Boost Your Returns: Focus On Skin In The Game🧠

<4m read ✔

Skin in the game

Skin in the game is a phrase popularized by Nassim Taleb’s book with the same name. Here is a quote from the author:

Never ask anyone for their opinion, forecast, or recommendation. Just ask them what they have – or don’t have – in their portfolio... I find it profoundly unethical to talk without doing, without exposure to harm, without having one’s skin in the game, without having something at risk. You express your opinion; it can hurt others (who rely on it), yet you incur no liability. Is this fair?

- Nassim Nicholas Taleb

The principle is applicable to business, as we want the managers leading the companies we own to be a shareholder alongside us. We it to mean something to them that the business is doing well, and that the shareholders are being rewarded. Why would we follow a CEO with no skin in the game? Obviously, he does not have any real conviction in the company he leads. Watch what managers do, not what they say.

Extraordinary businesses like LVMH, Berkshire Hathaway, and Copart have benefited from skin in the game. The founders have built the business themselves with a lot of skin in the game. These businesses are also called “owner-operators”. This means that the CEO owns a major stake in the business, while also operating that business. There are many examples:

Mark Zuckerberg at Meta Platforms

Steve Jobs at Apple

Bill Gates at Microsoft.

Their passion and will to succeed with their business align with what shareholders want: higher stock prices.

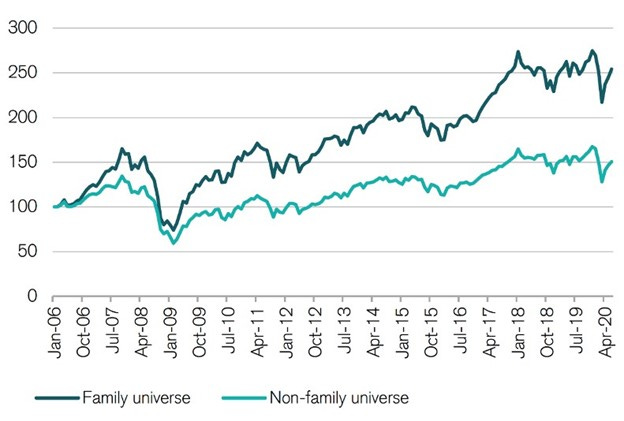

The owner-operator effect is closely related to family-owned businesses, which has proven to out-perform the “non-family universe”:

Credit Suisse’s report concludes that family-owned businesses perform better because the businesses:

Grow at a faster rate

Have higher margins

Conservative, low-risk, balance sheets

Higher cash earnings

SeekingAlpha is sponsoring this article.

Try it 14 days for free using my link: SeekingAlpha/InvestInAssets

SeekingAlpha is the best resource to access some of the best independant financial writers out there. It has been an essential part of my investing process for years.

The businesses mentioned above have all had fantastic 10-year total returns:

LVMH +784% (CAGR 24.1%)

Apple +1275% (CAGR 29.6%)

Copart +989% (CAGR 26.7%)

Berkshire +216% (CAGR 12.1%)

Microsoft +1033% (CAGR 27.2%)

Meta Platforms +1154% (CAGR 28.4%)

Note: Not to say every owner-operator or family business is superior – but it is a characteristic to look for as it aligns the CEO with the shareholders.

Another great example of a founder and CEO that have made several fantastic long-term decisions, is Marcos Galperin of MercadoLibre. Mercado Libre is Latin America’s Amazon. And the stock has been a 16-bagger since its inception in 2011.

5 Reasons Why Family Owned Businesses Do Better

More long-term oriented: Family-owned businesses have a tendency to reinvest their proceeds into the business, creating a compounding effect. They are less likely to use their cash to pay a dividend or do stock repurchases.

Focus on the business: Family-owned businesses have a better focus on what is best for the business, and not what is best for its management.

Incentives: Their incentives are much more aligned with shareholders. They often own a big stake in the business, and they have other motivations for the business to succeed, such as legacy and keeping the family prosperous.

Focus on organic growth: Usually, this is better for the business long-term. Big acquisitions often turn out to be poor investments for the shareholders, but good investments for the management group that is now managing a bigger business.

Tacit knowledge: The family usually has operated the business for decades. This gives family-owned businesses a clear advantage in tacit knowledge and know-how for the specific industry.

Management with skin in the game provides similar effects to family-owned businesses

Skin in the game means that management has a significant percentage of their wealth invested in shares of the business they are running. This is important because it ensures that management acts in alignment with shareholder values. They are less likely to do shady business and more likely to think long-term. Nothing is worse than CEOs who come into a company, pump and hype the price of the company to trigger bonuses and share options, and then take a job elsewhere after a few years.

If you like this post, you will love my upcoming book on quality growth investing, register your interest here to get a special pre-release offer: SurveyMonkey

Leaving you with a Buffett quote:

Thanks for the great write-up. Skin in the game is one of my criteria. Spot on!

Check out OTC Markets Group...CEO (quasi-founder) and family control 35%.