Buying 3 Compounders ✅

Selling Two Losers to Fund Three Compounders

Hi partner 👋

Today, I’m exiting my positions in Lululemon and Gofore.

Why?

Because I care deeply about the fundamentals. Both companies now show deteriorating economics, weak competitive positioning, and high uncertainty in sustaining growth and market power.

Let’s get into it 👇

Lululemon: From High-Flyer to Slow-Grower

What I saw at entry:

A pioneer in athleisure, with a strong community-driven direct-to-consumer model and brand strength far above wholesale-driven peers like Nike.

What happened since:

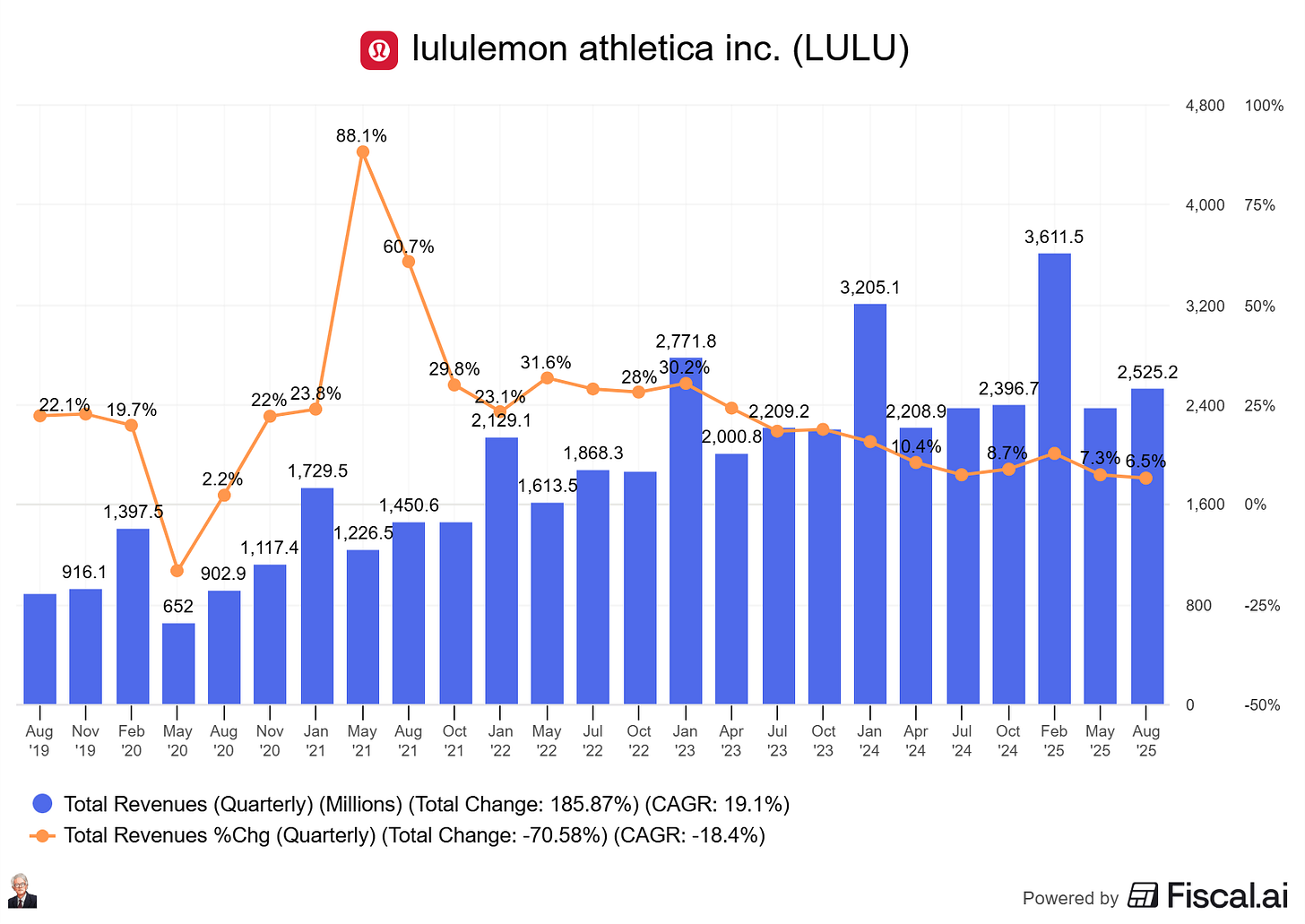

US growth has slowed from +20% YoY in 2021 to low single digits in 2024.

International sales are growing, but not fast enough to offset the slowdown.

Key executive for product development left — Sun Choe. Since Choe left, the product innovation has been executed poorly.

In the MRQ, Lululemon grew 1% in the US market, its largest market by far. While a 22% growth in international markets, this market is relatively small compared to the US and did not offset the poor US performance.

Total revenues were up 7%, but EPS fell -1%.

The real problem: competition is intensifying, and Lululemon’s brand edge looks weaker. Apparel is structurally difficult, with fickle consumer trends and limited pricing power. If tides are turning, the downside risk is significant, even with a low valuation.

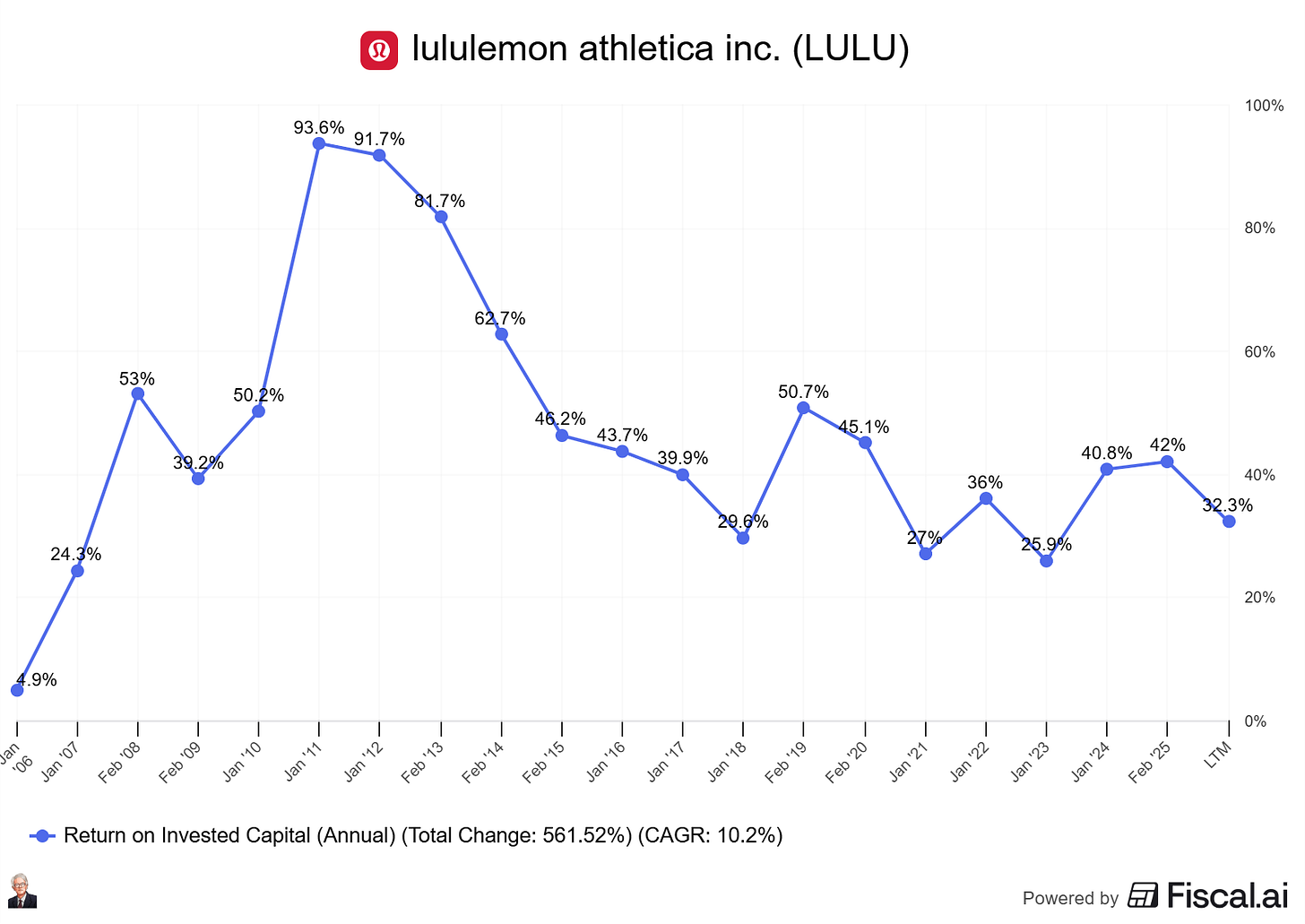

Lululemon remains at high ROIC levels, but high ROIC does not mean much without the possibility to reinvest, and right now, Lulu’s reinvestment possibilities look limited.

Gofore: Execution Failure

Unlike Lululemon, Gofore is not just slowing; it’s contracting.

Revenue declined 5.4% YoY in the LTM.

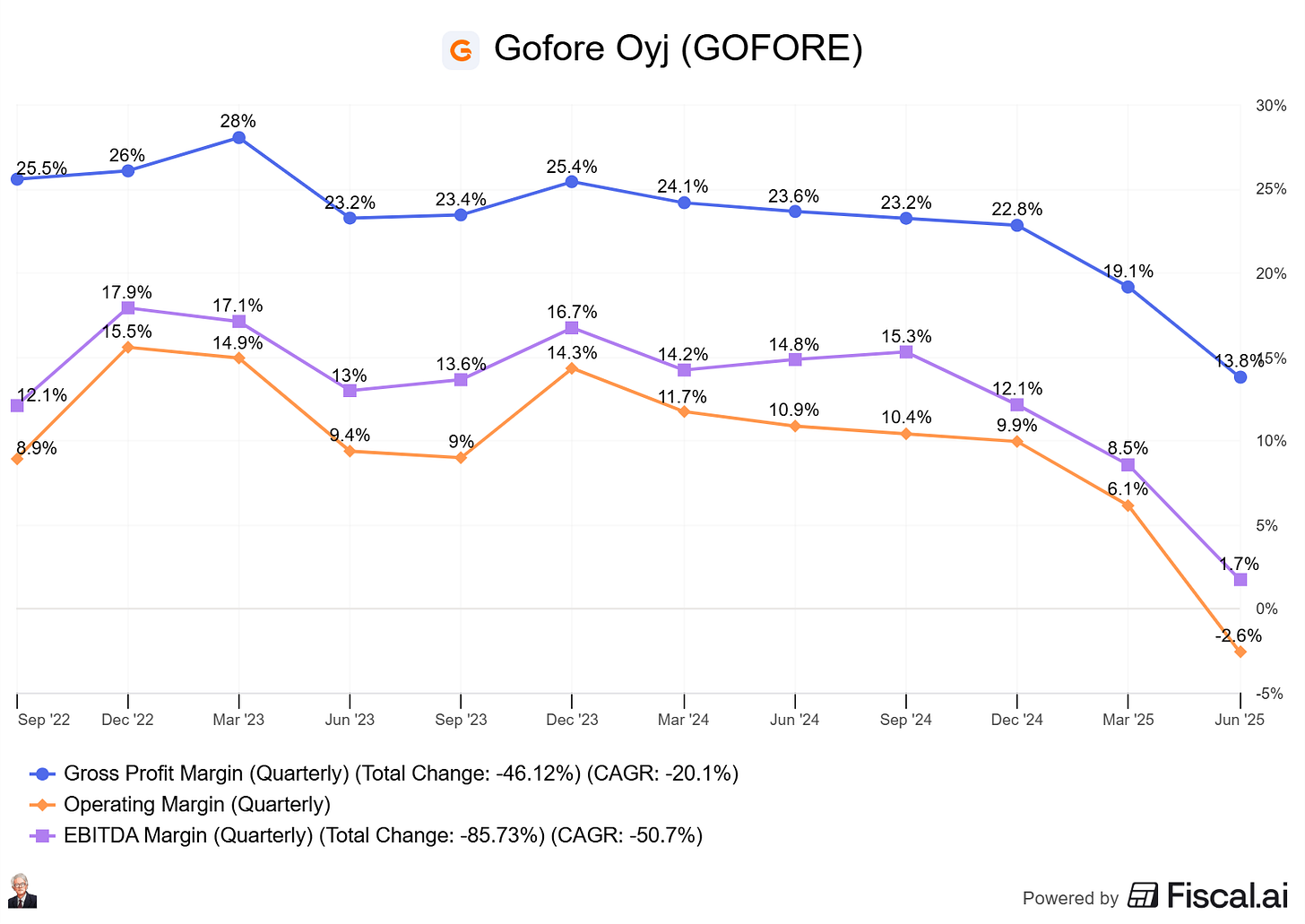

Operating margin has fallen from ~15% in 2022 to below -2.6% today.

Layoffs and downsizing contrast with peers like Bouvet, which continue to grow profitably.

Their 2023–2025 strategic plan has failed: M&A execution is poor, international expansion is weak, and organic growth is negative.

In short, Gofore is missing on all fronts. That’s enough for me to step aside.

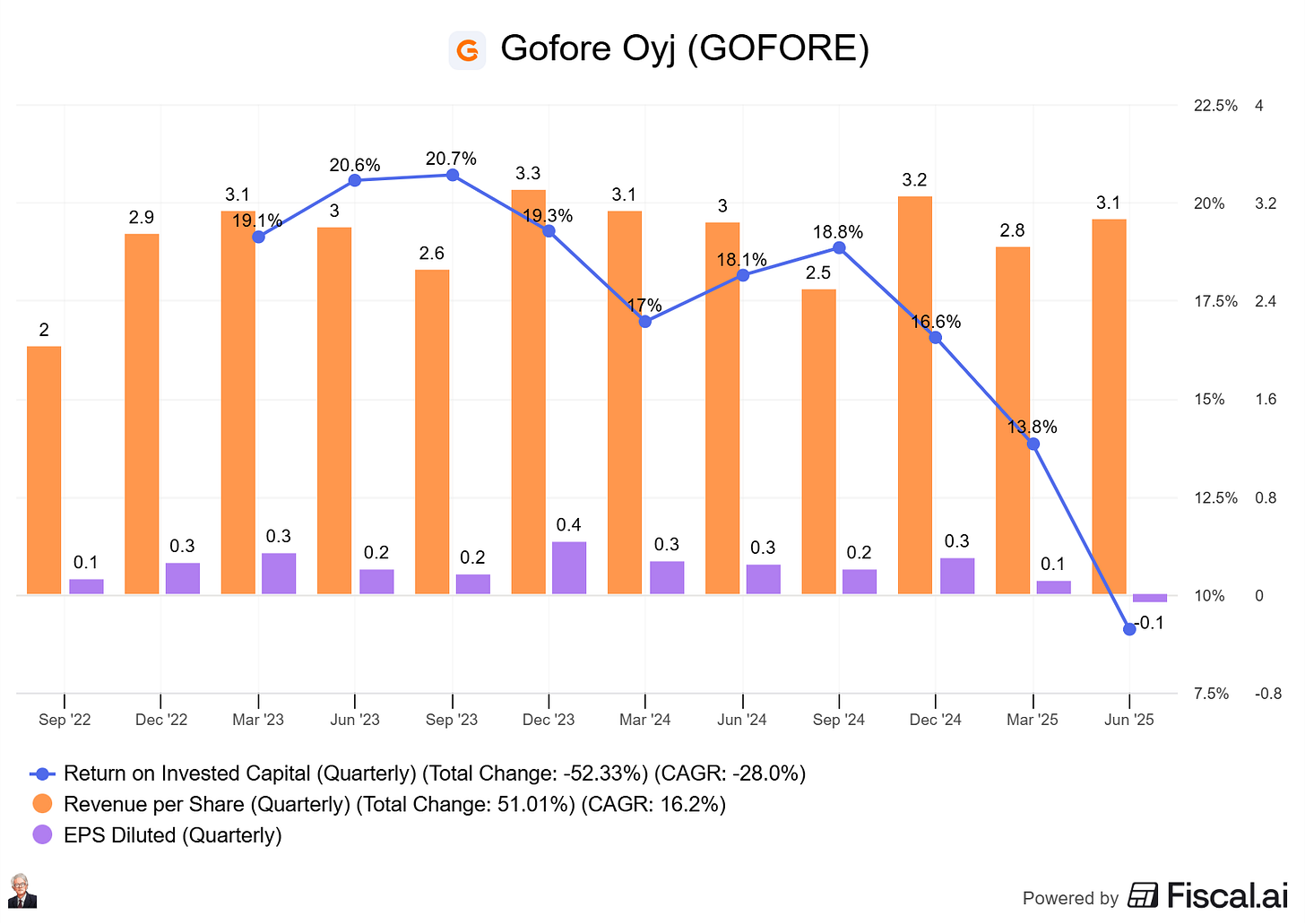

Return on invested capital has fallen through the floor, growth is declining, and the business is burning cash with a negative free cash flow per share: