Buying 2 Compounders 🧠

Adding to two quality compounders 💎

Hi partner! 👋🏻

Today we’re adding to two positions in the quality growth portfolio.

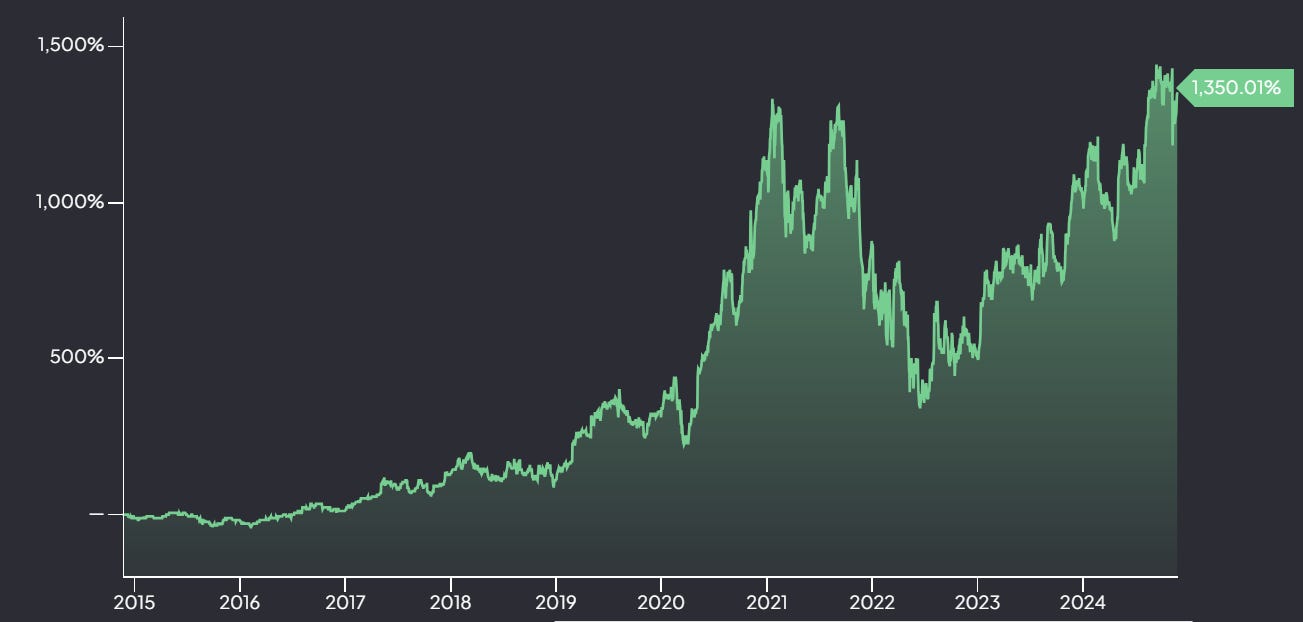

#1 Stock is a multi-bagger that has compounded shareholder capital by +30.6% annually over the last decade.

The investment case is compelling:

Large tangible addressable market

Multiple compelling growth drivers

Attractive business model with high ROIC

Founder-led business

Multiple business segments & geographies to grow from

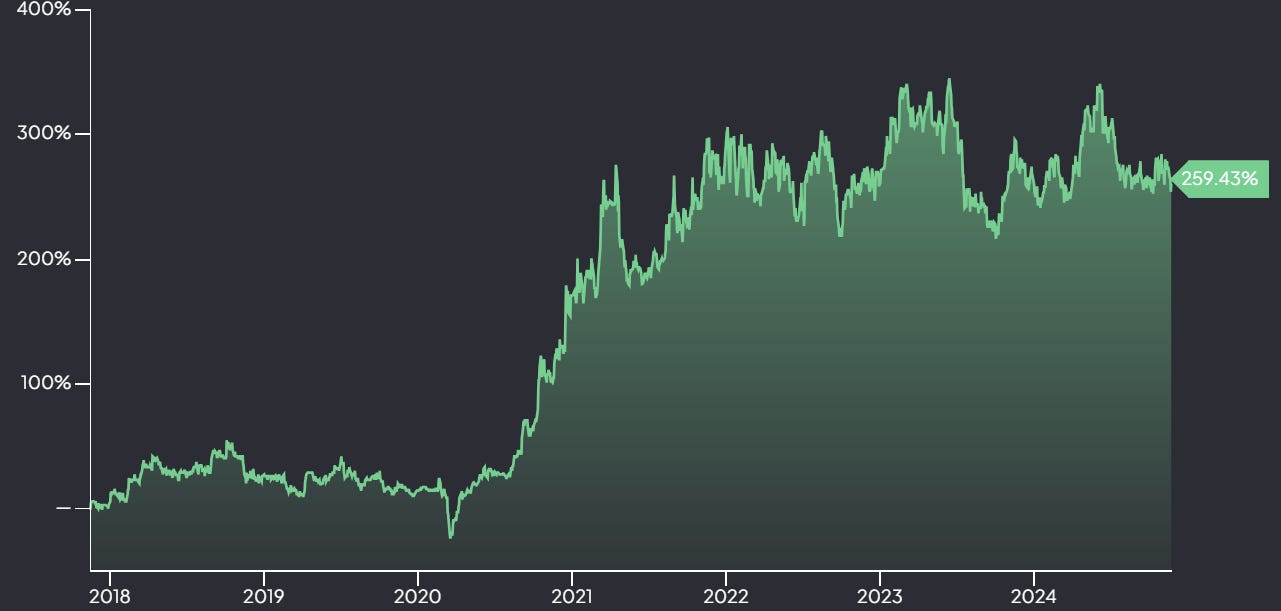

#2 Stock is one we expect to compound above 20% annually for investors.

The valuation is attractive, and the company is well-positioned to grow, expanding its multiple and EPS over the next 5 years.

The stock has returned 20% annually since inception in 2018 (Despite being depressed at current levels).

The investment case is attractive:

Low relative and absolute valuation

Strong business with a competitive advantage

High future demand for its services

Internationalization strategy to grow and expand

Without further ado, let’s get into the two stocks 👇🏻