💾 Can AMD Become the #2 Powerhouse in AI?

🚀Meteoric rise in Data Center technology has sparked a new growth cycle for AMD

Hello Investor 👋

Advanced Micro Devices (AMD) is not a common household name. But if you’re a developer or a technology enthusiast, you’ve likely encountered this giant. AMD has a history of being a scrappy underdog (To Intel, and now Nvidia). Lisa Su has led an incredible transformation of the company in the last +10 years. And AMD is rising to new highs due to its strong product portfolio.

AMD is widely known for its:

Ryzen CPUs

Embedded processors

Radeon GPUs

Motherboard chipsets, and more.

Further, the company now builds the engines powering everything that is next-gen.

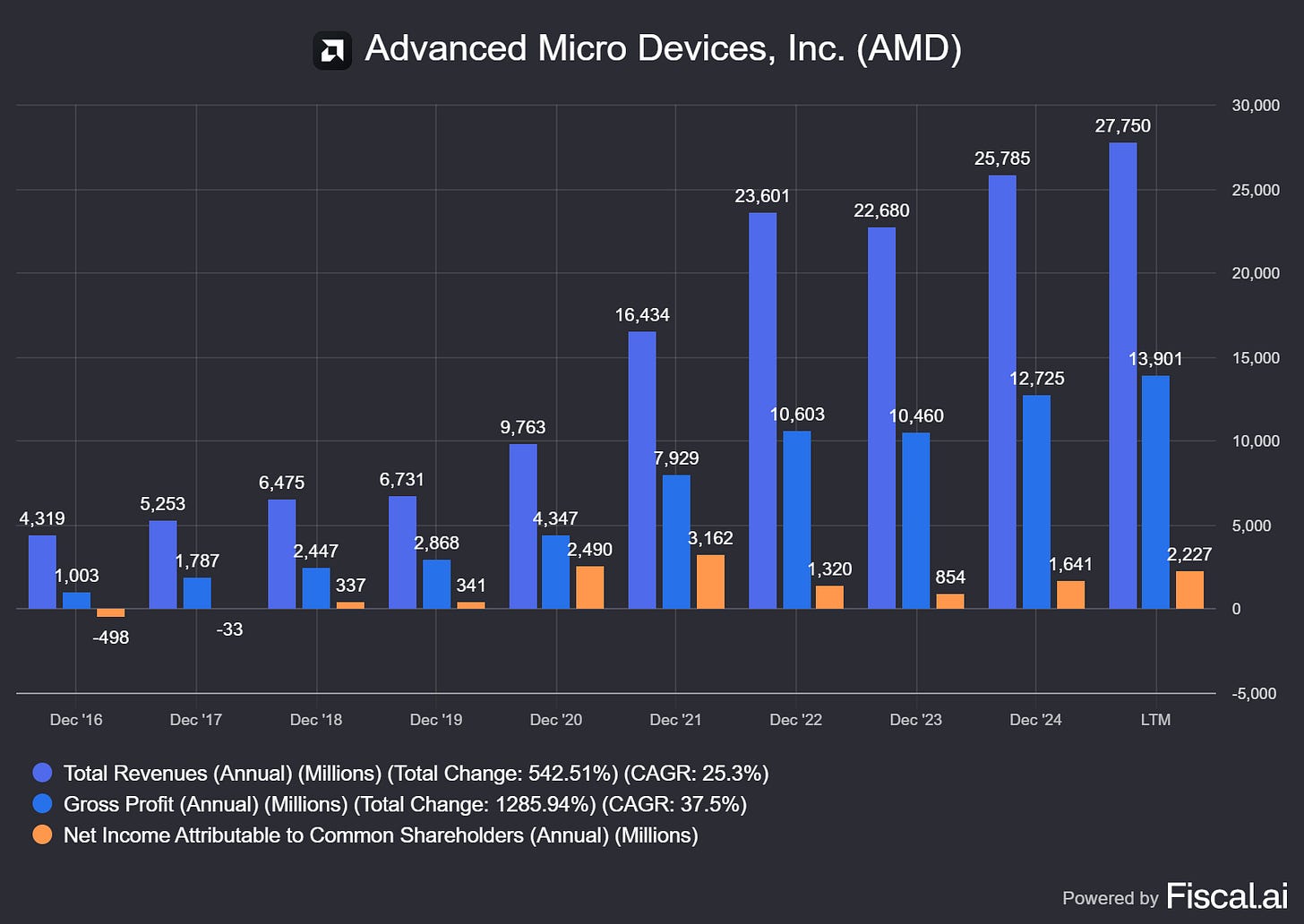

From rags to riches

In 2014, AMD was running on fumes. The stock traded below $3, losses were mounting, and Intel dominated every headline. But then came Lisa Su — and with her, a blueprint for one of tech’s most remarkable comebacks.

Her dedicated focus on (re)building the core: world-class CPUs, efficient GPUs, and a disciplined roadmap, has positioned AMD as one of the most influential technology companies of our time.

AMD is a $250B powerhouse powering AI clusters, gaming consoles, and hyperscale data centers.

The lesson? In investing, bet on execution. Because when the right team meets a misunderstood asset, the upside can be exponential.

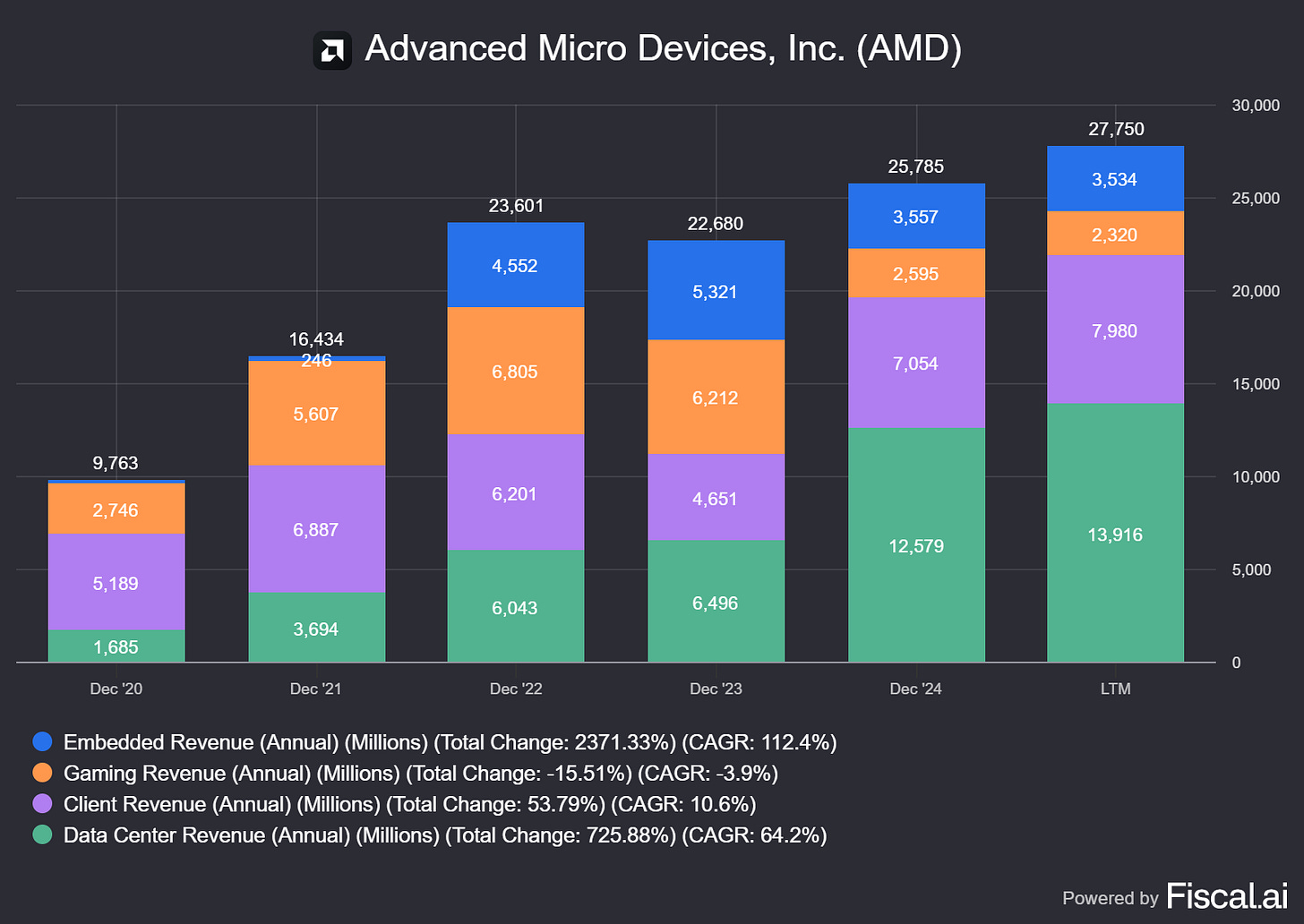

The clear drivers of revenue growth in recent times are the “Data center” and “Embedded Revenue” segments. This has given AMD new life in the eyes of growth investors.

If this journey from a tech-world underdog to a robust performer interests you, do read ahead. It’s time we break it down and determine if AMD belongs in your portfolio.

The Business Model

AMD designs the processors that make these machines run. But it doesn’t build the chips itself. Instead, AMD follows a fabless model. It primarily focuses on design and innovation while outsourcing semiconductor manufacturing to foundries like TSMC.

TSMC has helped it improve by up to 40% in terms of performance, with:

Lower costing

Less requirement for servers

Lower consumption of power

This kind of lean setup is exceptional for scaling, as AMD can scale without the heavy capital burden of owning and running manufacturing units.

How Does AMD Earn Money?

You can effectively break its revenue down into four primary segments:

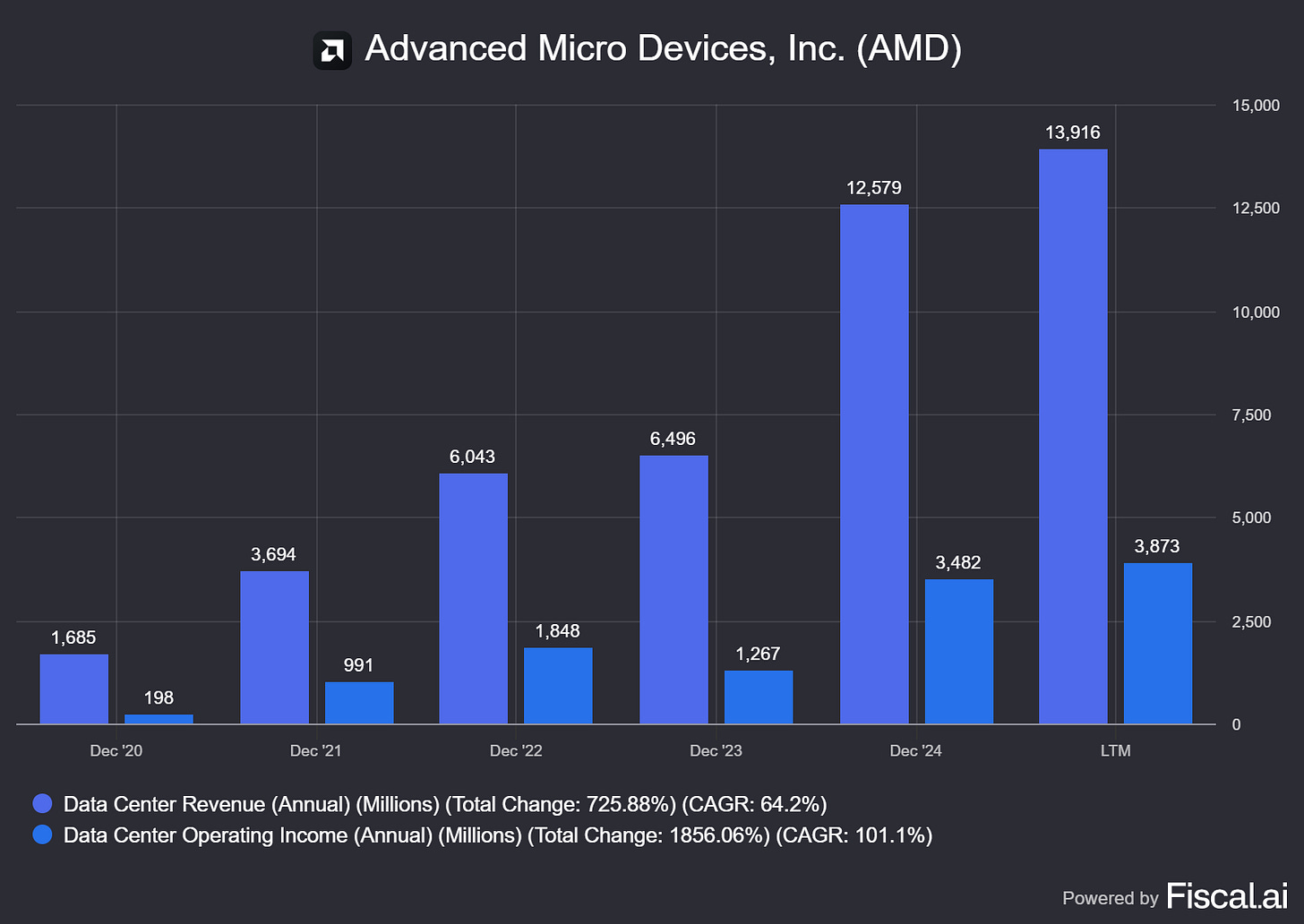

1. Data Center: Supporting AI and Cloud Growth

What it does: Sells high-performance CPUs (EPYC) and GPUs (Instinct MI series) for servers used in AI, cloud, and enterprise data centers.

This is AMD’s highest-margin, fastest-growing business — thanks to surging demand for AI infrastructure and cloud computing.

Data Center revenue exceeded $12B, driven by ramping MI300X shipments to hyperscalers like Microsoft and Meta.

This segment is AMD’s AI call option. If they can chip away at Nvidia’s GPU dominance — even modestly — the upside is significant.

Key products:

EPYC CPUs (5th Gen "Turin" coming in 2025)

Instinct MI300X GPUs (direct competitor to Nvidia's H100)

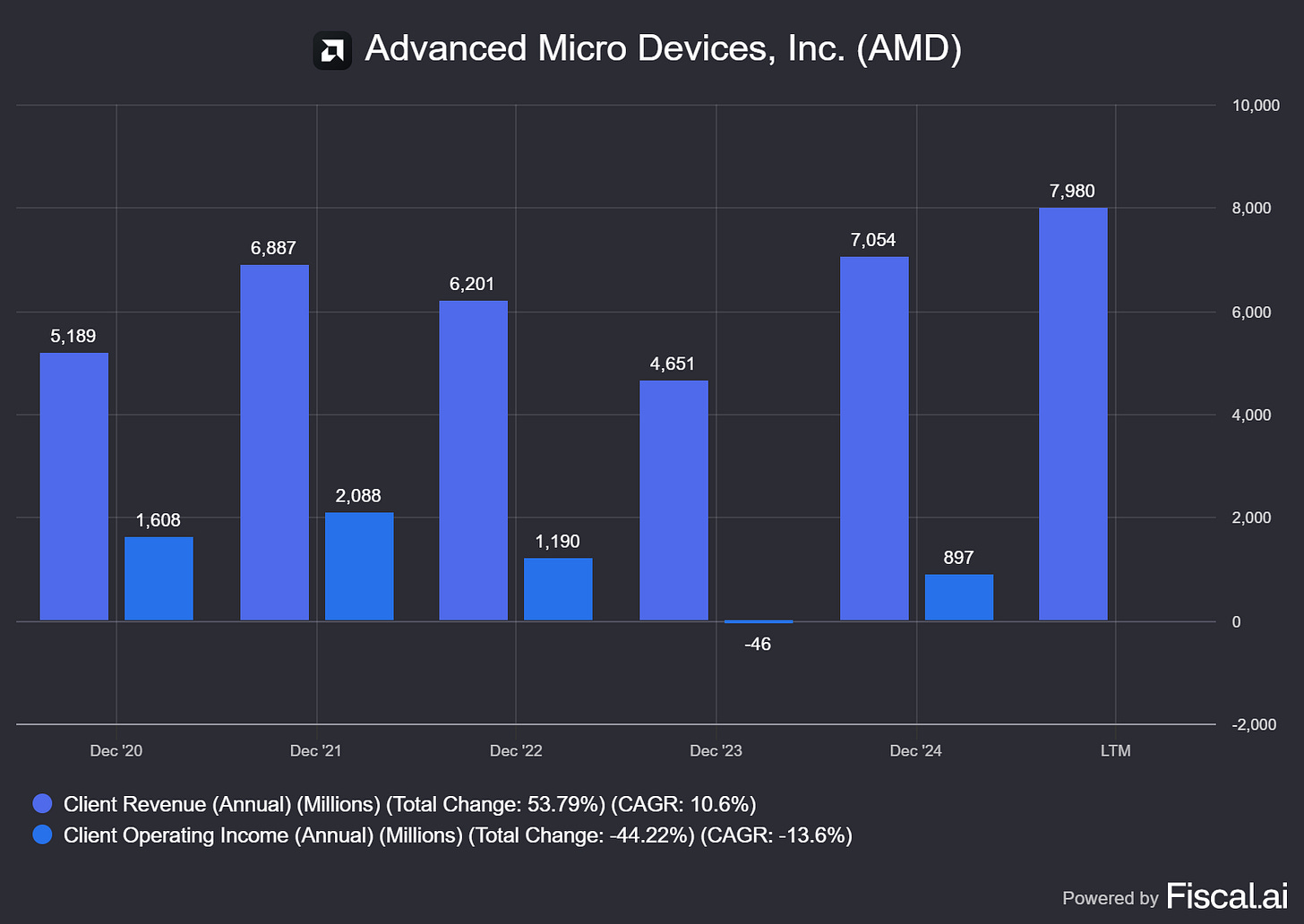

2. Client: The PC Comeback Story

What it does: Supplies CPUs (Ryzen series) for laptops and desktops — both consumer and commercial.

While cyclical, the PC market remains enormous. AMD has been steadily regaining share from Intel, especially in premium and gaming PCs.

The PC cycle is turning — and AMD is well-positioned to benefit from AI-powered devices and power-efficient CPUs.

Key products:

Ryzen 8000 series with integrated AI (NPU)

Strong design wins in ultra-thin laptops and AI PCs

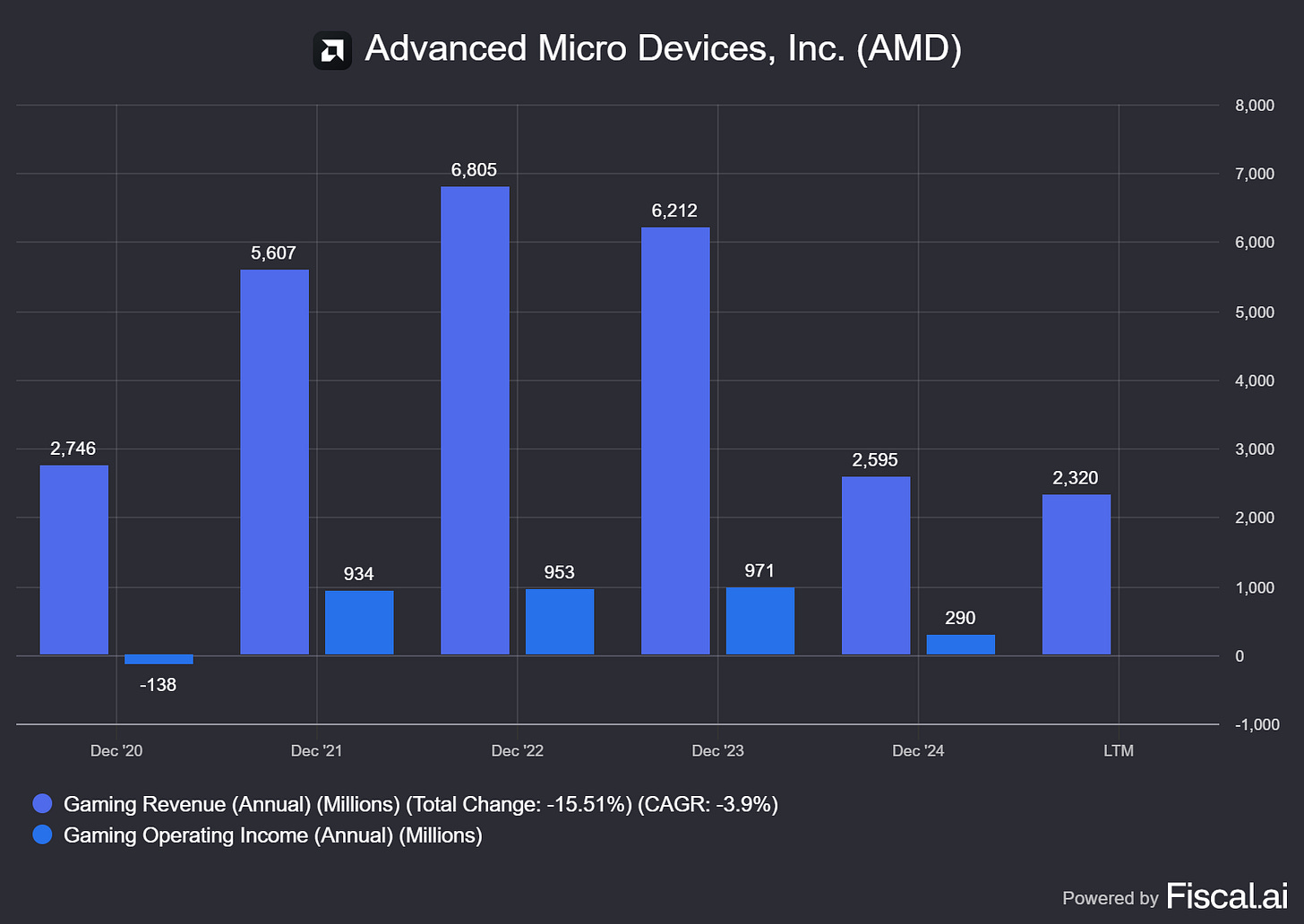

3. Gaming: Consoles and Beyond

What it does: Provides semi-custom chips for gaming consoles (Sony PlayStation 5, Xbox Series X) and discrete GPUs for PC gaming.

Console design wins are sticky and long-cycle. While not a hyper-growth engine, this segment generates stable cash flows.

Key products:

Semi-custom SoCs for Sony and Microsoft

Radeon RX GPU line for PC gaming

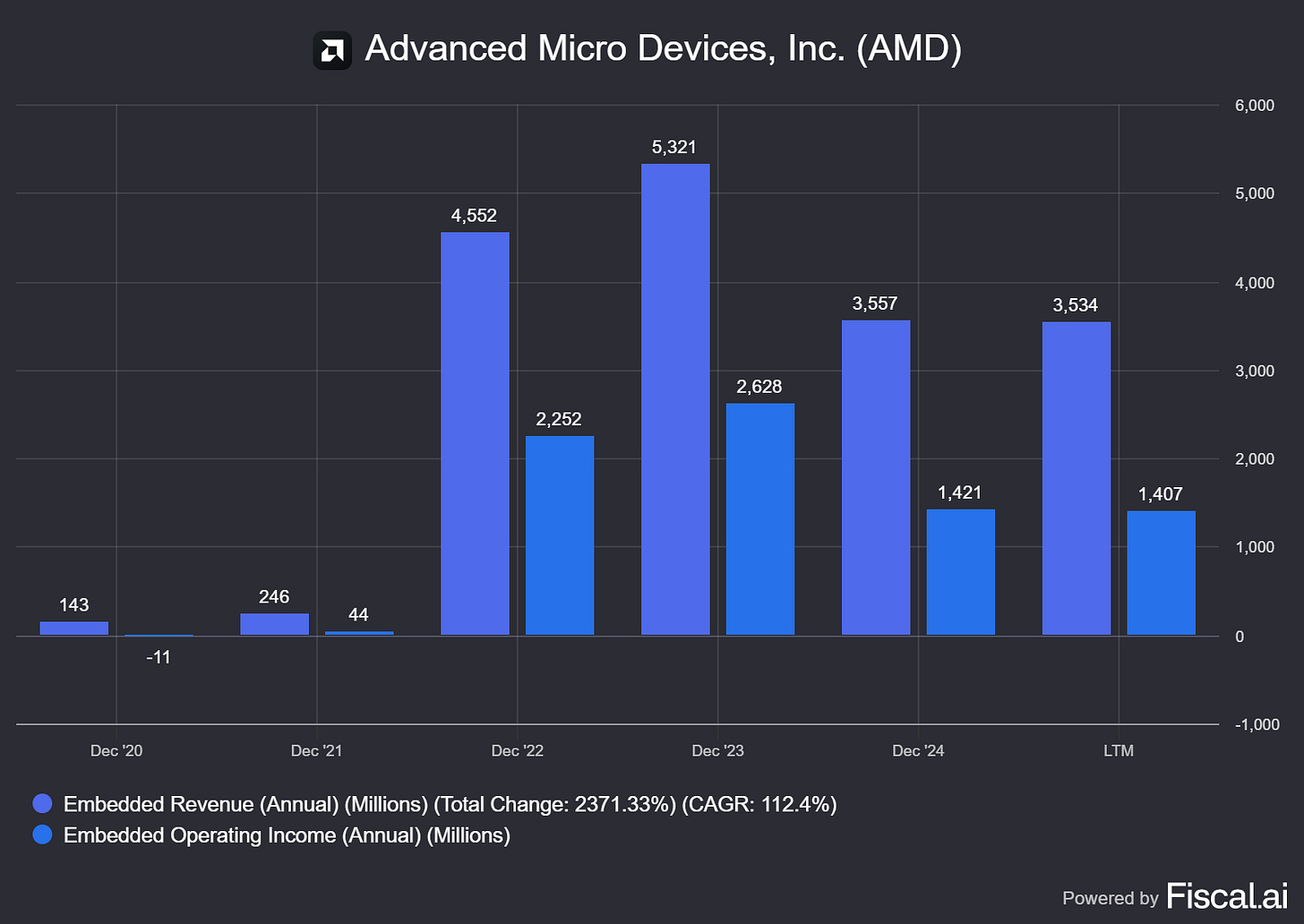

4. Embedded: The Quiet Compounder

What it does: Sells chips used in industrial, automotive, aerospace, and networking applications. This business came from AMD’s $35B acquisition of Xilinx.

Embedded chips have long lifecycles, sticky customers, and high margins. It’s a different rhythm than PCs or data centers — but just as critical.

Revenue fell YoY to ~$3.5B, largely due to an inventory digestion cycle post-COVID. But long-term fundamentals remain intact.

Key products:

FPGAs and adaptive SoCs for everything from fighter jets to 5G base stations

AMD’s business segments are more cyclical than other quality companies, but the data center segment is pulling the load with high growth and high margins.