Decoding Unit Economics: The Blueprint For Sustainable Business Growth 📊

<5 min read

Invest In Quality is writing a book on Quality Growth Investing to be released in August, join the pre-sale list to get a discount when the book releases here: SurveyMonkey

In the realm of business, achieving profitability and long-term success goes beyond generating revenue. Unit economics, a critical concept, plays a pivotal role in determining whether a business model is viable and sustainable. In this article, we will deconstruct unit economics and explore the reason why it is such an important concept in investing.

Understanding Unit Economics 💎

Unit economics refers to the fundamental financial metrics that pertain to a single unit of a business's product or service. It involves analyzing the cost and revenue associated with each unit to determine its profitability and contribution to the overall financial performance of the business. The key components of unit economics include cost per acquisition (CPA), lifetime value of a customer (LTV), gross profit, and churn rate.

Cost per acquisition: The dollar cost of each new customer acquired

Lifetime value:

Gross profit: Revenues from customers - variable costs

Churn rate:

The Importance of Unit Economics 💡

Sustainable Growth Assessment: Unit economics provide crucial insights into a business's potential for sustainable growth. By understanding the profitability of each customer or product unit, companies can optimize their strategies, ensuring that growth is built on solid financial footing rather than unsustainable practices. Companies that grow their revenue despite having negative unit economics will never turn a profit.

Decision-Making Clarity: Armed with accurate unit economics data, business leaders can make informed decisions. They can identify which products or customer segments drive the highest value and focus their resources on areas that offer the most significant returns on investment. By allocating resources to initiatives that have high unit economics, management can ensure profitable growth.

Investor Attraction: For businesses seeking funding, sound unit economics can be a compelling tool to attract investors. Solid financial metrics demonstrate a well-thought-out business model and a clear path to profitability, instilling confidence in potential investors. Unit economics is widely used by venture capitalists to evaluate start-ups’ business models.

3️⃣ Examples Of Unit Economics

Uber - The Ride-Hailing Revolution

Uber, the pioneer of the ride-hailing industry, exemplifies the significance of unit economics. At its core, Uber connects riders with drivers, and the unit of analysis is the individual ride. Uber's unit economics have been carefully designed to strike a balance between rider satisfaction, driver earnings, and the company's profitability. By optimizing its pricing structure, Uber ensures that the cost per ride, including the driver's share and platform fees, is covered while leaving room for a reasonable profit margin. This approach has allowed Uber to scale rapidly, capture a significant market share, and maintain its position as a global ride-hailing giant.

Amazon - The E-commerce Trailblazer

Amazon, the e-commerce behemoth, is known for its relentless focus on unit economics. Each product sold on its platform represents a unit, and the company carefully analyzes the cost of acquiring and retaining customers as well as the lifetime value of each customer. Through economies of scale, robust supply chain management, and innovative logistics, Amazon has consistently improved its unit economics over time. This approach has enabled Amazon to offer competitive prices, maintain customer loyalty, and reinvest profits into further expanding its business and services.

SaaS Businesses - The Subscription Model

Software-as-a-Service (SaaS) companies, such as Salesforce and Adobe, rely heavily on unit economics to drive their growth. In the SaaS model, the unit is typically the individual user or subscription. These companies focus on acquiring customers at a reasonable cost while aiming to increase the customer's lifetime value by offering valuable features and services. By maintaining a high customer retention rate, these businesses can improve their unit economics, leading to steady and predictable revenue streams. This approach has proved successful for SaaS companies, allowing them to scale efficiently and deliver consistent value to their customers.

Unit Economics Are Best Explained Using An Example ✔

Let’s calculate the unit economics of a Fictive SaaS Business

The SaaS business spends $10,000 on a Social Media advertising campaign.

The ads resulted in 2,500 new customers

Variable cost is 20% of revenue each month.

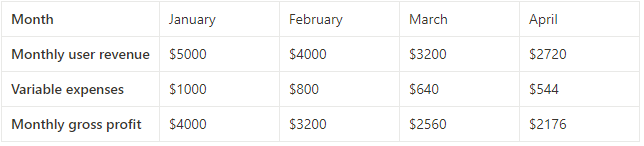

The result over 4 months:

Step 1: Calculate the Cost of Acquisition

We know that the business spends $10,000 to acquire 2,500 new customers.

10,000 divided by 2,500 = $4

The cost per acquisition (CPA) for the SaaS business is $4 per customer.

Step 2: Calculate the cumulative revenue and gross profit from January to May

Calculating the cumulative revenues and gross profit in the table above, we get the following:

Cumulative Revenue = $14,920

Cumulative Gross profit = $11,936

Note: When calculating unit economics we use Gross profit. We subtract the variable costs to get a clearer picture of the business model and how much an additional unit will benefit the company.

Step 3: Forecast future revenue by estimating the churn

Churn: How many customers the business loses each month as a %.

We forecast that the churn will be similar to what it has been in the months we have data from January to April.

We calculate the churn month over month by taking the previous month’s revenues, then subtracting the next month’s revenues, dividing the result by the previous month’s revenue, and multiplying by 100 to get the percent.

Formula:

$5000-$4000 = $1000

$1000 / $5000 x 100 = 20%

This means that the business is losing 20% of its customer revenue from January to February. We will use a similar churn rate for the forecasted months.

Step 4: Calculating the Life Time Value for the 6 months

We use the Cumulative Gross Profit in July, and we divide it by number of new customers:

$17,243.2 / 2500 = $6.90

Step 5: Compare Cost per Acquisition and Life Time Value

From step 1, we know our cost per acquisition: $4

From Step 4, we know our lifetime value: $6.90

As long as the lifetime value is higher than the cost per acquisition, we are making a profit.

This means that the unit economics for this advertising campaign are positive.

3️⃣ Important Points On Unit Economics

It is important to consider the different segments or customer groups of a business. Some customer groups will drive all profits for a business, but it is important to also look at the cohorts and customer groups that are marginal or negative. Can these negative unit economics groups be transferred into positive ones? If not, the business should probably focus most of its resources on the customer group providing superior unit economics.

There are many ways to improve this calculation, but if we look at the math, it is pretty simple. Either you have to increase revenue per customer, or you have to reduce the cost of acquisition, you must reduce churn, or you have to reduce the variable costs associated with new customers. This is why you should track this information when possible. Some companies will disclose this in their annual reports or investor presentations. If not you might have to do some rough calculations to determine the unit economics.

Unit economics must be aligned with the overall business model, cost structure, strategy, value proposition, customer segments, and competitive advantage. Unit economics is a great measure to show that a business model works, or a marketing strategy, a product strategy, or a new segmentation strategy.

Conclusion

These customers were acquired through social media. Customers acquired using different channels or market strategies might have different unit economics. There are a few factors that affect this, for example, if the SaaS business has three different offerings - Basic, Pro, and Pro+. The more customers that pick Pro or Pro+, the higher the revenue per customer will be. Additionally, the churn rate will affect the lifetime value to a large extent.

If the unit economics were negative, it would not necessarily mean that it is a bad activity. The cohort of customers could still provide positive unit economics after the 12 or 18-month mark. But keep in mind, the longer into the future you try to forecast, the less likely you are to be right.