The Business

Danaher Corporation is a global conglomerate with diverse business segments, operating in Life Sciences, Diagnostics, and Biotechnology. Known for its innovative technologies and operational excellence, Danaher has established itself as a leading player in precision measurement instruments, analytical instruments, consumables, and services.

Dan Loeb famously stated that studying Danaher and the Danaher Business System is more valuable than an MBA. In the last 25 years, the stock has returned +4.500% and is considered a quality compounder.

The Market

The global bioprocess technology market size was evaluated at USD 20.8 billion in 2022 and is projected to hit around USD 79 billion by 2032, growing at a CAGR of 14.26% during the forecast period 2023 to 2032.

This is a fast-growing market that Danaher is well-positioned to take market share in.

Danaher Business Segments

Danaher Corp. has transitioned from being a real estate trust, into a bioprocess pure play. Danaher consists of 3 primary segments:

Life Sciences:

This segment focuses on providing tools and technologies for the study of basic biological research and drug discovery. Key products include mass spectrometry, flow cytometry, and liquid chromatography.

Life Sciences has shown consistent growth, driven by increased demand for advanced analytical instruments in research and pharmaceutical industries.

Diagnostics:

Danaher's Diagnostics segment specializes in offering diagnostic solutions for healthcare professionals and clinical laboratories. Products include clinical chemistry, immunoassay, molecular diagnostics, and point-of-care testing.

The Diagnostics segment has demonstrated resilience, benefiting from the growing emphasis on diagnostic testing and healthcare advancements.

Biotechnology

The biotechnology segment has demonstrated robust financial performance, driven by the increasing demand for advanced analytical tools in both academic research and pharmaceutical development. Danaher's commitment to innovation, coupled with the strategic integration of acquisitions, positions the biotechnology segment as a key contributor to the company's overall growth.

Danaher’s 5-Year Transformation

Danaher has increased its operational excellence by a mile since 2018. Gross margins have improved, operating margins have improved, and operating cash flow is significantly better in 2023E than in 2018.

The improvements are driven by divestments in low-quality assets, such as Envista and Veralto, new, high-quality acquisitions, such as Cytiva and Aldevron, and Organic expansion in existing markets.

It is therefore hard to compare Danaher from 5 years ago, to the company we see today.

The fundamentals

Over the last decade, Danaher has grown its revenues by 5.05% annually, its Net Income by 8.40%, and its Free cash flow by 8.54%. As you can see, the period from 2013 to 2019 was more or less stagnant, while 2020 and 2021 were big growth years for Danaher.

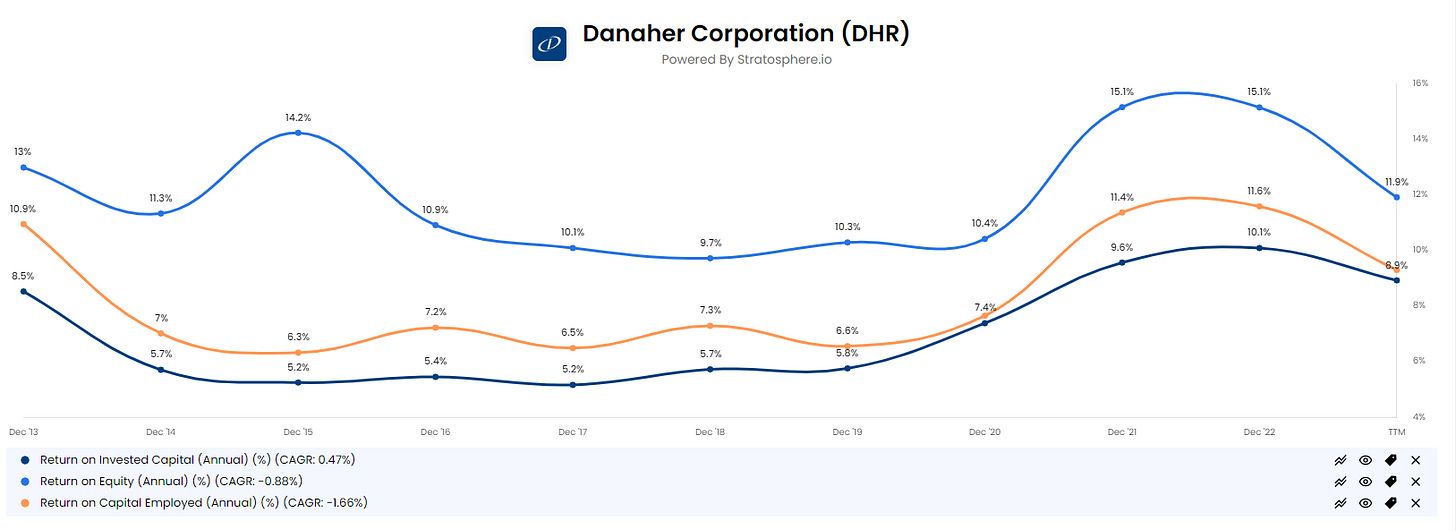

Danaher has increased its return on capital in recent years, however, the trend is currently on its way down to pre-pandemic levels. The return on capital is lower than other businesses, mostly due to its large Goodwill section on its balance sheet due to acquisitions.

As mentioned, Danaher has shown improvements in margins, specifically gross and operating margins. This indicates increased business quality and a competitive advantage.

Danaher is not over-leveraged. Its interest coverage is 25.9x, and its net debt / EBITDA is 1.2. This indicates that Danaher can take advantage of opportunities that come their way in the near future.

Overall, Danaher is a solid business with good fundamentals. A steady compounder.