Earnings Season 📊

Breakdown of Google, Evolution AB, and Amazon Q4 earnings 🧠

Google GOOGL 0.00%↑

Q4 Key Numbers:

Revenue +13%

Google Search & Other +13%

YouTube Ads +16%

Google Network -2%

Google Cloud +26%

Other Bets +191%

EBIT +30%

Operating margin 27% (24)

EPS +56%

Google delivered decent results for the final quarter of 2023. The market’s reaction to the earnings report was still negative, sending the stock down ~6% after hours. This is primarily due to the cut to free cash flows which were significant on a YoY basis. There are 2 reasons for this, 1) last year Google got a one-time tax break that made their FCF much higher for this quarter, and 2) Google has significantly increased its capex to invest in artificial intelligence.

My thoughts on the results

Alphabet is the most fairly valued company among the magnificent 7 in my opinion. However, it has not been the top performer by far. Compared to Apple and Microsoft, Google has significantly underperformed. But the underperformance is still 20.3% CAGR over the last 5 years. I still believe this is a stellar result and this report has not changed my long-term view on Google. I remain bullish and want Google in my portfolio. The position sizing might change, but I do believe Google will be a good investment over the next 5 years. The one thing I would like to see over the next year is that Google can produce high levels of cash from its operations and continue to grow it. If they make strategic investments in AI, I’d also like to see this contribute to revenues and earnings shortly.

Evolution AB $EVVTY

Key numbers:

Game Rounds +30%

Revenue +17%

FX-neutral +25%

Live Casino +21%

RNG -4%

EBITDA +21%

EBITDA Margin 70.9% (68.6)

EBIT +21%

Operating Margin 63.7% (54.8)

Net Income +27%

Net Margin 59.5% (54.8)

EPS +26%

OCF per share +21%

Proposed dividend +33%

2024 EBITDA margin guidance: "We are raising the guided range to 69-71% - we will continue our strong focus on expansion and with the expectation that the margin will be stronger in the second half of 2024."

Operating leverage in practice - beautiful.

The market reacted positively to the report, sending the stock up +6%. Evolution stock usually falls after earnings, because the expectations are very high, and the risk factors are pressing. This time Evo was impressed. In their last earnings call, there were concerns about their ability to hire and build new studios. This ER tackled this issue and showed significant progress on both hiring and new studio openings. For a growing business like Evo, it is important that they can build out their capacity to leverage their fantastic business model and the “table economics” for their dealers.

Amazon

Key numbers:

Revenue +14% YoY

Operating margin 8% (+2pp Y/Y)

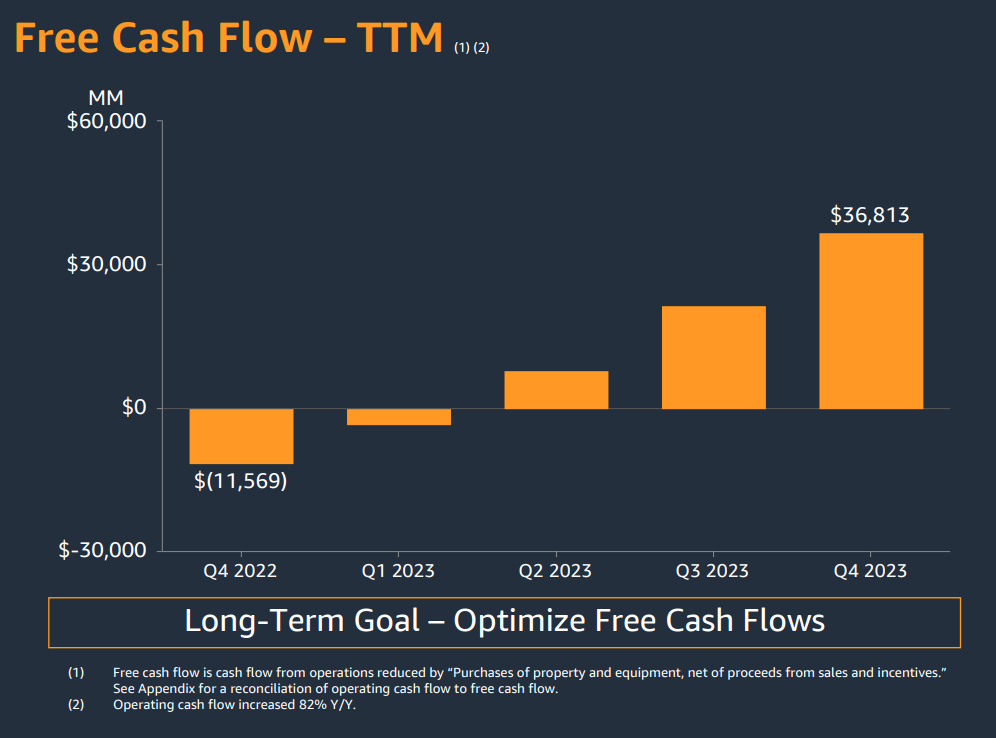

FCF $37B TTM.

AWS:

Revenue +13% Y/Y to $24.2B.

Operating margin 30% (+5pp Y/Y)

Q1 FY24 Guidance:

Revenue ~$138-$143B ($142B expected).

Numbers breakdown from appeconomyinsights.com:

Wonderful results

Amazon delivers great numbers in Q4. The free cash flow numbers are particularly interesting. Amazon is now gushing out FCF with $36 billion in Q4. If you compare this number to the FCF the previous year in the same quarter, it was -$11.5 billion. Additionally, improved gross, operating, and net margins of 3%, 2%, and 7% show that Amazon can transition into a cash-producing machine when needed.

AWS Q4 numbers met analysts’ expectations. It is worth noting that Amazon added $1.1 billion in cloud business in the quarter, which is the largest gain of all the cloud providers in the market on a dollar basis.

Ads numbers exceeded analysts’ expectations. Additionally, Amazon will debut its Prime Video advertisements in 2024, which hopefully turn Amazon Prime into a profit center.

The operating income has risen 383% YoY:

Thoughts

A great quarter from Amazon. Margin expansion from the core business, reacceleration in AWS, fantastic growth in ads & 3rd party, and exciting new profit-makers being introduced in 2024 like Prime Video advertisements. The thesis for Amazon has played out in our favor.

Whenever you are ready, this is how I can help you:

Essentials of Quality Growth — Join more than 200 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

Promote yourself to +6,000 stock market investors (46% open rate) — Contact us via: investinassets20@gmail.com