Essentials of Quality Growth Investing (Book) 📚🧠

<5 min read

I’ve written a book on quality growth investing, link:

Essentials of Quality Growth Investing

If you like my content, I think you will love this book. It is written to cut through the bull crap and provide you with the best financial data, strategies, methods, and useful tools to improve your returns while reducing the time needed to research stocks.

Essentials of Quality Growth Investing consists of 7 modules 🧠

Why quality investing is superior 💎

5-minute analysis 🏆

How to identify a compounder 👑

Valuation methods for quality companies 💵

Risk Management 📉

Building a Quality Stock Portfolio 🏰

Create your checklist ✅

Bonus: List of global quality growth compounders 🧾

Bonus: 3 Lists of quality businesses based on screeners from Terry Smith, Peter Lynch, and Quality Growth factors. 📃📃📃

Bonus: Excel Sheet for the 3 valuation methods with instructions ⚖

Bonus: Portfolio Management Tool 💻

The Essentials of Quality Growth Investing will provide you with:

Proven strategies for investing in the stock market that minimize risk while optimizing for performance 📈

Help you understand key financial metrics like ROIC, FCF, and reinvestment rates and how to apply them for effective stock analysis 💲

How to quickly identify potential quality growth compounders 👑

How to do an in-depth analysis of potential compounders 🤿

Learn how to value a business by utilizing 3 proven methods ⚖

Understand the importance of risk management 📉

Learn principles for building and managing a quality stock portfolio 🏰

Learn how to create your own checklist to minimize mistakes 🧾

Get a complete list of the best compounders in the world to start researching 👑

Get 3 additional lists of potential quality compounders based on criteria used by super investors Terry Smith, and Peter Lynch, and a Quality Growth screener. 3️⃣

One comprehensive tool for valuing a company with instructions for the methods covered in the book ⚖

One comprehensive portfolio management tool that will make the decision-making process easier 🏰

Read more: Essentials of Quality Growth Investing

What to expect? 3 Snippets from the book 🧠

Snippet 1: From Module 4 on Valuation 📈

Step 3: Putting it all together in a Discounted Cash Flow Analysis

DCF analysis is a widely used valuation method that calculates the present value of a company's future cash flows. This method requires investors to forecast a company's future cash flows and discount them back to their present value using a discount rate. DCF analysis is particularly useful for valuing high-quality companies, that are expected to generate consistent cash flows over the long term.

Now that you have your company's:

Free cash flow or earnings per share

Growth rates

Discount rate

We can start putting the values into our discounted cash flow analysis.

The DCF model displayed below is a part of this eBook and can be opened in a separate document called “Discounted Cash Flow Analysis template” or downloaded from investinassets.net.

The DCFA template forces us to think in different scenarios and take a weighted average based on those scenarios.

A conservative estimate will create a margin of safety. It is easy to believe that a company will continue to grow by 40% annually for years but it is often very unlikely. This is why the concept of margin of safety is so important, it protects us from our own stupidity and naiveness.

The 3 ASML scenarios:

Worst: 13% growth

Best: 22% growth

Normal: 18% growth

ASML is currently trading at a market capitalization of ~£250 billion.

The worst-case scenario for ASML in this analysis is £214 billion, suggesting a small downside if growth comes in at a lower clip than expected, and with a substantial detraction in multiple. The multiple put on the cash flow at the end of the year is 18 in this scenario, which is very conservative for a quality business like ASML.

The best-case scenario has a present value of £515 billion, a significant upside.

The normal scenario has a present value of £333 billion per share, which is a ~33% upside from today's market capitalization.

Read more: Essentials of Quality Growth Investing

Snippet 2: From the Module 3 on how to identify a compounder 👑

Why do we consider a competitive advantage when investing?

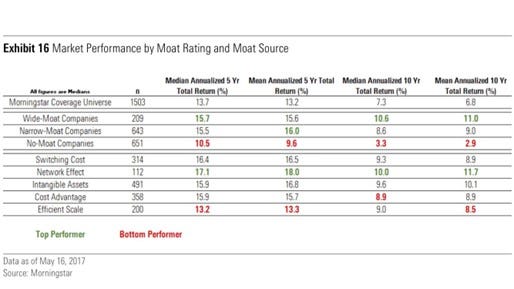

#1: Wide moat companies have outperformed the overall market over the past decade. The MSCI world index has returned +121% over the last decade, while the Vaneck Morningstar Wide Moat fund has returned +253%. The fund only invests in companies with wide moats.

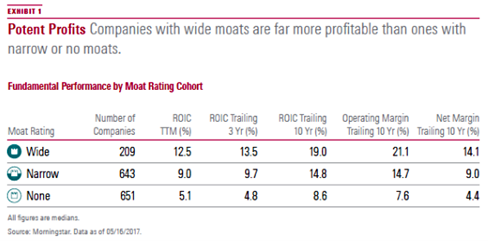

#2: Wide moat companies have superior profitability metrics. Consider the image below. The average 10-year ROIC for wide moat businesses is 19%, versus narrow moat companies with 14.8%, and none moat companies with 8.6%. This is a significant difference.

#3: Wide moats encourage long holding periods and are more likely to be compounders. As wide moats protect the revenue, earnings, and cash flows of a business, it also ensures that the business will be relevant for a long time period, compounding our capital at high rates (Given a high ROIC and reinvestment rate/capital allocation).

There is a significant difference in the stock performance between companies with moats, and no-moat companies:

11 Wide moat companies

3M

Masco

Amazon

Alphabet

Microsoft

Blackrock

Medtronic

Transunion

Lam research

Roper Technologies

Intercontinental exchange

Read more: Essentials of Quality Growth Investing

Snippet 3: From Module 6 on building a quality stock portfolio 💎

Fundsmith - Run by Terry Smith

Fundsmith has compounded its capital by 16% annually since its inception in 2010. The fund is focused on identifying a small number of high-quality, resilient, global growth companies that are good value. They follow three simple rules for their strategy:

Buy good companies

Don’t overpay

Do nothing

Terry Smith, the portfolio manager, and CEO of Fundsmith is inspired by Buffett’s approach and tells us that their favorite holding period is forever. They seek to invest in businesses that continuously create value for shareholders, while never destroying value. High-quality companies with stable earnings, high margins, and resilient business models provide this for Fundsmith and are compounding machines that they aim to hold for the long term.

Terry Smith is a controversial figure in the investing community because he teaches us that the businesses you are invested in, are more important than the valuation you are getting. He often talks about what PE you could have paid for quality compounders early on, and still have beaten the market:

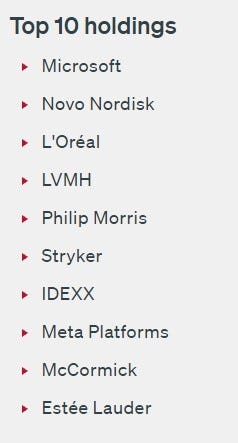

Fundsmith runs a concentrated portfolio. Their largest holding is Microsoft, which represents ~10% of the portfolio. Microsoft has been a 7-8 bagger for Fundsmith, as they first started buying in the early 2010s. Fundsmiths top 10 holdnings:

Fundsmiths position sizing is more concentrated than traditional funds, but not as concentrated as Valley Forge for example. The allocation below does not include some of their biggest holdings, like L’Oréal and LVMH.

There are several strategies for position sizing, but the approach used by most legendary long-term investors is to concentrate on their best ideas. A portfolio can contain 10-15 different stocks but be concentrated into the top 5 for example. If you have no high-conviction stocks, you should do a deeper dive to understand the businesses you invest in and why they will keep on winning 10 years from now. If you are not comfortable having 10% of your portfolio in 1 stock, that is fine, but understand that diversification after a certain point only will hurt your performance. Often times it is better to just invest in an index fund or ETF at a certain point.

Key takeaways:

Spend most of your time identifying superior businesses, that can keep being superior for the next decade or more.

Concentrate on your highest conviction ideas, don’t go overboard on the concentration, but take inspiration from the three funds mentioned in this chapter.

The best investors in the world use concentration as a tool to achieve superior returns.

Read more: Essentials of Quality Growth Investing

I get directed to a SurveyMonkey page in Norwegian?

Hi the pre sale registration link takes me to a survey monkey app in Norwegian