DSV A/S - A boring Peter Lynch Business Returning 800% in 10 years Trading at a Forward FCF Yield of 5.8%

<5 Min Read

I’m writing a book on Investing, it will contain:

Detailed “how to” analyze a business

Methods used by the best investors worldwide

Tools to make the valuation process easier

My global list of quality stocks and my buy price

Join the pre-sale list to get a discount when the book releases: SurveyMonkey

The business

DSV is a leading global provider of transport and logistics solutions. The company has a diverse customer base in healthcare, retail, and technology and operates in three different segments:

Air and Sea services globally

Road freight services across Europe, North America, and South Africa.

“Solutions” that offers contract logistics services, including warehousing and inventory management, across the globe.

DSV is benefiting from the structural trend of global trade. More countries are trading physical goods with each other that needs to be moved across countries and regions. DSV is well-positioned to assist customers by moving its goods by air, sea, or road. Additionally, they have logistics solutions that can streamline their customer’s supply chain which in turn will result in better cost discipline and win-win situations.

The trend of global trade is strong and growing in all years, except the pandemic year 2020:

The fundamentals

ROCE: 20.4%

Operating Margin: 10.5%

Cash Conversion: 143%

NTM FCF Yield: ~5.82%

FCF/Debt: 1.56

Note: The company has a solid balance sheet and a healthy cash flow, which provides ample room for further investments in growth opportunities.

A financial summary of DSV:

This article is made in cooperations with Stockopedia.

The Invest In Quality team use the platform to:

Research Global Stocks

Get weekly ideas from the Stockopedia team

Use their stock screener to find hidden global gems

Try it 14 days completly free, if you like it, you will get 25% off your purchase using our link: Stockopedia (You also have 30-day money back guarantee after the 14 days)

The Stock

The stock price has outperformed by a wide margin over the last 10 years, returning more than 800% to shareholders (not including dividends).

DSV has also increased its dividend payments at a 26% CAGR since 2017. However, their dividends are expected to be cut in 2025 as earnings are expected to be normalized after the post-pandemic boom:

The Growth (10-Year / 5-Year CAGR)

Revenue: 17% / 23.5%

Earnings per share: 23.6% / 35%

Free cash flow per share: 39% / 51%

Dividends: 15.6% / 23%

Book Value: 21% / 32%

Note: EPS and FCF growing at a faster rate than revenues suggests DSV has experienced a margin expansion over the last 5-10 years.

Capital Allocation

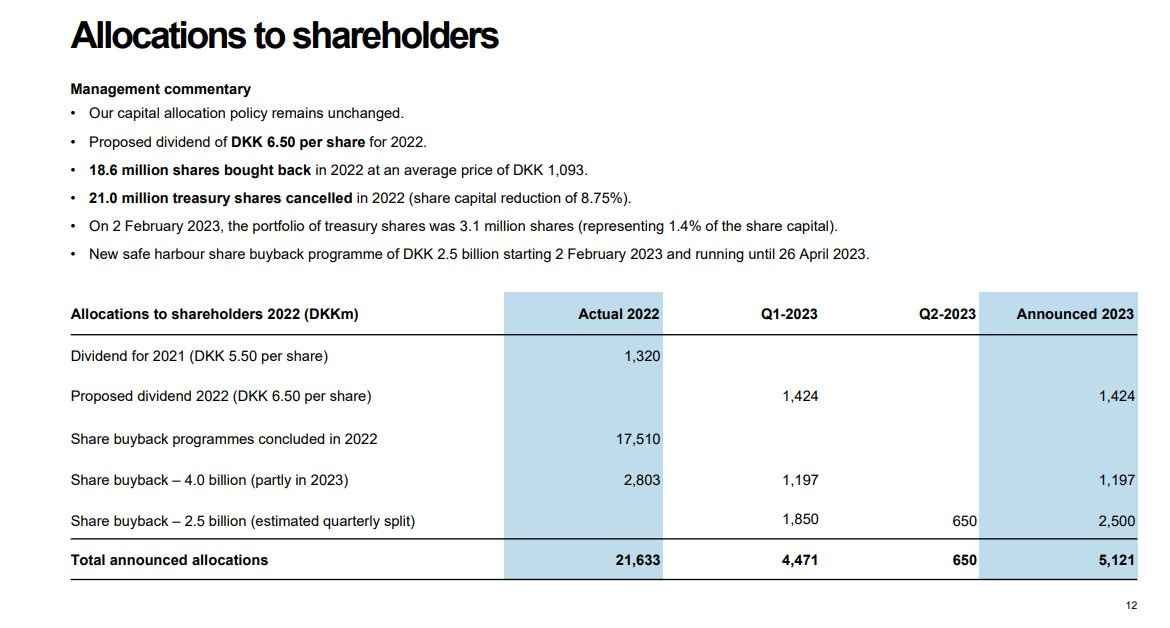

DSV's management has shown prudent capital allocation as they bought back 20.33BN of share buybacks in 2022 representing ~7% of the company It also pays a small, but growing dividend of 6.5DKK per share:

Full P&L 2022 for DSV DSV is coming off some "extraordinary" 2 years, they expect that this will go back to normal, hence the decline in revenue/ebit YOY. Forward PE is expected to be ~22

Competitive Advantage

Since 2013, DSVs margin has expanded as follows:

Gross Margin: 2013: 11% - TTM 23.5%

Operating Margin: 2013: 5.4% - TTM: 10.85%

Net Margin: 2013: 3.4% - TTM: 7.6%

The margin expansion suggests that DSV has a competitive advantage that they have been leveraging over the last 10 years to increase its margins. This was also the case pre-covid, with operating margins at ~9%, substantially higher than in 2013 of 5.4%

DSV has a proven track record of growth, both organically and through strategic acquisitions. In 2019, the company completed the acquisition of Panalpina, a Swiss-based freight forwarding and logistics company, which significantly strengthened DSV's competitive position

Based on this, DSV has a favorable competitive position.

Why own DSV?

Demand for their services will only increase as global trade increases

DSV has a favorable competitive position

DSV is well capitalized and has shown prude capital allocation in the past

DSV doesn’t need debt to achieve superior returns

High return on capital

Widening margins suggest they have a competitive advantage

Highly growing dividends

Stellar growth (Even if you subtract the post-pandemic years).

The Risk

Political risk: Conflicts in Europe and ROW poses a possible threat to DSVs business, as it operates in most European countries.

Recession risk: A economic recession means less trade, fewer investments, and fewer goods moved across countries, this will affect DSVs revenues and earnings.

Nationalization risk: Over the last 5-6 years, we’ve seen a trend towards nationalism instead of globalism, meaning many countries would rather use their national goods than import/export goods. This is a possible negative for DSV.

Post-pandemic boom: Management has said that 2021-2023 has been some out-of-the-ordinary years as freight rates boomed in the pandemic years. As this normalizes and we go back to a “normal” world, DSV expects its revenues and earnings to come down (However, still at a substantially higher level than in pre-pandemic). This will however affect valuations moving forward as the PE of today is much lower than the forward PE.

Valuation

For this discounted cash flow analysis I use DKK12.25 billion because this is what is expected to be the net profits in 2024 (Down from current levels).

In the black cells you can see my inputs:

Worst scenario: 8% growth for 5 years, then 6%, and valued at 15 times earnings at the end.

Best scenario: 16% growth for 5 years, then 14%, and valued at 24 times earnings at the end (Same fwd. PE today)

Normal scenario: 14% growth for 5 years, then 11%, and valued at 20 times earnings at the end.

DSVs current market cap: DKK 306 billion

My intrinsic value estimate: DKK 380 billion

My analysis suggests a 24% upside for DSV.

For DSV to meet my requirement of a 15% annual growth rate, this is the price I’d consider at:

A mere 5-6% discount from current levels. That is if I believe the growth rates can be achieved.

Conclusion

Overall, DSV is a well-managed and financially sound company with a strong position in the global logistics market. Its focus on sustainable growth through strategic acquisitions positions it well for continued success in the years to come.

DSV is riding the global trend of international trade of physical goods. This trend is set to continue in the years to come, and DSV is likely to take a substantial piece of the pie.

The valuation is also decent, and at current levels, investors can expect a 12-14% annual return (depending on how they execute on growth in the next few years).

DSV is in my investable universe, but I’m waiting for it to hit my hurdle rate.

Can you please explain why the Revenues and bottomline are declining in 2023 and 2024? Also, in a high interest rate environment (which is likely to prevail for 24 months+), the global trade is bound to fall. Don't you think with that sort of outlook, the stock is a bit too much overpriced? The decline in profitability should impact the stock price performance for at least 24-36 months in my view.

Many thanks for this interesting highlight. Can you please let me know what is the main reasons of the much better performance in the short and long term pf DSV versus Kuehne & Nagel ?

Superficially they look to have a lot in common.