Cadence Design Systems - Predictable Growth & Cash Flows with a Wide Moat 💎

<5 min read 🧠

SeekingAlpha is sponsoring this article.

Try it for free for 7 days and get $50 off an annual subscription

Introduction

The semiconductor industry has boomed over the last few decades. The world is craving more advanced technology at a rapid rate, and companies like Cadence Design Systems have to deliver ever more complex software to design new chips. As a leading global provider of electronic design automation (EDA) software, hardware, and intellectual property, Cadence plays a crucial role in the development of cutting-edge electronic products.

This article will cover Cadence Design Systems’ business model, financial performance, market positioning, competitive advantage, and whether it is an attractive investment at current levels.

The Business

Founded in 1988 and headquartered in San Jose, California, Cadence Design Systems has established itself as a stalwart in the EDA industry. The company provides a comprehensive suite of solutions that enable semiconductor and electronic system companies to design, verify, and implement complex integrated circuits and systems. Cadence's software and hardware offerings cater to a wide range of industries, including automotive, aerospace, consumer electronics, and telecommunications.

Business model

To understand Cadence from an investor perspective, we must investigate the business model to understand how it generates value, maintains a competitive edge, and sustains profitability in its industry.

The Core of Cadence's Business

At its core, Cadence's business revolves around providing software, hardware, and intellectual property (IP) solutions that empower semiconductor and electronic system companies to design and validate complex integrated circuits and systems. The business model consists of:

Product Portfolio: Cadence offers an extensive suite of software tools, spanning the entire electronic design process. These tools assist engineers in designing, verifying, and implementing semiconductors and electronic systems efficiently.

Licensing Revenue: A significant portion of Cadence's revenue comes from licensing its software and intellectual property to clients. This revenue stream is often recurring, as customers pay licensing fees to access and use Cadence's tools and solutions. The licensing model is an attractive model for investors as it provides stability and long-term customer relationships.

The image below shows Cadence’s recurring revenue model, its backlog and revenue growth:

Maintenance and Support: In addition to licensing, Cadence generates revenue through maintenance and support services. Customers pay for ongoing maintenance to receive software updates, technical support, and access to Cadence's knowledge base. This ensures customer satisfaction and contributes to revenue stability.

Consulting and Professional Services: Cadence offers consulting and professional services to assist customers in optimizing their design processes and solving complex design challenges. This additional service revenue complements its software and hardware offerings.

The image below shows how Cadence divides its revenue based on product and geography. The revenue stream is well diversified and only 18% of the revenue comes from China and 18% from “Other Asia”. This is a lower concentration than other semiconductor players. Additionally, their revenue stream is diversified in several product segments, which means that they have several legs to stand on to provide stability in their business.

The fundamentals

ROIC: 27.5%

Gross Margin: 89.4%

Operating Margin: 28.8%

FCF/Net Income 5Y: 130%

Net debt / FCF: Cadence has a net cash position of 225 million and an FCF of $989.2 million

Interest coverage: 31.45X

The Stock

Cadence has increased its share price by ~1622% over the last 10 years, a compounded annual growth rate of 32%, outpacing its peer Synopsys.

The Growth

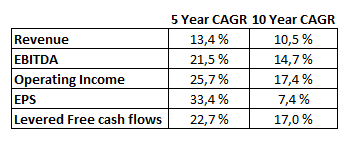

Cadence has seen solid growth over the last 5 and 10 years:

The 10-year CAGR numbers are not consistent with the 32% CAGR in stock price, this indicates that Cadence has benefited from multiple expansions over the last 10 years as more investors are recognizing the quality and predictability of Cadence’s cash flows.

The future estimations for Cadence’s EPS are decent, but the current valuation is high:

Market Positioning & Competitive Advantage

Cadence’s niche market is estimated to be at ~$12 billion dollars and growing. Cadence has 1/3 of that market with a TTM revenue of $3.8 billion. The other big player in the space is Synopsys with TTM revenues of $5.5 billion. These two companies generally dominate the industry, similar to Visa and Mastercard in the payment processing industry.

The source of Cadence’s competitive advantage:

Comprehensive Product Portfolio

One of Cadence's primary competitive advantages lies in its comprehensive product portfolio. Cadence offers a diverse range of software and hardware solutions tailored to meet the unique needs of semiconductor and electronic system companies. This end-to-end approach allows customers to seamlessly navigate the entire design process, from conceptualization to manufacturing.

From digital design tools to analog and mixed-signal design solutions, Cadence covers it all. Their product suite includes tools for:

Design Entry: Streamlining the initial design phase with intuitive entry and simulation tools.

Verification and Validation: Ensuring the reliability and functionality of complex designs through simulation and validation.

Synthesis: Optimizing the design for manufacturability and performance.

Physical Implementation: Navigating the intricacies of manufacturing with precision and efficiency.

IP Solutions: Providing a library of intellectual property to accelerate the design process.

This breadth of offerings empowers Cadence's customers to create innovative and reliable electronic products efficiently, saving time and resources.

Technological Expertise

Cadence's competitive advantage is further strengthened by its technological expertise. In a constantly evolving industry, staying at the forefront of innovation is essential. Cadence has consistently demonstrated its ability to develop and incorporate cutting-edge technologies into its solutions. In 2022, 35% of Cadence’s revenues were used on R&D to keep up with the rapid changes in the industry:

For example, the company has been actively involved in the development of advanced nodes for semiconductor manufacturing. Collaborations with industry leaders such as Taiwan Semiconductor Manufacturing Company (TSMC) have allowed Cadence to integrate the latest manufacturing processes and design methodologies into its tools. This ensures that customers have access to the most advanced technologies, enabling them to create chips that meet the demands of today's complex applications.

Strategic Partnerships

Cadence recognizes the importance of strategic partnerships in enhancing its competitive edge. Collaborations with semiconductor foundries, semiconductor manufacturers, and other key industry players have enabled the company to better align its solutions with market needs.

These partnerships foster synergy in innovation and facilitate the development of comprehensive design flows that are optimized for specific manufacturing processes. For example, Cadence's partnership with TSMC has resulted in the creation of design rule decks that are customized for TSMC's advanced process nodes, streamlining the design and manufacturing process for mutual customers.

Acquisition Strategy

Cadence's strategic acquisitions have also contributed to its competitive advantage. By acquiring companies that offer complementary technologies and expertise, Cadence has expanded its product portfolio and enhanced its capabilities. For instance, the acquisition of AWR Corporation brought advanced RF and microwave design capabilities into Cadence's fold, catering to a broader range of customer needs.

Culture

Cadence has an effective corporate culture built by and for engineers. Their work environment has been recognized by different prices and is a source for them to attract and retain top talent in an industry where it is hard to attract great people. Cadence become #35 in Forbes 100 best companies to work for in 2023:

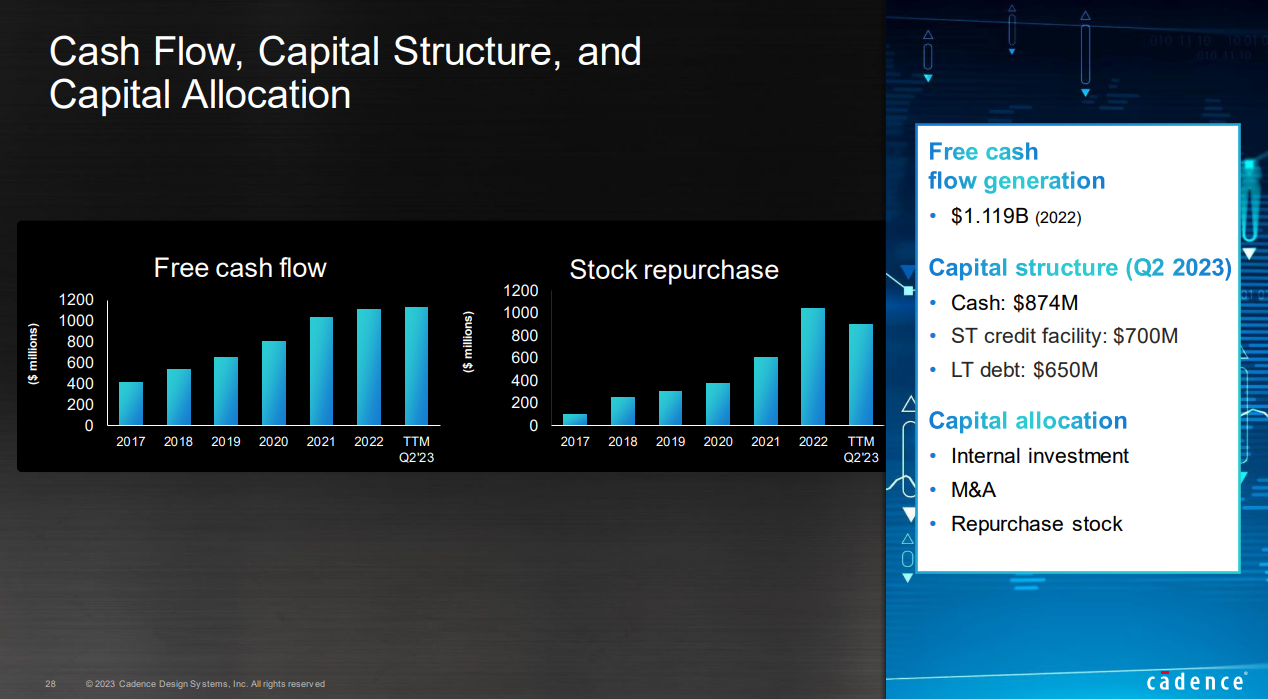

Capital allocation

Cadence is a free cash flow machine. Its FCF margin is ~26%, meaning that for every $1 of revenue, it produces 26 cents of cash flow that can be allocated. These proceeds are used for 1) reinvestments, 2) M&A, and 3) Repurchases of stock.

Reinvestments at high rates of return are what we want to see. However, Cadence does not have profitable reinvestment opportunities for all their cash. This is why they have increased their focus on acquisitions to strengthen their product portfolio. Additionally, they are buying back stock. Stock repurchases can be a great use of excess capital, but it depends on the price that is paid. Repurchases at undervalued levels create value, while repurchases at overvalued prices can destroy value.

Why own Cadence Design Systems?

Consistent Revenue & Earnings Growth

High Profitability and Margins

Strong Cash Flow Generation

Technological Leadership

Diversified Revenue Streams

Industry Tailwinds

Cadence Valuation

I use a DCF model with exit multiples to determine the intrinsic value using 3 scenarios:

Normal case: 15% growth for 5 years, then 13% for the next 10 years, with an exit multiple of 25

Worst case: 10% growth, followed by 8% growth, and exit multiple of 20

Best case: 18% growth, followed by 15% growth, and exit multiple of 30

The current market capitalization of Cadence is $64.3 Billion. Our fair estimate based on our inputs is $40 billion. Based on this DCF, Cadence is currently overvalued.

For Cadence to meet a 15% annual hurdle rate, it will need to grow substantially faster than what is expected over the next few years, in addition to keeping its high multiple:

How likely is it that Cadence can meet or exceed these expectations? We believe it is of low probability.

Conclusion

Cadence is a high-quality business, with steady and predictable growth, diversified revenue streams, a competitive advantage, and high returns on capital. The semiconductor industry is riding several technological trends, such as the expansion of 5G, the rise of AI, the increase in IoT devices, and the increased demand for more advanced semiconductors globally. The industry is likely to grow at a high rate for the foreseeable future, and Cadence shows no cyclicality in its business in contrast to other semiconductor players.

Cadence is producing a lot of cash and is using a decent amount of this cash to repurchase shares. In our valuation section, we deemed Cadence to be overvalued. The expected growth rates for Cadence to be a superior investment are of low probability. This means that Cadence is using its FCF to repurchase overvalued shares, which is not what we want to see as investors.

Overall, Cadence is a fantastic business, trading at a very high valuation. It can grow into this valuation, but our opinion is that at current levels, Cadence is not an attractive investment. We expect Cadence to return around 5.5% annually based on its normal scenario.

Try SeekingAlpha for free for 7 days and get $50 off an annual subscription

If you like this content, you will love our book: Essentials of Quality Growth Investing

Thanks for a short summary of CDNS which I own as well. It would have been great to read always a short comparison to SNPS as well. I assume that SNPS is a bit better off in comparison to CDNS due to the portfolio differentiation and higher market share. However I stick to CDNS.