Alphabet: The Greatest Business Model in History 💎

8 min read 🧠

This article is sponsored by my investing service here on Substack. Read more here:

The business of Alphabet

Alphabet is best known for its search engine, Google. Google is where we all go when we want the answer to something we don’t know, or when we are looking for new products, resources, newspapers, journals, and much more. The business is quite extraordinary due to Google’s ability to use the data from consumers to make targeted ads. They sell inorganic search results, so if a business wants their website to appear when a consumer writes “car”, they can pay Alphabet to get a “promoted” section at the very top.

Google processes ~100k searches per second, and the estimated daily searches are 8.5 billion (!). They have a 92% market share in the search engine market, with the closest competitor being Bing with a 2.9% market share (Source).

Most popular websites worldwide in April 2023, based on share of visits

“Google is more than a business, Google is a belief system. And we believe passionately in the open internet model”

- Eric Schmidt

Gmail & Chrome

Google has built out an entire ecosystem with different free offerings that collect data on the users and help Google provide better and more targeted advertising to its clients. Gmail has 1.8 billion users and is the preferred email service provider by consumers, while Google Chrome has 63% of the browser market share.

YouTube

YouTube has risen to become a real player in the media space, competing for the attention of consumers with 2.7 billion users. Younger adults are spending more time on YouTube, and less time on traditional media and even streaming services like Netflix.

YouTube focuses on growing in 4 main areas: i) Shorts, ii) engagement, iii) premium subscriptions, and iv) making YouTube more commercial or “shoppable”. (Philip Schindler).

Google Cloud

Google Cloud is the third largest cloud provider, behind Microsoft and Amazon. Their smaller size allows them to grow somewhat faster than their competitors, but Microsoft has been the most impressive player in the cloud space as of late. Nonetheless, Google is now making an operating profit from its cloud business, and it might be a significant addition to its profits in the future.

The synergies with Gemini, Alphabet’s generative AI model, and Google Cloud can benefit Google Cloud users a lot in terms of productivity in the near future.

Generative Artificial Intelligence — Gemini

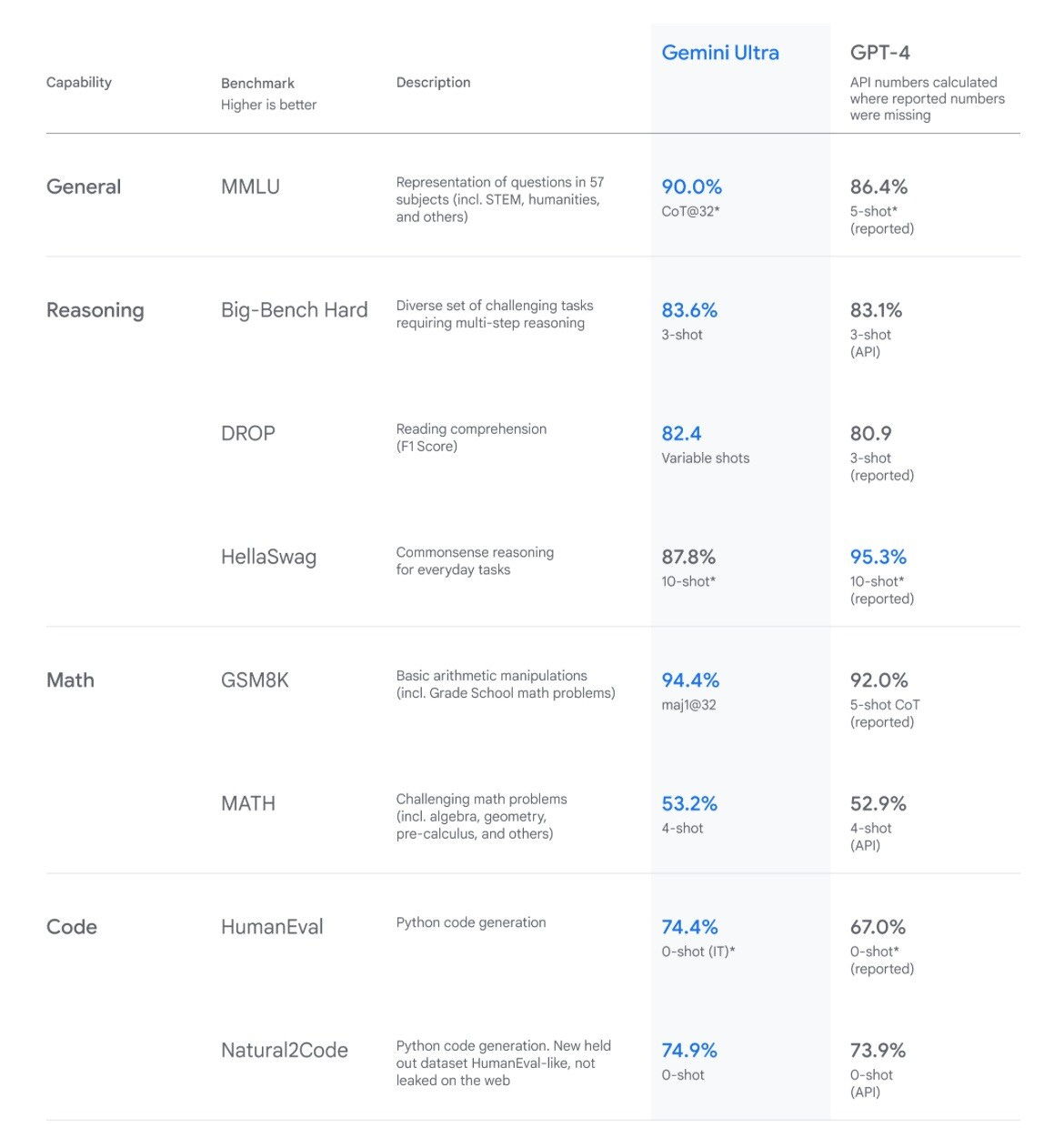

Google is quickly catching up to Microsoft in terms of AI. Alphabet’s new Gemini has been compared to ChatGPT 4 and is beating it on several points:

The business model of AI and how it will affect revenues and earnings for Google is still up for debate, but having a powerful technology that they can feed into their enormous portfolio of services and products will not only increase their competitive advantage as users become more effective, but it is also likely to create a new suite of services that private and enterprise customers can purchase from Google.

Web Analysts want AI

70% of web analysts and SEOs think the new AI search will incentivize people to use search engines more. If generative AI was integrated into search, 75% of web professionals believe it would positively impact their blogs. This means that Google will create a bigger use case for its existing Google Search and hence its earnings potential.

Drivers for growth

Global modernization

5.47 billion people use the Internet daily. Approximately 2.7 billion people do not have internet access. Every year, hundreds of millions of new users are introduced to the internet. It can be expected that the modernization and digitalization of the world will increase the adoption rate of the Internet even further. As Google is the most used website (by far) it is likely to benefit from this trend, as it has — we can see that the amount of users has more than 5X’ed since 2005.

YouTube

YouTube primarily earns money by showing targeted ads. The benefit of the Google Network is that clients can specify to Google, exactly what consumers they want to reach. And Google has a very comprehensive database with key information on users that allows them to target consumers very precisely.

YouTube can display video commercials to the end users. There is also the option to set a specific commercial based on the type of video you see. For example, if you see a video for an upcoming sporting event, you will often get a directly related commercial to convert you then and there. This has been very effective for YouTube.

YouTube is also increasing its offerings with YouTube Music, Streaming, and YouTube Premium. The latter is a paid-for service that takes away commercials and gives the user some benefits on the platform. The service has 26.7 million subscribers in the US alone and is growing at a steady rate:

Number of YouTube Premium subscribers in the United States from 2020 to 2024

YouTube is beating out other streaming and entertainment services when it comes to the younger generation. Children in the UK spend significantly more time on YouTube than on other services like Netflix, Disney Plus & Amazon Prime:

YouTube has been growing at a rapid rate since 2010, we can expect growth to continue, but at a more mature state.

Cloud Computing

Alphabet's cloud division, Google Cloud, has emerged as a strong player in the highly competitive cloud computing space. Competing with industry giants like Amazon Web Services (AWS) and Microsoft Azure, Google Cloud provides a range of services, including storage, computing, and analytics, catering to enterprises worldwide.

Google launched its cloud service after AWS and Azure and is lacking in terms of the extensive services it offers with the lower global spread of databases compared to their competitors. But Google Cloud differentiates itself in three main categories:

Big data

Machine learning

Analytics

Every cloud project is different, and it is hard to claim that Azure is better than AWS and Google Cloud. They all have their strengths and weaknesses. Google will be the clear winner in some projects, while competitors will be the clear winners in others.

The bottom line is that there is a large global demand for cloud infrastructure to build on, and Google Cloud is likely to get a significant slice of that pie.

Artificial intelligence

AGI is all the talk in technology today. I do believe that Google’s work on Gemini will benefit the business as a whole by creating a stronger moat around search, YouTube, and other Google services. I also believe that AGI can be a significant revenue stream in the future. However, I don’t like to speculate on what amount of earnings this might bring in 5-10 years. But I will acknowledge that this will be a positive for Google as a business and investment case.

Diversification of revenue

Alphabet has many revenue streams, but their most significant one is from “Google Search & Other” with ~58% of revenues. This is followed by Google Networks which is ~12% of revenues. YouTube ads that are ~10.4% of revenue, and “Other bets” that is 10.3% of revenues

Whenever you are ready, this is how I can help you:

Essentials of Quality Growth — Join more than 200 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

Promote yourself to +5,000 stock market investors (48% open rate) — Contact us via: investinassets20@gmail.com

The fundamentals

Capital Efficiency & Margins

Alphabet has kept its margins high for decades, despite emerging competition and regulatory issues. Additionally, the return on invested capital has only dipped below 20% one time (in 2017). Other than that the ROIC has been in the 25-35% range.

Growth

In the last 10 years, Alphabet has compounded its revenues at 18.77%, its net income by 18.51%, and its free cash flow by 21.84%.

Per share growth

The per-share growth is slightly higher, indicating that the shares outstanding have shrunk. Alphabet does not need to issue shares to grow, as it can use its internally generated cash flows to invest in new opportunities.

Financial Health

Net debt to EBITDA: -0.9

Debt to Equity: 11.1%

Interest coverage: 63x

Cash conversion (FCFPS/EPS): 117%

Alphabet has a stellar balance sheet, and even if it ran into trouble it is highly unlikely that it would go bankrupt.

Overall, solid fundamentals for Google, high and consistent margins & return on capital, and high per-share growth indicate that there is low dilution and almost no debt is required to fund its operation.