Earning Season Summarized 📈

5 minute read

Earnings season is over, let’s spend 5 minutes recapping what some of our companies did in Q3 of 2023.

This article will include an earnings review of:

Amazon

Microsoft

Google

Evolution Gaming AB

Constellation Software

Adyen

Teqnion AB

Want me to review other companies? Let me know in the comment section!

Check out the Steady Compounder investing series from Thomas Chua:

Investing is the most important skill to master if you want to make your money work while you sleep.

That's why Thomas Chua created an email course that features lessons from super investors such as Warren Buffett, Nick Sleep, and Mohnish Pabrai.

With these 15 timeless investing lessons, you will be able to identify and analyze great businesses that will compound your wealth over time.

🎁 As an added bonus, you'll have access to exclusive investing tools and resources.

🕒 You can sign up for this course for FREE for the next five days only.

Button: Sign Up Now.

Amazon AMZN 0.00%↑

Amazon delivered an outstanding Q3 report, posting $21 billion of Free cash flow for the quarter. The sentiment was negative for this earning season, but the report sent Amazon up ~10% in the aftermarkets.

Additionally, the e-commerce giant beat estimates on all levels. Most impressing was how they have managed to turn the tides from losing billions to profiting billions in 1 year.

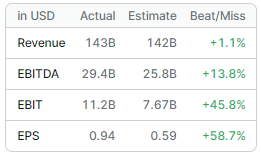

Analyst estimates:

Revenue beat by 1.1%

EBITDA beat by 13.8%

EBIT beat by 45.8% (!)

EPS estimates were beaten by 58.7% (!)

Business Segments (Net sales YoY)

Online Stores: +7%

AWS: 12%

Third-party seller services: +20%

Subscription services: +14%

Advertising: +26%

AWS growth is notably lower than Microsoft Cloud, and Microsoft keeps getting closer to AWS’ leadership position. Still, a 12% YoY growth on their large base is a solid result. Additionally, third-party, subs, and advertising grew 20%, 14%, and 26% YoY. These segments are valuable, and in my opinion not recognized by the market. Keep in mind, third party is a $34 billion business segment, ads is a $12 billion business segment, and subs is a $10 billion segment that enables other segments like ads and third party.

Overall a great quarter, read my article on Amazon here.

Microsoft MSFT 0.00%↑

Microsoft delivered above expectations, beating estimates on revenue by 3.6%, EBITDA by 8.4%, EBIT by 11.5%, and EPS by 12.9%. The stock reacted positively to the news. One of the best parts of the earnings report was the immense growth in Azure, growing by 28% YoY from a large base. With AWS growing at 12%, and Google Cloud at 22% from a small base, Microsoft is taking more and more market share in the cloud market.

Revenue was up 12% YoY, driven by 12% growth in “Productivity and Business Processes” and a 19% growth in “Intelligent Cloud”. Microsoft managed to expand gross and operating margins in the quarter while growing its Net Income and EPS by 26%. For a business of Microsoft’s size, these numbers are impressive.

Microsoft is showing its strength and growth in several business segments. The business has many legs to stand on and manages to enter and become a market gainer or leader in new markets. One of the strengths of Microsoft is its ability to copy great ideas and implement the software into its ecosystem, making it easy for existing clients to implement. One example of this is how Teams was rolled out in response to Zoom and the large demand in pandemic times.

Overall, a great quarter for Microsoft. The business is showing tremendous momentum.

Google GOOGL 0.00%↑

Google delivered solid results for Q3, however, the market did not take a liking to it, sending the stock down ~10% after hours. The main concern was that Google Cloud posted lower growth than Microsoft Azure, while Azure has a much larger base. This was concerning to investors, indicating that Google is losing the cloud infrastructure battle to Microsoft and Amazon.

Top line growth of 11% and operating margin expansion from 25% → 28%, while increasing diluted earnings per share from 1.06 to 1.55, a 46.2% increase YoY.

Google slightly missed expectations from the analysts on EBITDA and EBIT, while delivering a beat on revenue and EPS. The main takeaway most investors took from the earnings report was the weakness in the cloud, estimating lower future growth for Google.

Google Cloud grew by 22% YoY, which is great, but when Azure grew at 28% from a larger base, it is not necessarily a great thing.

Moving forward, we want to see Google Cloud continuing to take market share, and that search & YouTube ads continue to grow at healthy rates.

Overall a solid earnings report with some concerns we should monitor.

Evolution Gaming $EVVTY

Evolution disappointed shareholders with a mere 19.6% growth in operating revenue from the same quarter last year. EBITDA increased by 22.1%, and EBITDA margins expanded from 69% → 70.4%. The “live segment” continues to grow at 24.3% YoY, while RNG contracted by 1.9%. Live is delivering fantastic results, while Evolution is not able to get the foothold they want with the RNG segment. This also has investors concerned. It should also be noted that Evolution had 6-7% headwinds from FX this quarter, and revenues would be higher on a currency-constant basis.

The main issue on the earnings call was that Evolution is not able to build out and hire at in fast enough rate in relation to the demand for their product. It takes 1-2 years to build a new facility, and it is not always easy to keep up with demand in terms of hiring new dealers for their tables. I’m not convinced this is a negative, as “too much demand” seldom is a problem. It is however something we should keep an eye on for the next few quarters.

Carlesund bought shares for 100MSEK on the 10th of November, indicating that he believes the SEK1000 per share range is a good purchase.

Overall a solid quarter with further confirmation from the CEO that the business is doing great. Read my article on Evolution Gaming here.

Constellation Software $CSU.TO

Constellation grew its top line by 23%, where 8% (6% CC) came from organic growth (which is fantastic). Net income increased by 30% YoY, CFO and Free cash flow available to shareholders increased 60% YoY. This earnings report sent Constellation to new all-time highs at +3000 CAD.

Constellation completed a large acquisition of Optimal Blue from Intercontinental Exchange, I’m looking forward to seeing how this acquisition pays off.

The highlight of this quarter is no doubt the high organic growth, in my opinion, it shows that Constellation’s businesses have pricing power and are mission-critical to their clients.

A great quarter from Constellation Software.

This article was created with Quartr which is today’s sponsor.

Sick of trying to get an overview of the earnings calls of all your holdings?

Quartr solves this by providing the best resource on the internet for:

Tracking quarterly and annual earning calls

Pulling out key slides and data in no time

Keeping track of company mentions

Try Quartr 7 days for free & get 20% off their Core & Pro plans

The Invest In Quality team has been using the Quartr service for years, it is fantastic.

Adyen $ADYEY

Adyen only comes out with new reports on a 6-month basis. The last report sent the stock down ~50% as investors started to question their moat and competitive powers as they lost a lot of growth, especially in North America. The stock fell down to inexpensive levels compared to what Adyen usually trades at.

Adyen recently gave an investor day, that sent the stock up ~40% the next day. Adyen aims to grow revenue at a low to high twenties for the next 3 years reaching a EBITDA of +50% in 2026.

"Payments has really over the past 15 years changed from being a transactional means, much more of a commodity in how it operates, towards much more of a strategic enabler for running and growing your business"

The investor day was what investors needed to regain trust in Adyen as a business and its near & long-term outlooks.

1H earnings report was not great, but the investor day was helpful in understanding Adyen’s challenges, strengths, and potential.

Overall, there sure are challenges in the payment space, but Adyen seems like a good play. Read my article on Adyen here.

Teqnion $TEQ.ST

The Swedish serial acquirer posted solid results in Q3 with an 18% YoY increase in revenues, +45% in EBITA, and +38% in EPS. EBITA Margins from 9.6% → 11.7% despite an ugly housing market in Sweden.

So far, Teqnion is proving that they are worth the extra premium the market has set for them vs. other serial acquirers. The stock rose by 43% in the quarter as new investors are entering, at some point we need to look at the valuation, but with this level of execution, Teqnion is worth it.

I would like to see new solid acquisitions, and that their housing-related businesses start to do better. As they write in their report, the Swedish housing market made it hard to post organic growth this quarter. However, organic growth is something we should keep an eye on for the next few quarterly reports.

A great quarter from Teqnion. Read my article on Teqnion here.

What other companies would you like me to review? Comment below!

Whenever you are ready, this is how I can help you:

Essentials of Quality Growth — Join more than 200 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

Promote yourself to +5,000 stock market investors (48% open rate) — Contact us via: investinassets20@gmail.com

I bought BLDR for the first time about a year ago. So far I am up 115%. I would enjoy reading your take on their potential for 2024.