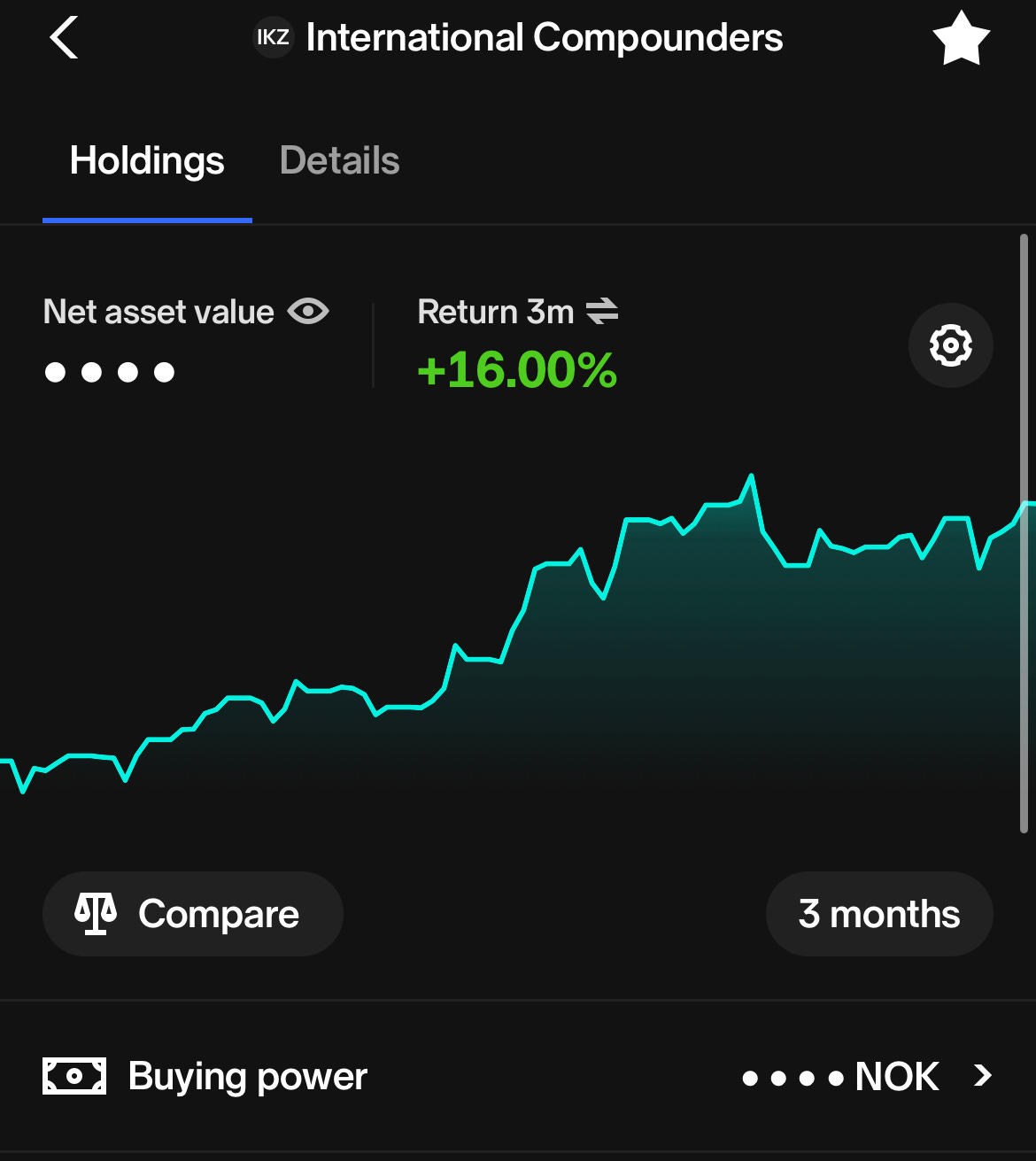

International Compounders

My top holding is Amazon AMZN -1.05%↓ which grew ~26% in Q2, following a strong Q1 with a price increase of 22,96%.

I’ve also had FX headwinds this quarter subtracting ~3% of my USD investments.

My International Compounders portfolio is concentrated on a few global compounders:

Amazon AMZN -1.05%↓ (+26% Q2)

Alphabet GOOGL -0.77%↓ (+11% Q2)

Constellation Software $CSU.TO (+4% Q2)

Microsoft MSFT 0.29%↑ (+17% Q2)

LVMH $LVMH (+3% Q2)

Qualys QLYS -0.73%↓ (+1.6% Q2)

Mastercard MA 0.32%↑ (+9% Q2)

Visa V 0.05%↑ (+6% Q2)

Adyen $ADYEY (+11% Q2)

Evolution Gaming and Teqnion

International Coumpounders Q2 Performance +16%:

International Coumpounders YTD Performance +53.31%:

Thoughts on Q2 2023

Large positions

Microsoft

Some of my larger holdings moved quite a bit this quarter, moving the needle for my portfolio (Specifically Amazon and Microsoft). Microsoft is riding the recent AI-hype train and is currently trading at a PE above 35. Even though I think this price is high, and I would not purchase Microsoft currently, I won’t sell it either. I believe that quality companies that are participating in several markets with secular trends, often suprise to the upside. And my assessment is that keeping Microsoft as is, is a better long-term play, than selling it for an index fund for example.

Amazon

The market has begun to recognize the possibilities in Amazon, although I have not yet seen the fundamental ‘turnaround’ I expect to see from Amazon just yet. I’m patiently waiting for Amazon to provide better financial results by focusing on their “best horses” and cutting some of their massive spending. If the price continues to rise in anticipation of this happening, but the results are heading in the other direction, I might reevaluate my position at Amazon.

Q2 Moves

Added to my position in Admicom. Admincom is continuing its downward trend, although it has flattened out. This is as expected as their business is contracting somewhat in line with the construction sector. I’m expecting better results and a ‘turnaround’ in 2024. I currently find this business attractive, as long as they can execute as expected.

Added to my position in AF Gruppen (Construction company). AF Gruppen has provided a profit warning for the next quarter. It is expected that construction businesses will contract somewhat, although my thesis is that AF Gruppen will handle a downturn fine, and come out of it in a strong fashion. I am however monitoring the business performance for the next few quarters, and I might trade this position in for the Danish firm AOJ if I don’t see them delivering after my expectations.

Added to my position in Teqnion. This little not-so-hidden gem has been on a roll over the last few months. I have had favorable entries, and been able to pick up shares when the stock has shown weakness. International investors are piling into this company after it was mentioned in “We Study Millionaires”, where the Co-Founder “Stig” disclosed that he has a position in the company. The business is currently trading at a premium to other serial acquirers and will have to execute on a high level to justify the premium imho. My entries and return from Teqnion:

Generel Q2 and Q3 thoughts

I don’t care much for a single quarter’s performance, be it business- or stock price performance. It is always nice to “beat” the index, but I apply Rochon’s rule of threes to this, as I expect to underperform at 1 out of 3 years, I expect 1 out of 3 stocks to be a mistake.

Q2 2023 was an uneventful quarter for my portfolio. As many of my businesses grow in stock price, I need to see their earnings grow accordingly. Many of my stocks are reaching what I deem “fair value”, and the opportunities are much more infrequent than in Q2-Q3 of 2022. I think it is wise to show greater caution in periods when everything seems to be fine, and stocks keep on increasing in value. I am constantly thinking about my portfolio and the alternative costs of selling one position and taking a new position.

I have no forecasts for Q3 other than that I expect my businesses to do well, as they do (almost) every quarter, and continue to compound their revenues, earnings, and free cash flows.

I deployed ~5% cash in Q2 to opportunities as I saw it in the above-mentioned businesses. I added continuously to my investing account, which leaves me at a cash position of ~7.5%. I am looking at a few possible new positions for Q3 2023, but I am following these businesses tightly to learn more and see that the business is developing as I expect.

I’m not an expert in FX, but I’m assuming I will feel the mean reversion of the USDNOK relationship at some point, negatively impacting my portfolio. 3% subtraction for this quarter is not bad and is what I expect after such a run-up. I won’t hedge against this, but I will prefer Scandinavian opportunities from US ones moving into Q3 (Hence my investment in AF Gruppen, Admicom, and Teqnion - although the EUR relationship is not ideal either).

Leaving you with this quote to consider as I’m currently re-reading the Intelligent Investor:

"The intelligent investor is a realist who sells to optimists and buys from pessimists”

- Benjamin Graham

Thanks for this great article.

Great performance!! Well done sir 👏