My Investing Strategy🧠

<3m read

Investing Strategy

My investing strategy is a product of the greatest investors I am aware of.

I like to keep things simple, like Fundsmith:

Buy great businesses

Don’t overpay

Hold them for a long time

Buying companies of high quality

High-quality means:

Revenue, earnings, and cash flow growth

+10%

High returns on capital over time (ROCE)

+15%

Reinvestment rates

Ideally above 50%

High margins (Operating, free cash flow, and gross margins)

+50% GM

+10% Fcfm

High levels of cash conversion

+75%

Interest coverage above 10x

FCF yield above the risk-free rate preferably

2.5%-5% (High FCF growth can justify lower FCF yield)

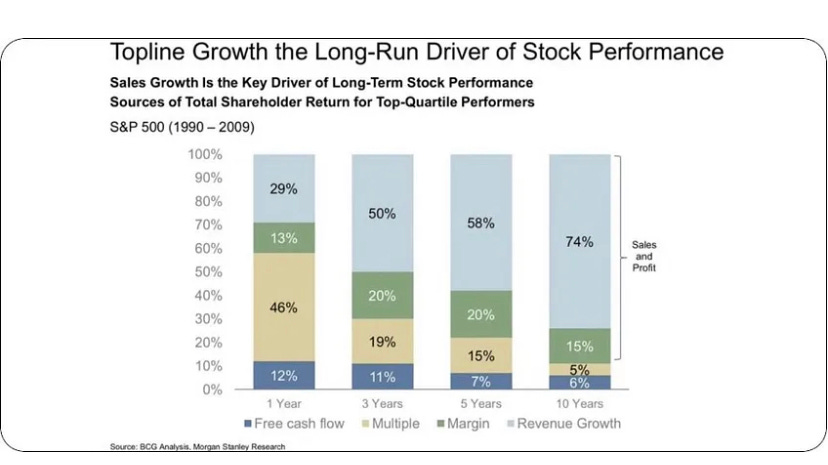

Growth is one of the most important factors, because it drives the long-term performance of the biggest winners:

Note: Revenue growth alone is useless.

The less I have to pay for quality growth, the more interested I become, and the higher my bet out to be.

Why I focus on business quality:

Other traits I look for in companies for my portfolio:

Owner-operators (Founder led)

High insider ownership

Mission-driven (great mission statement)

Optionality - Companies that test new ideas out to fulfill its mission. Most may not work, but if only a few do, they will move the needle (Amazon is the prime example, Axon is another great example)

Non-toxic workplace (Glassdoor)

Low Cyclicality

Low Debt levels

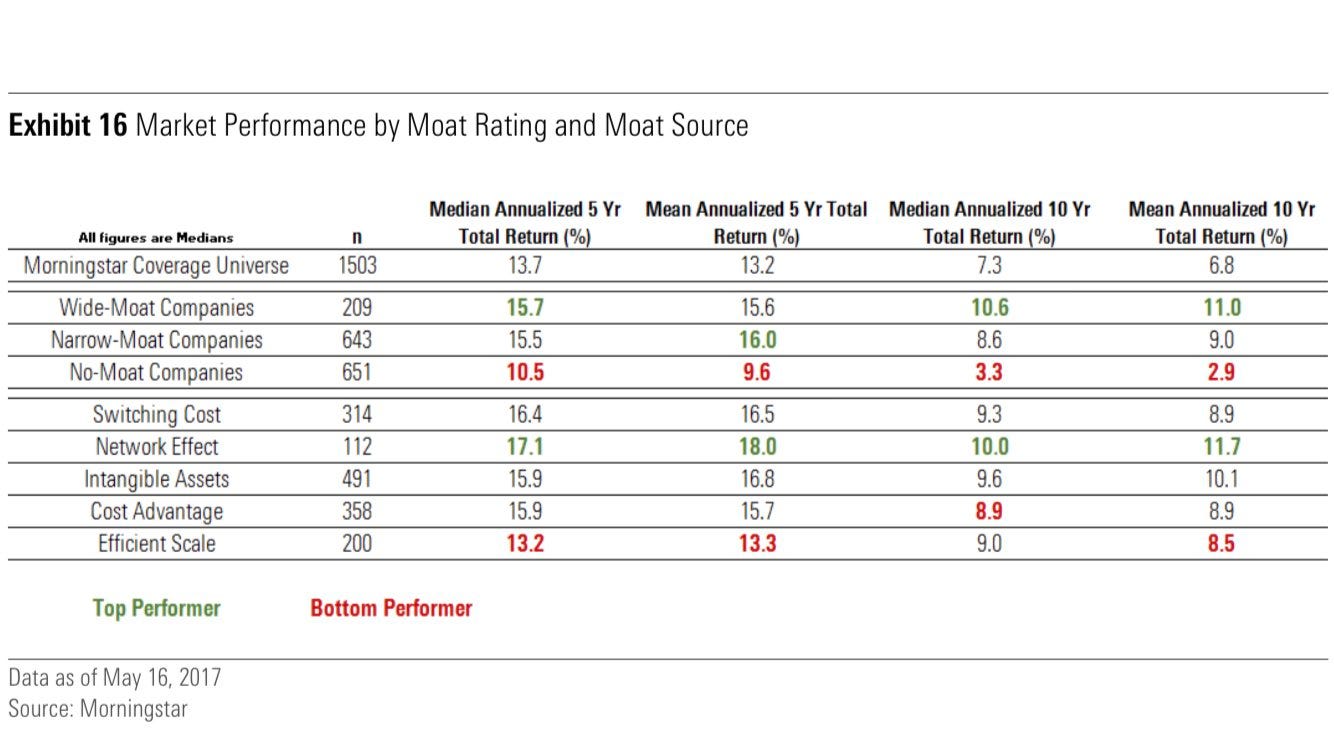

Wide moats (Enduring competitive advantage): Growth means NOTHING w/o a wide moat

I want there to be a moat in place that protects the earnings of the business I invest in. There are several moats:

Network Effect: Each user makes the product better

Switching Costs: Hard to stop using

Low-Cost Production: Offer something for a cheaper

Intangibles: Patent, Brand, etc

Efficient scale: Uses scale to gain an advantage

Counter-Position: Competition harmed using your model

Companies with a moat outperform those without one:

Capital light business models

Capital light companies tend to outperform their asset-heavy competitors:

My aim is to buy businesses with the following characteristics:

Capital expenditure / sales below 10%

Capital expenditure / Operating cash flow below 20%

Examples of capital light businesses: Admicom, Constellation, Adyen, Qualys.

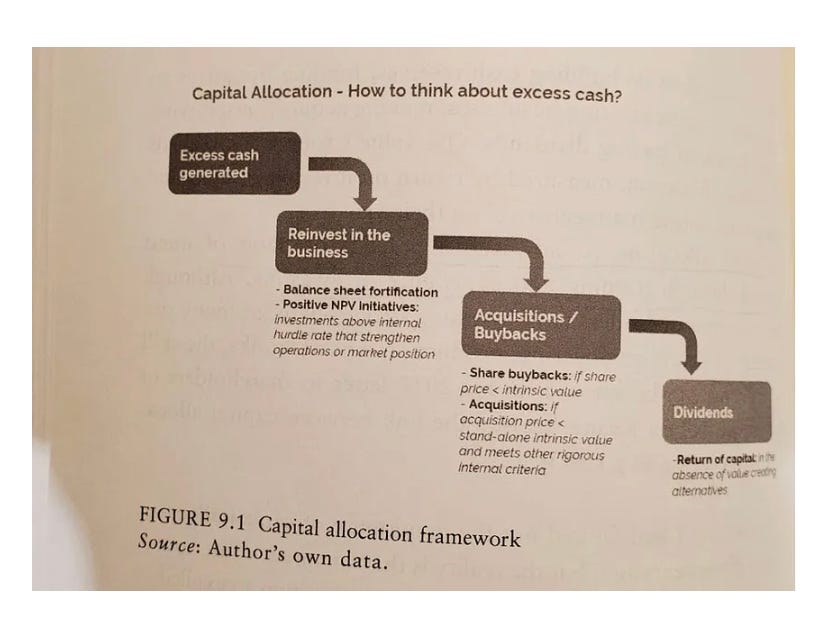

Capital allocation

The best CEOs are great capital allocators. Here is a list of what management can use excess cash on. Great capital allocators will know when to reinvest in the business when to buy back stock or do M&A. This metric can be viewed by calculating ROCE.

Examples: Jay Adair (Copart), Buffett (Berkshire), Mark Leonard (Constellation software), Jeff Bezos (Amazon)

The industry matters

Some industries have a higher ROIC than others. This is why Fundsmith has 1/3 in consumer products, 1/3 in healthcare, and 1/3 in software/technology.

I will primarily try to invest in these 3 sectors:

Consumer products (Household)

Healthcare

Software/Tech

These sectors tend to outperform because they offer more attractive ROIC and better long-term returns for LT shareholders:

I want to pick the best companies in the best, and most favorable industries.

Valuation

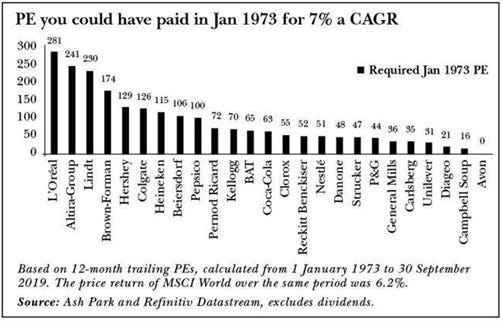

PE tells you nothing about the price you are getting

High PE can be cheap

Low PE can be expensive

It depends on the quality factors of the company

High FCF growth can offset a low FCF yield. FCF can grow at 20%+ per annum. 10-year treasury cannot.

I prefer companies with FCF yield above the 10-year treasury yield (3.65% as of 21.05.23).

I like to subtract stock-based compensation from FCF to get a more accurate picture of what the FCF for shareholders is.

Check out my “Valuation Cheat Sheet” (Its free): https://investinassets.gumroad.com/l/zxxpc

Linearity

I prefer companies with high linearity. I borrow this term from Long Equity (@long_equity on Twitter).

This means companies that have steadily increased in price for 5-10-20 years. No huge ups and downs like:

This is what I want:

Companies with a high linearity have consistently created value for its shareholders. It reflects stability in earnings and its business.

A few linear compounders:

Roper Technologies

Visa

Verisign

Factset

Tyler Technologies

Sherwin-Williams

That’s it. Let me know what you think in the comments below!

I pay particular attention to linearity as well. My method is to plot price on a log scale so that a straight line is a constant percent increase per unit of time. If a straight line (or channel) can be used to fairly represent the price movement over a long-ish period of time, then i simply measure the slope of the line in units of % increase per year. I look for the the high quality companies that have a minimum 15%/yr increase, and highlight those with >20%/yr. More or less it can be thought of as sort of a linear regression line, and the slope of that line is a better indicator than CAGR which depends of price start and end points.