PayPal - A Falling Star or a Quality Business Trading at a Discount?

Unpopular and Priced like a Commodity stock, High Margins, High Free Cash Flow generations and decent return on capital.

The Business

PayPal (PYPL) is a pure-play payment compounder that is intricately tied to the global e-commerce market and the widespread adoption of digital payments. Consensus expects PayPal to achieve a top-line growth rate of 10-12% annually, with an EBITDA margin and return on invested capital (ROIC) exceeding 20%. Furthermore, PayPal is projected to generate approximately 7% of its market capitalization as free cash flow (FCF) in 2023. The company also has a strong balance sheet with $10.66 billion in cash, accounting for approximately 15% of its current Mcap.

The Fundamentals

Operational

ROCE: 11.7%

Gross Margin: 49%

Operating Margin: 16%

FCF/Net Income: 5Y: 181%

Growth (5-Year CAGR)

Revenue: 16%

Operating Income: 12.3%

EPS: 7.3%

FCF: 22.3%

Shares outstanding are down 4% in the 5 year period

Valuation metrics

Price/Sales: 2.54 vs. 5-year average: 8.3

Price/Foward earnings: 10 vs. 35

Price/Book Value: 3.5 vs. 9

PEG: 0.52

EBIT/Enterprise Value: 16.7 vs. 43

Business Segments

Let's take a closer look at PayPal's business. The company boasts 400 million consumer accounts and 35 million merchant accounts, with 92% of its revenues generated from transaction fees. PayPal operates through various business segments:

PayPal Branded Digital Wallet: This segment enables merchants to receive payments from the 400 million consumer accounts. It includes features such as "buy now pay later." Merchants pay PayPal a transaction fee of 3.49% plus $0.49.

Braintree: Acquired by PayPal in 2013, Braintree offers end-to-end e-commerce payment processing. This segment competes with companies like Stripe and Adyen. Braintree's impressive client list includes Uber, Doordash, Airbnb, Google, Meta, TikTok, and Live Nation. The take rate for Braintree is 2.59% plus $0.49, although the actual rate may vary depending on the client.

Venmo: Venmo is a free peer-to-peer payment service used primarily as a customer acquisition tool. With over 80 million annual users, PayPal aims to monetize this customer base by adding services over-the-top (OTT). For example, PayPal launched "Pay with Venmo" on Amazon in late 2022, and considering that Amazon accounts for 40% of US e-commerce volumes, this presents a significant opportunity. In 2022, Venmo generated $246 billion in transaction volume, resulting in revenue of approximately $1.3 billion, with a take-rate of 0.54%.

Other Value-Added Services: This segment accounted for 8% of PayPal's revenues in 2022 and includes revenues from partnerships, co-branding, interest from loans, and cash deposits, among other sources.

Paypal’s two-sided platform:

The stock

The stock has compounded by 7.5% annually since it was spun out from eBay in 2015. This is however not a fair portrait of the company, as the shares have suffered since 2021, contracting by ~76% from its ATHs.

The Decline

Despite its strong fundamentals, PayPal's stock has witnessed a significant decline of 76% from its all-time highs (ATHs). Several factors can explain this downward trend.

Firstly, e-commerce growth has slowed down post-pandemic, dampening expectations for PayPal's future performance.

Additionally, concerns over higher interest rates and the normalization of credit metrics have affected market sentiment.

Moreover, PayPal reported a decline in earnings per share (EPS) in 2022, raising doubts about its ability to maintain its market share against competitors.

Reduction in take rates and intensified competition. This has led investors to question the strength of PayPal's competitive advantage or "moat."

Sustainable competitive advantage

Network Effects

PayPal's competitive advantage lies in its network effects. The more consumer accounts it has, the more attractive it becomes to merchants, making its 400 million users a valuable asset. According to a ComScore study, PayPal drives a 60% improvement in sales conversion compared to other payment methods. Furthermore, PayPal is accepted by 79% of the top 1,500 online retailers, significantly higher than the acceptance rates for Apple Pay (28%) and Amazon Pay (15%). However, it is important to note that PayPal's competitive position is not considered a wide moat.

Brand value and trust

PayPal is a well-known brand that has been central in the digital payments space for decades. PayPal has a competitive advantage from its brand and building trust with consumers and merchants. This is showcased by its Net Promoter Score of 78%. It is the 109th-ranked global brand and #30 in “Tech”:

PayPal is well-positioned to benefit from strong secular trends, including the growth of digital payments, the ongoing process of digitalization, and the rise of peer-to-peer lending. These factors provide a favorable backdrop for PayPal's long-term growth potential.

I don’t think PayPal has a wide moat, but they certainly have a favorable competitive position or a "narrow moat”.

Why own PayPal?

There are several compelling reasons to own PayPal despite the recent challenges it has faced.

Cost pressures are expected to be transitory rather than structural, indicating that PayPal's profitability should rebound.

Competition has not suddenly intensified, and PayPal maintains a strong position in the competitive payment market.

The market has set low expectations for the company, making it potentially easier for PayPal to surpass them.

PayPal is a fundamentally attractive business with stable revenue growth, strong margins, a clean balance sheet, and robust cash flow generation.

PayPal's increasing accessibility on large online retailers like Amazon.com and the potential for Venmo to further monetize its user base offers significant upside.

Elliot Management, an influential investment firm has secured a seat on PayPal's board. Elliot Management is pushing for cost-cutting measures, which could potentially impact the company's operations and profitability.

The stock's attractive valuation compared to similar businesses adds to the appeal of owning PayPal.

The Risk

There are risks to consider.

A slowdown in e-commerce growth

Intensified competition

The impending replacement of the CEO and CFO could introduce uncertainties and impact PayPal's performance.

What is the intrinsic value of PayPal?

Currently, PayPal is trading at approximately 10 times its 2024 EBITDA and 13 times its EPS. This represents a discount of 40% from pre-COVID levels, indicating that the stock may be undervalued. Comparing PayPal to similar businesses of comparable quality, PayPal appears to be attractively priced.

As showcased in “The Fundamentals”-section, PayPal valuation metrics are way lower than they have been historically. This creates a backdrop for us to do a DCA.

Discounted Cash Flow Analysis

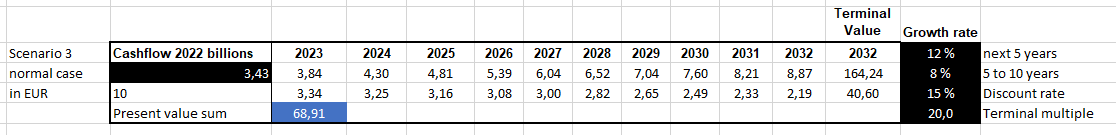

My normal scenario: 12% growth for the next 5 years, then 8% for the next 5 years, and a multiple of 20 at the end of the period (Using a 10% discount rate)

My worst case scenario: 8%—6%—15

My best case scenario: 15%—12%—25

My DCA suggests a fair value of $94 billion. This suggests a 36% upside or margin of safety on the 10% we expect.

Given PayPal’s opportunity for multiple expansions, strong fundamentals, cash flows, and cash position this is a solid upside.

My requirement of 15% is satisfied in the normal scenario:

Conclusion

PayPal has faced some challenges in recent times. However, its strong fundamentals, attractive valuation, and exposure to secular trends in the payment, digitalization, and peer-to-peer lending spaces make it an intriguing investment opportunity. Investors should carefully evaluate the risks and rewards before making any investment decisions in PayPal.

Disclosure: As of this writing, I don’t hold any positions in PayPal

Thank you for this analysis , helps a lot.

Eventhough the valuation has been greatly inflated during covid, it appears to me that a big part of the stock decline is due to a huge change of narrative and a lot about market narration is about guessing and the rest is about bias. The problem is that narration plays a big part in market gyrations and can put a stock in the dog house for a long time.

Great analysis man. Well done.

We believe that the upcoming change in management (CEO retiring) would be a reason for investors to regain trust in management's abilities which will help in driving the price higher.

The continuous downward forecast revisions and the withdrawal of the 750 million accounts target caused investors to lose confidence in the company's future.