Meta Platforms: Is the Market Underestimating the AI Upside? 💎

Pristine fundamentals, fair price, but unprecedented AI spending 📊

Meta Platforms META 0.00%↑ : Ad Titan With A Second Act

Meta is a cash-printing advertising machine built on capturing the attention of global consumers (Facebook, Instagram, WhatsApp, Messenger).

Meta Platforms has been the go-to platform for digital advertisers, with unmatched click-through-rates and conversions (As well as segmentation possibilities).

The highly profitable ads business is also seeing benefits from AI, speeding up and expanding the monetization flywheel.

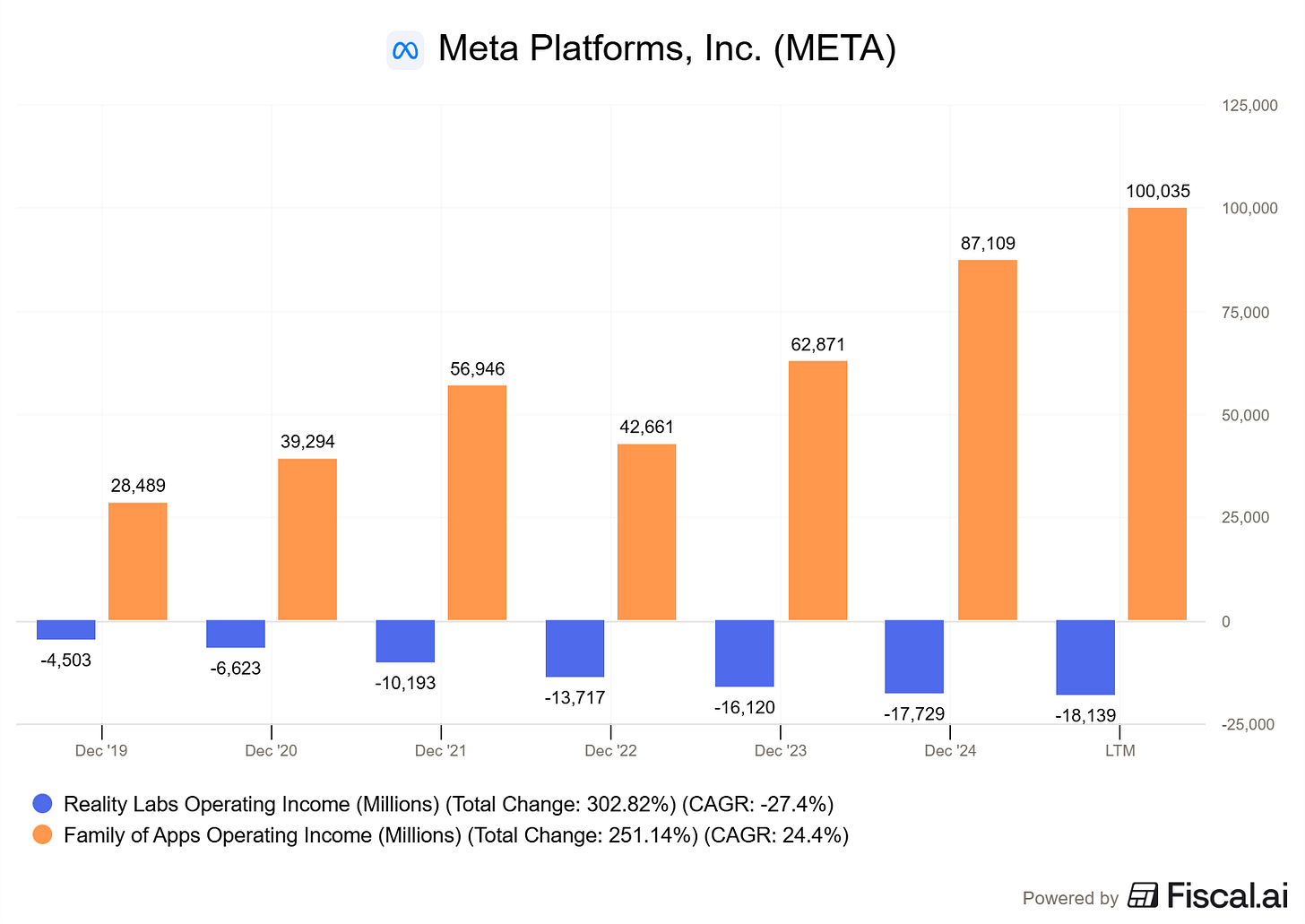

While Meta’s side projects, such as Reality Labs, have been largely a money drain, their core business, ‘Family of Apps’, is one of the strongest, most profitable, and scalable businesses out there.

Let’s get into the details 👇

What Meta does

Meta sells performance advertising across its apps.

What Meta really sells to advertisers is access and the attention of highly specific niche audiences.

Let’s say you sell weight loss programs to women in their 50s. Pretty niche market, right? Well, Meta allows you to target your target audience with much more precision than any other advertisement service. Meta has plenty of information on its users. This includes demographics, like age, sex, location, but also what you are interested in (Much better indicator for advertisers), this can be the content you consume (E.g. weight loss-related content), the accounts you follow, and what you share with others.

This information is made available to advertisers, who can be extremely specific in their targeted ads, allowing for high click-through-rates and conversion rates.

This is extremely attractive for advertisers, as they can easily measure the return on investment:

A weight loss program business spends $1000, they get 5000 views, 500 clicks, 50 conversions at $50, resulting in a $2500 return on $1000.

This is just an example, but the clear-cut numbers make it really easy for businesses to justify spending more money on ads, because they can document the effect and show results.

Other forms of advertisement are often more “spray and pray” in nature. Yes, many might become aware of your product, but how many people really purchase as a direct effect of a billboard campaign? It is very hard to measure.

And measurement is key, because it adds certainty, making Meta Platforms very attractive to grow any business online.

Looking at the numbers, there is really only one great business model within Meta Platforms (And one cash-drag, or a long-shot as Peter Lynch would call it):

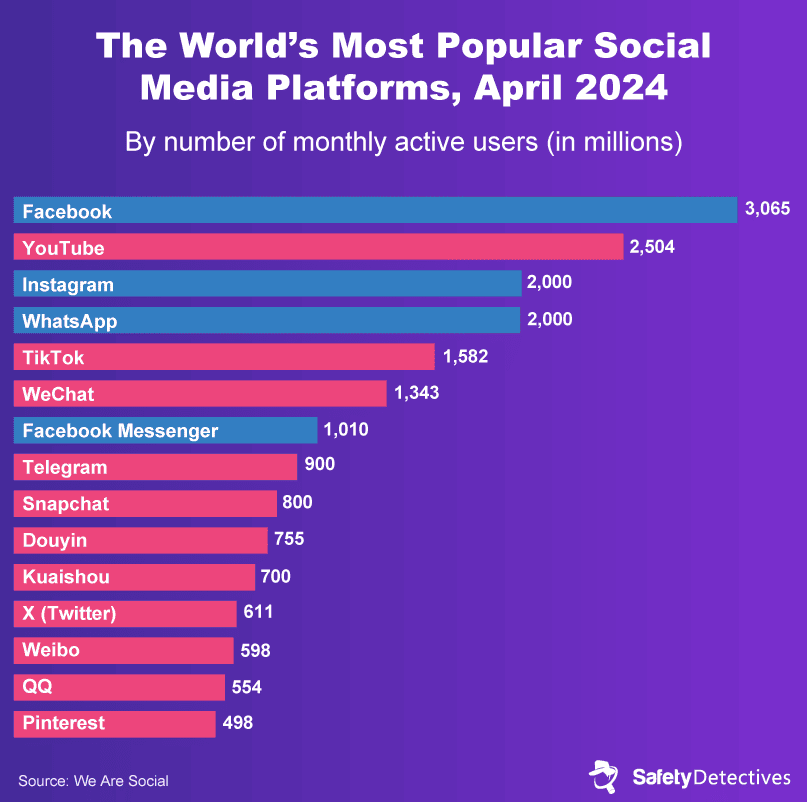

The product surface area: one company, multiple monopolies of attention

Meta’s unfair advantage is not one app, it’s the portfolio of apps:

Instagram: Discovery + creators + Reels + shopping behavior (and increasingly where younger attention lives).

Facebook: still massive, still monetizes, still the core of the business globally.

WhatsApp: the global communication utility; monetization is earlier but strategically huge.

Messenger: Huge daily user base with monetization opportunities

Threads: Competing with X to also dominate written content

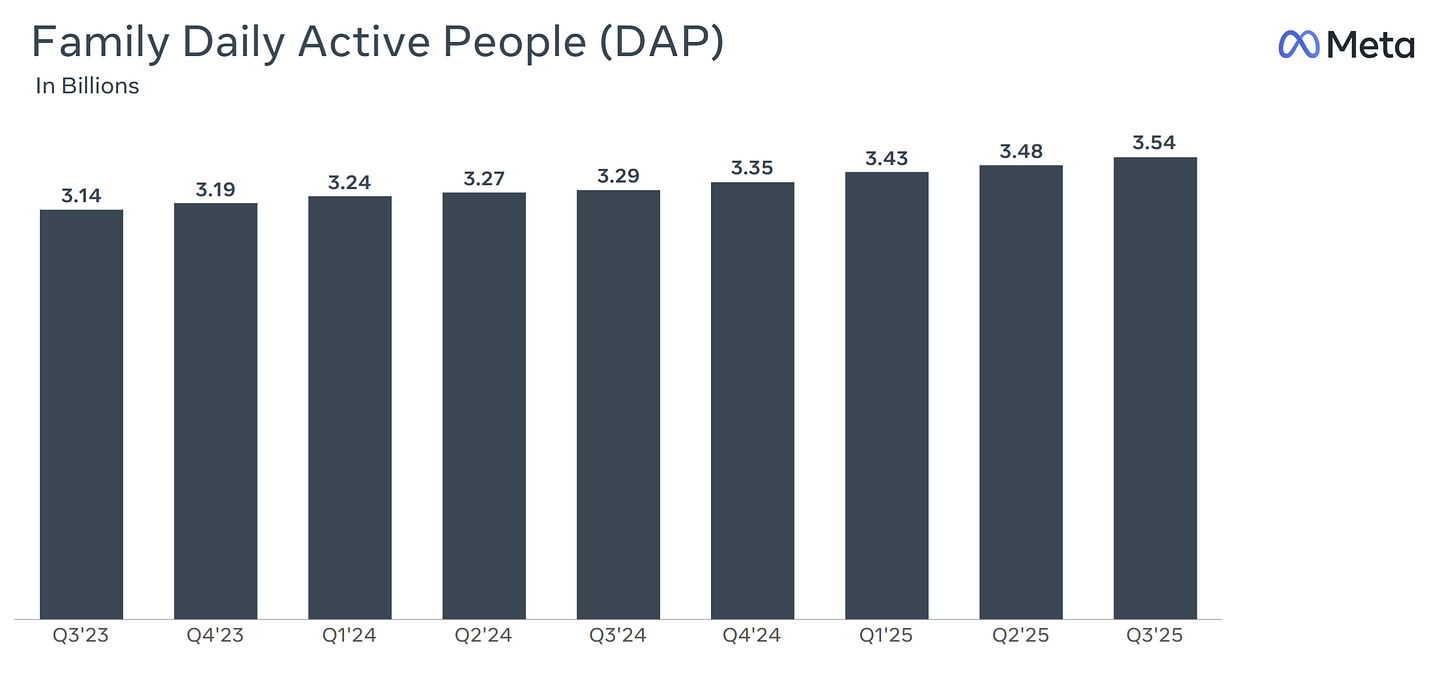

The scale is absurd: Meta reported 3.54B “Family Daily Active People” (average for September 2025).

So, we have ~8.3 billion people on this planet, 42.6% of them use a Meta Platform service (Insane).

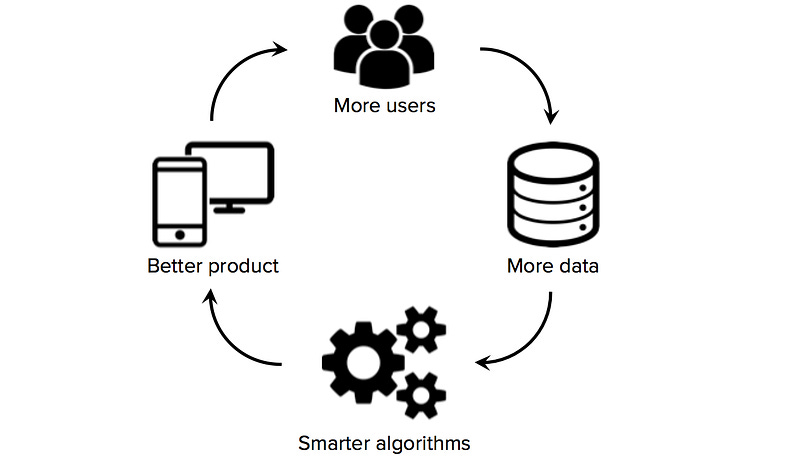

That scale matters because it compounds three things:

More data → Better relevance

Better relevance → Better ad performance

Better ad performance → More advertiser demand → Higher pricing power

How Meta makes money

Meta generates all revenue from selling ad placements across its apps.

In practice, growth comes from two levers:

More ad inventory (more time spent, more impressions, new surfaces like Reels)

Higher pricing (better conversion performance, better targeting, better measurement)

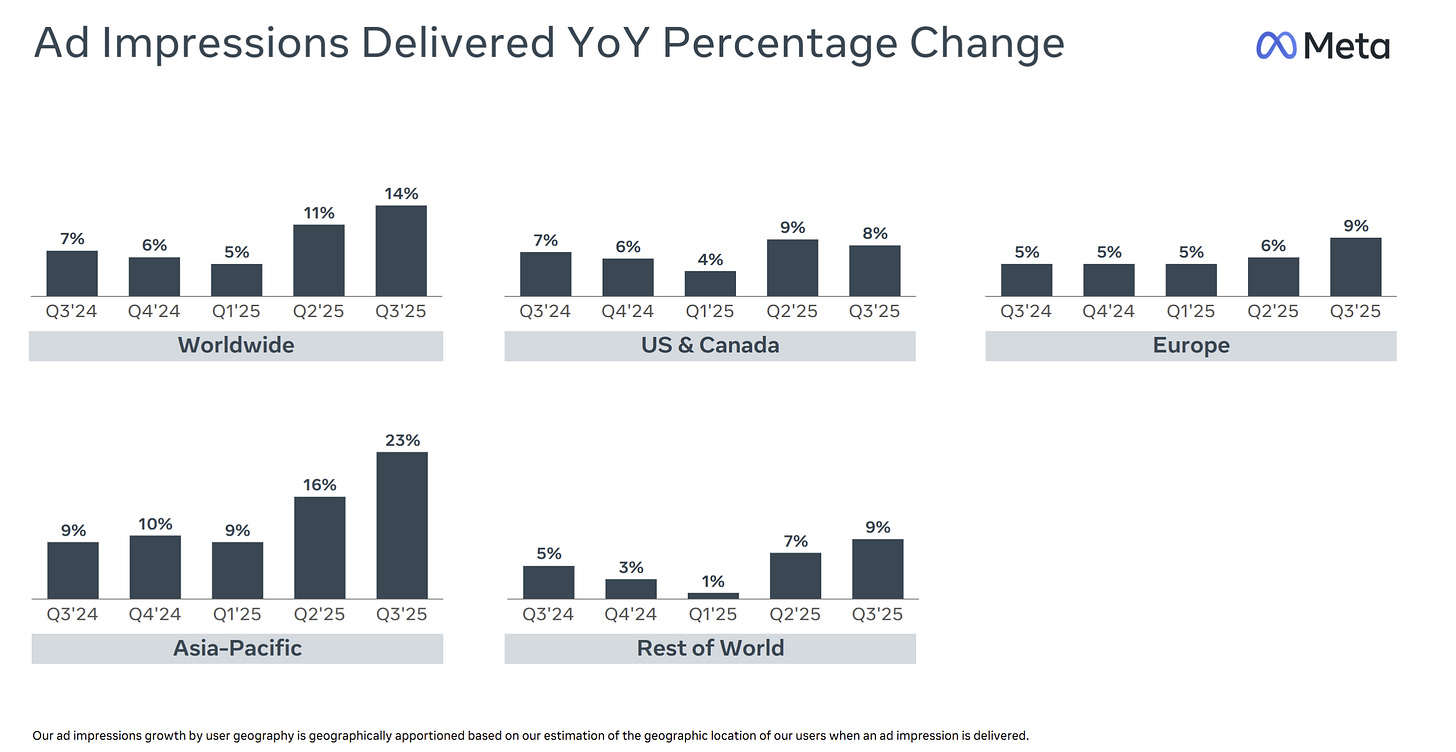

Example: In Q3 2025, Meta reported:

Ad impressions up 14% YoY

Average price per ad up 10% YoY

Revenue $51.24B (+26% YoY)

That’s the business model in one sentence: compound attention, then compound monetization.

Why this is a quality business (the moat)

✅ Network effects + distribution

Meta owns daily habits at global scale. For advertisers, it’s hard to ignore a platform where billions show up every day.

The continious user growth feeds the ‘data flywheel’, providing more data to Meta, improving the product and Return on ads spent for advertisers.

The distribution of Meta Platforms is incredible with 3.54 billion monthly active users within their portfolio of apps.

✅ Data + performance loop (AI is the multiplier)

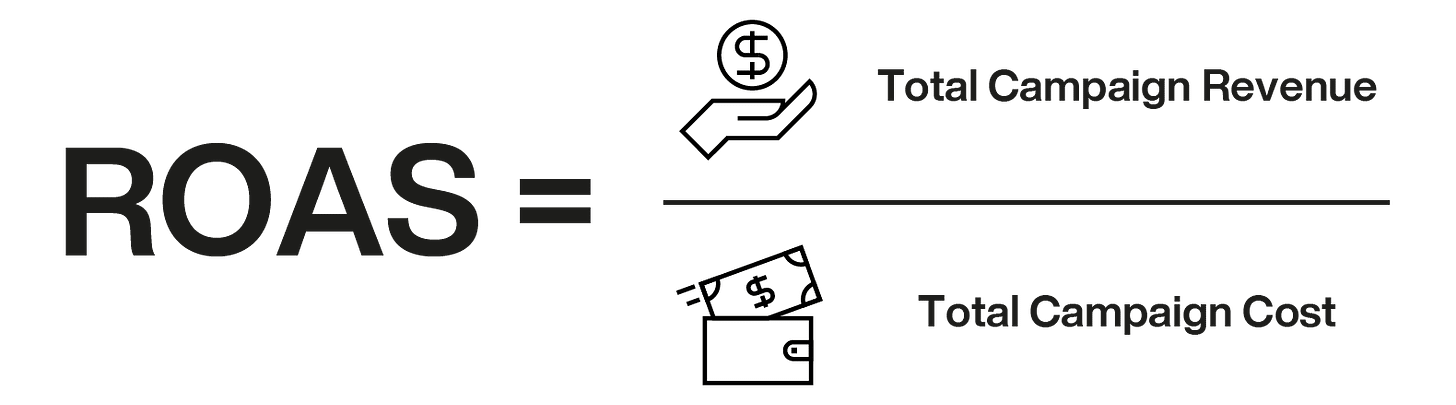

Meta’s ad system is increasingly “black-box performance marketing”: advertisers care less about targeting knobs and more about ROAS. Better AI improves matching + creative optimization, which improves ROAS, which increases budgets (Higher ROAS = Higher Budgets = More ad revenue for Meta).

ROAS = Return on ads spent, the holy grail of online advertisement KPIs:

✅ Switching costs (practical, not contractual)

Advertisers “switch” only when performance deteriorates. When Meta performs, budgets stick.

This is why Meta can look cyclical quarter-to-quarter but structurally durable over multi-year periods.

Digital advertisers might use other digital platforms like Google Ads, news websites, or niche magazine websites, but as many will experience, Meta Platforms is the king of ROAS. This is also why most advertisers return to Meta with most of their ad spend.

Growth runway: Where the next leg comes from

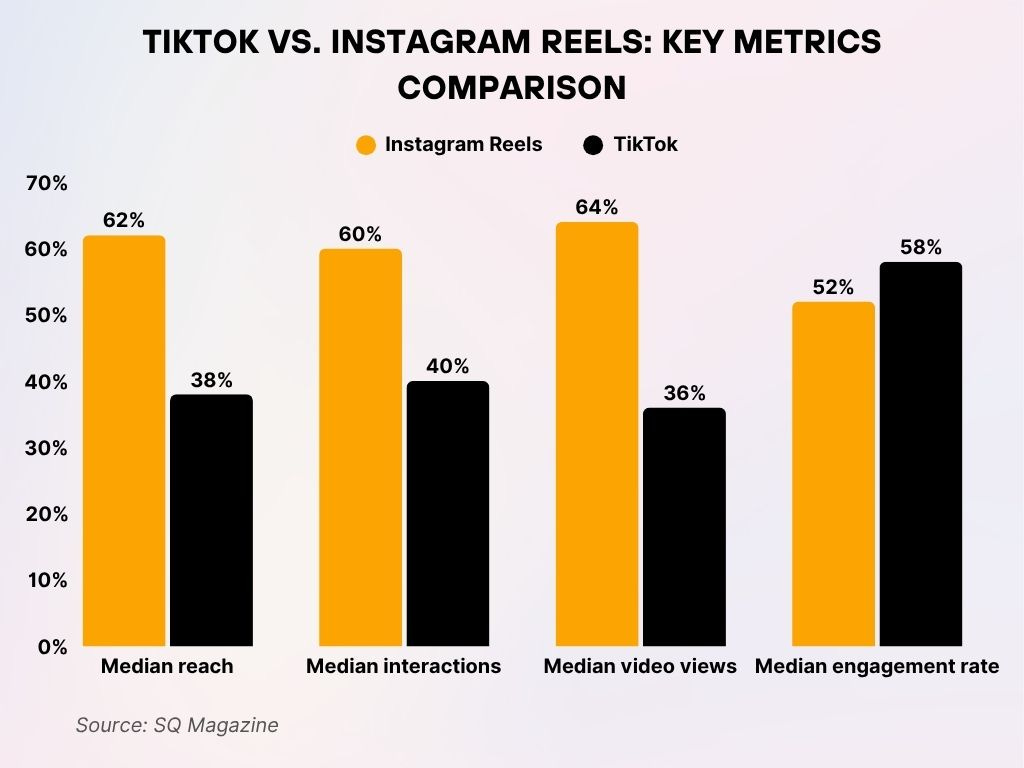

Instagram + Reels monetization maturation

Short-form video started as a monetization headwind; it’s becoming a tailwind as ad formats mature and engagement remains strong. (And Instagram’s scale keeps climbing).

Zuckerberg said Instagram hit 3B monthly active users as of September 2025 (Not bad for a $1 billion acquisitions).

Reels on Instagram and Facebook has been a massive success for Meta Platforms. It was a copy + paste from TikTok’s short video concept, but Meta managed to move quickly, and given its massive distribution, it has kept much of the attention and even beating TikTok on multiple KPIs:

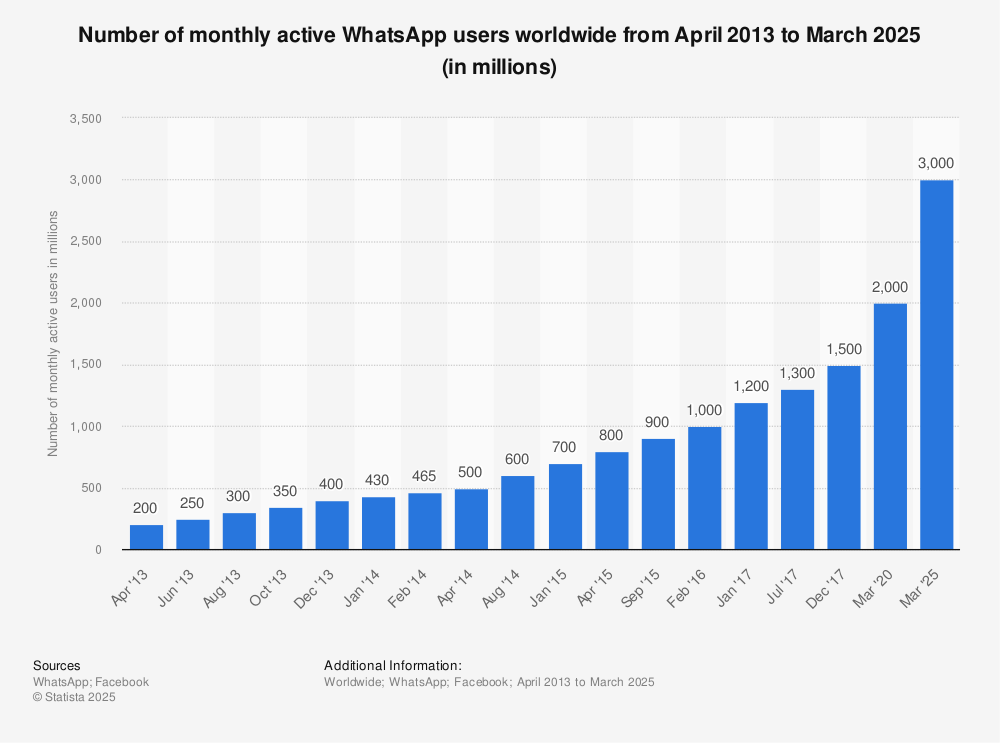

WhatsApp monetization

WhatsApp is one of the few products that can materially move the needle over time by better monetizeing the existing customers.

WhatsApp is growing like crazy, showing no signs of stagnation:

Meta Platforms can further monetize WhatsApp by:

“Click-to-WhatsApp” Ads: Businesses can create ads on Facebook and Instagram that, when clicked, open a direct chat on WhatsApp. This ad format allows businesses to capture high-intent leads and guide customers through the purchase journey within a single chat interface.

WhatsApp Business Platform (API): Medium and large businesses use the API to automate customer service, send notifications (like order updates or flight tickets), and manage high volumes of customer interactions. Meta charges these businesses per conversation.

WhatsApp Pay: In select markets like India and Brazil, WhatsApp offers peer-to-peer and merchant payment services. While typically free for individual users, Meta may charge businesses a small fee for receiving payments for premium services or high-volume transactions.

WhatsApp represents monetization optionality for Meta.

AI-native ad products

Meta is pushing more automation across targeting, creative, and measurement, which typically expands the advertiser base (especially SMBs) and increases spend per advertiser when ROI improves.

The 3 main expected effects of AI:

Advertising Efficiency: AI models improve ad ranking and content relevance, leading to a 10% increase in the average price per ad in Q3 2025 and higher return on investment (ROI) for advertisers.

User Engagement: AI-driven recommendation models boost user engagement across Facebook and Instagram, which in turn increases the time spent on the apps and the number of ad impressions served.

New Products: The “Advantage+” suite of AI-enabled ad tools automates campaigns, contributing to substantial revenue growth. The Meta AI assistant, with over 1 billion monthly active users, also offers potential for future search advertising monetization.

These 3 growth drivers can sustain top-line growth for the coming years given execution and focus stays sharp.

The risks (what can break the story)

Regulatory pressure (privacy, antitrust, ad targeting rules): recurring headline risk and real constraints over time. This is a prevailing risk, and governments worldwide are now putting age-limits on social media (potentially reducing the reach for Meta on the younger generation).

Platform competition (TikTok, YouTube, Apple’s ecosystem constraints): attention is always contested. Just to continue to get the same amount of attention as today, will require exceptional execution and product development from Meta Platforms.

Reality Labs burn: Meta is choosing to fund a long-duration bet; if adoption lags, it stays a drag on consolidated margins. RL is likely to be a long-term cash drag with low probability of ever paying back the spend.

Ad cyclicality: recessions hit ad budgets; Meta’s earnings can be volatile even if the product remains dominant.

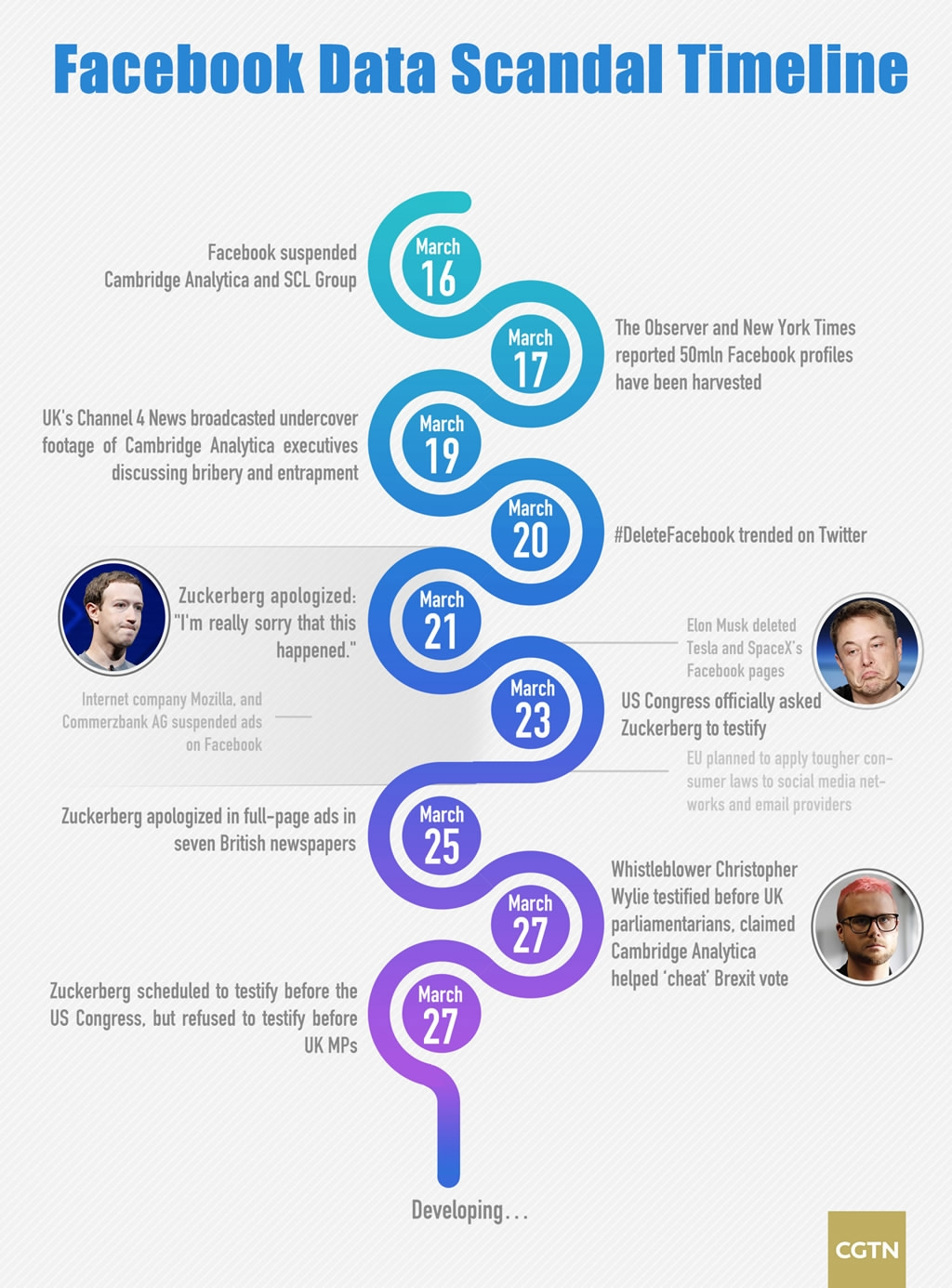

For anyone that needs a reminder of the Cambridge Analytica scandal:

Financial Analysis

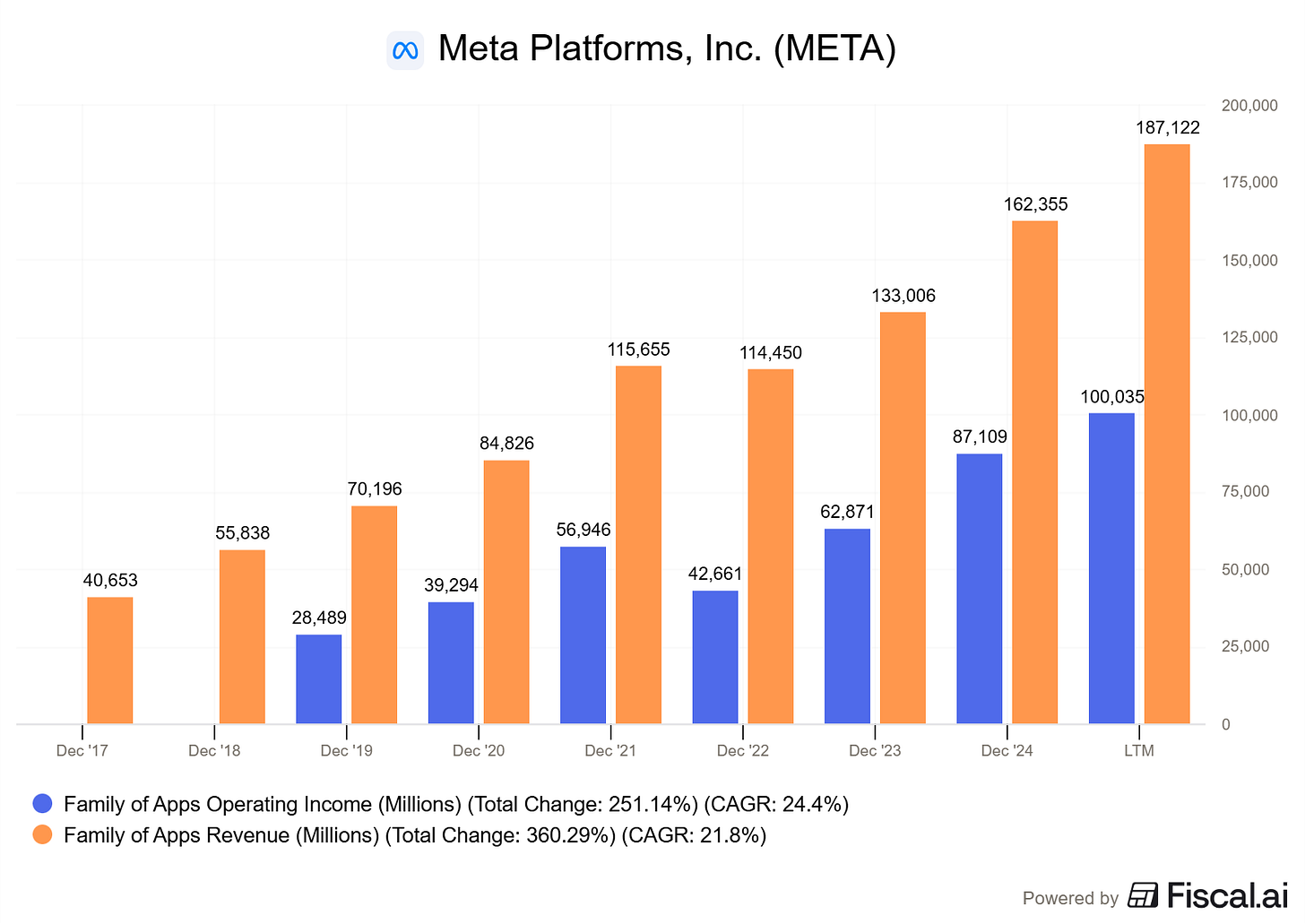

There is really only one business segment to talk about with Meta, and it is the core advertising business.

In the last twelve months, Family of Apps has generated $187 billion in revenues and $100 billion in operating income.

That is an operating margin of 53.47%, not many businesses or segments have this incredible operating margin at this scale.

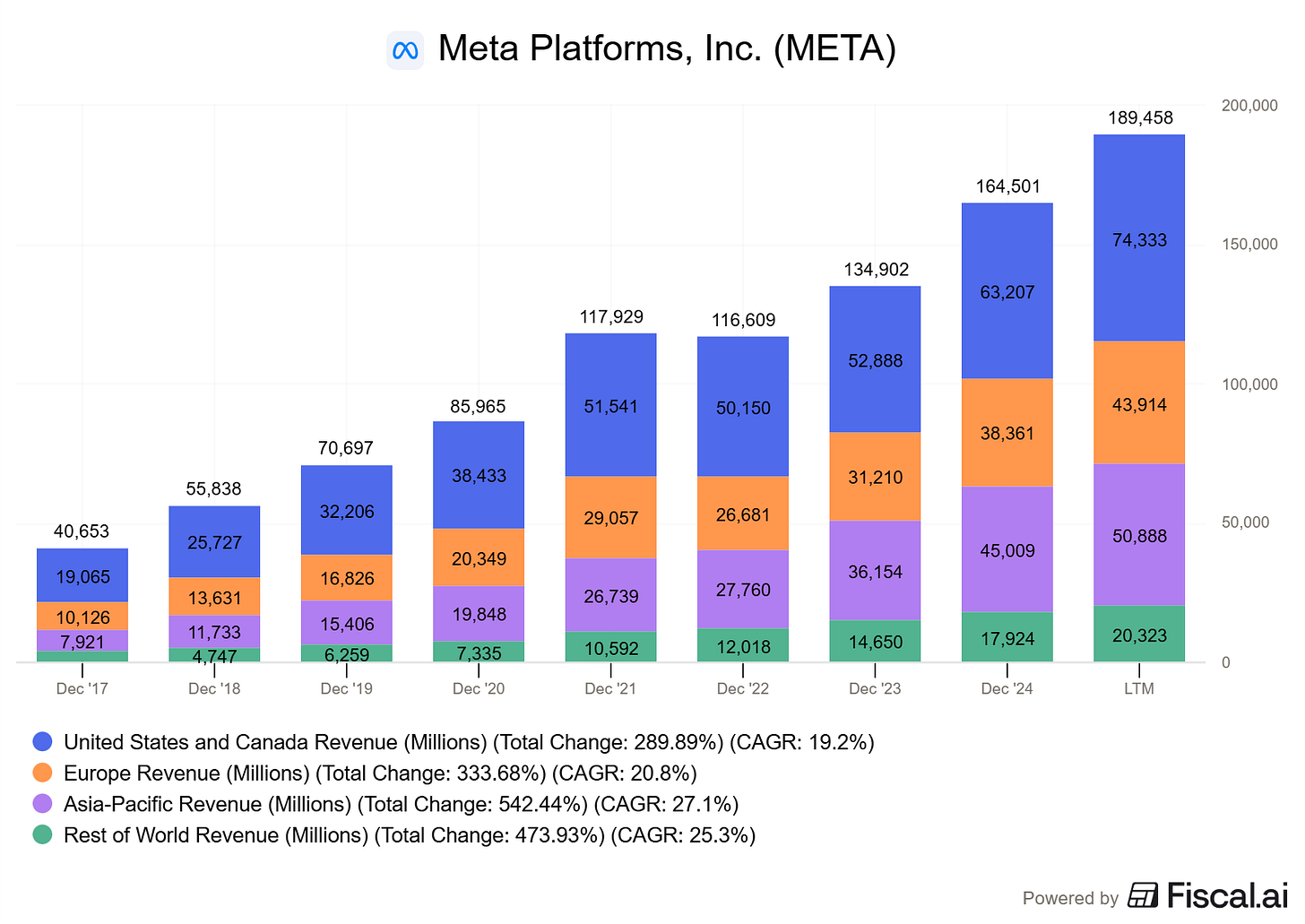

Meta Platform’s business is globally diversified, and growing rapidly across all the largest markets in the world: the US, Europe, Asia, and the rest of World:

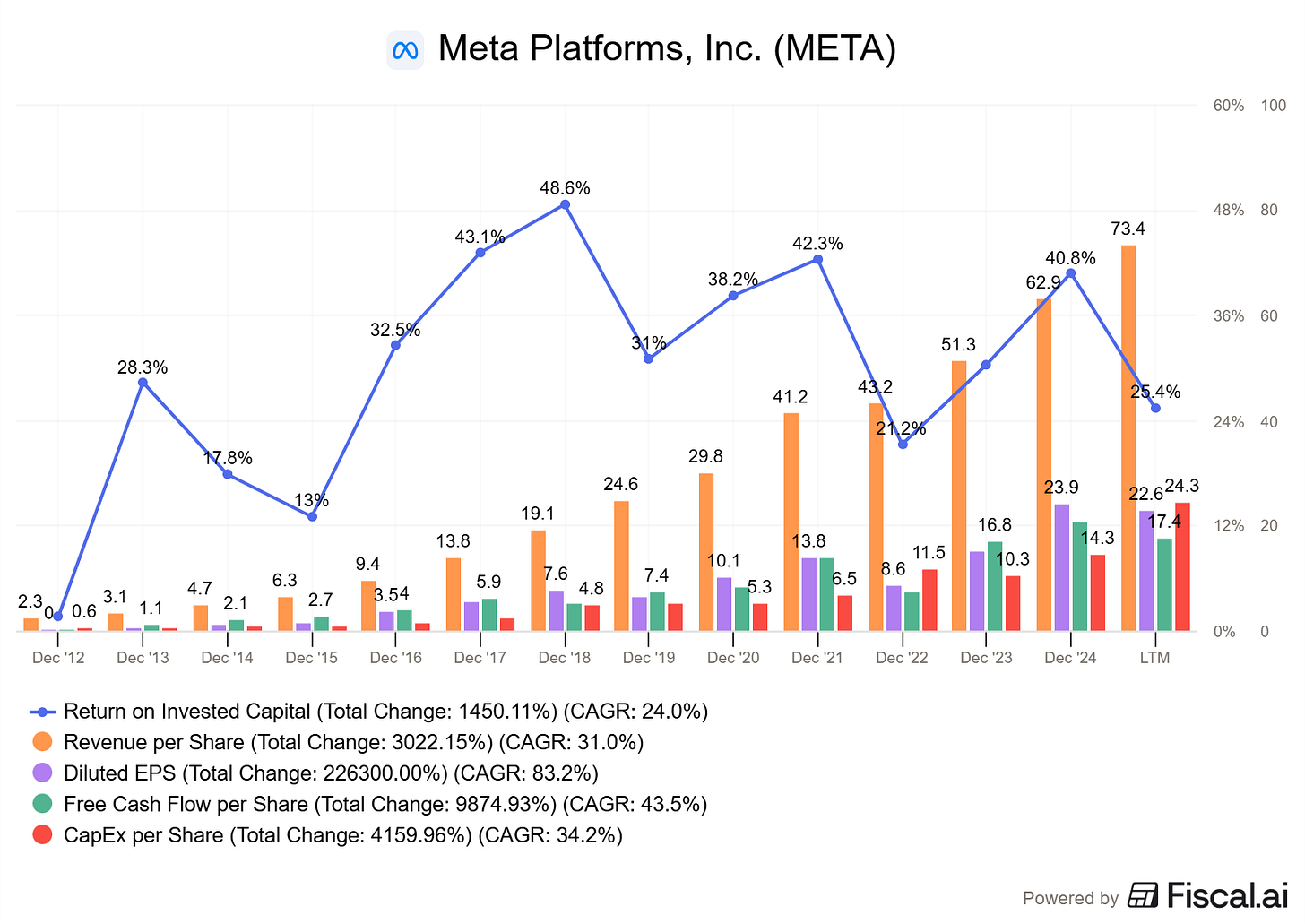

Meta’s ROIC is generally in the 20-50% range, indicating that Meta is managing its reinvestment into the business in a high return matter.

In addition, growth since 2012 has been nothing but stunning:

Revenue per share is up 24% CAGR

EPS is up 83.2% CAGR

Free Cash Flow is up 43.5% CAGR

Capex per share is up 34.2% CAGR

Similar to the rest of the magnificent 7, Meta is spending billions on Capital Expenditure to capitalize on the AI opportunity (Very similar to Alphabet, Microsoft, Nvidia, and Amazon).

Whether this will turn out to be a great investment remains to be seen. What I do know is that Meta has an incredible money-making engine where AI is an obvious accelerator. Execution matters, but the potential is huge.

Financially, Meta Platforms is a pristine business. Flawless balance sheet, gushing cash, generating billions of free cash flows, and is less likely to go bankrupt than the US defauling on its loans.

Is Meta a “compounder”?

Meta is a high-quality compounder as long as:

User attention remains resilient (it has)

Monetization keeps improving (it is)

Reinvestment doesn’t destroy returns (Reality Labs + AI Capex)

If you’re underwriting Meta, you’re effectively underwriting:

Family of Apps as a durable, AI-improving ad monopoly-of-attention

Reality Labs as a call option

So, we agree that Meta’s core business is exceptional. But, much of the free cash flows being generated from this business will be used on AI-related investments (Developing its own model competing with OpenAI, Google, data centres, and infrastructure) in the next few years.

Meta has committed $600 billion in CapEx over the next three years to AI:

2026 CapEx of ~$140 billion.

2027 CapEx of ~$200 billion

2028 CapEx of ~$260 billion

I don’t understand how Meta will get a decent return on this investment. And my view is that they don’t quite know themselves, no clear business model, no clear plan on how to transform these investments into cash flows.

This reminds me of the Reality Labs focus in 2022. The funny thing is that even tho Reality Labs has turned out to be a horrible investment (At least if you look at the financials), Meta continues to be carried by its core business.

I’d argue that Mark Zuckerberg’s capital allocation skills are limited, at least in newer times — increasing buybacks at peak stock price levels (value destroying), heavy investments into Reality Labs (losing -$15 billion p.a. and counting), and now $600 billion in AI, with a clear disadvantage to competitors (Namely OpenAI and Gemini) — these decisions make me question if the business will continue to be a quality compounder, or if it will turn into a capital intensive, low(er) growing business with limited upside.

Bottom line: Meta’s core business is exceptional, but the massive future investment in AI ($600 billion) is likely to depress cash flows and earnings moving forward (Increased CapEx and OpEx), challenging the ‘compounder’ status for Meta.

6-pillar of Quality Growth Scorecard

Management: Strong capital discipline when forced; aggressive reinvestment mindset (good and bad). Founder-led, strong founder that can navigate hard environments. Has shown weak capital allocation in the past (Reality Labs + Buybacks at peak 2022 levels).

Score: 7/10

Moat: Very strong (global distribution + performance ads engine). Unmatched measurement and targeting capabilities make it the preferred choice for digital advertisers. The business has network effects, and more users attract more advertisers (The strongest moat source). The threat to the moat is that other Social Media platforms like TikTok will steal more attention over time and reduce the relevance of FB/Insta.

Score: 8/10

Business model: Excellent business model (high operating margin ads + operating leverage). Best-in-class targeting and digital marketing tools for advertisers. The most used digital platforms (Facebook, Instagram, WhatsApp) globally (Alongside Alphabet).

Score: 9/10

Growth: Solid to strong, analysts expects Meta to grow long-term EPS by +16.8% - this estimate could be depressed due to higher operating expenses from its large investments in the coming years. Analysts expects ads to re-accelerate, but there might also be long-term upside from WhatsApp monitization, and AI-invesetments paying off - both from improving the core business, and through new business models.

Score: 7/10

Risk: Medium (regulation + platform competition + Reality Labs spend + Massive AI Capex investments)

Score: 6/10

Valuation: Time to Buy Meta Platforms?