A Swedish Serial Acquierer of Micro Niche Businesses Growing its Topline at 46% Annually for the Last 5 Years

An interesting compounder from Sweden with stellar fundamentals, high returns on capital, stellar growth, competent management, and a cultural edge that sets them apart from the competition.

The Thesis

Teqnion is a small Swedish serial acquirer. It has compounded its capital 15-20% rates for years. The management is competent, honest, and of high integrity. The thesis is that Teqnion will manage to acquire high-quality niche micro/small caps due to its unique culture and management while also applying strategies to existing businesses in its portfolio that promotes organic growth. The business is growing rapidly, both from inorganic and organic sources.

The business

Teqnion operates across three distinct business segments: i) Industry, ii) Growth, and iii) Niche. Within these segments, Teqnion provides top-tier products and specialized expertise in specific market niches. Its offerings encompass high-tech components, machinery, systems, and services.

Through its diversified business areas and the integration of organic growth and acquisitions, Teqnion is strategically positioned to drive value creation and maintain a competitive advantage in its niches. This comprehensive approach enables the company to leverage its operational expertise and deliver innovative solutions to meet the evolving needs of its customers.

The core of Teqnions acquisitions strategy is to buy strong cash-flowing businesses that will pay back their investment in 5 years or less. As a result, Teqnion aims to double its earnings per share every 5 years.

Teqnion is diversified between different niche markets, and has mostly been active in Sweden, but has now ventured into Europe, with 3 acquisitions outside Scandinavia. Here are the businesses Teqnion owns:

The Business Model

Acquisitions

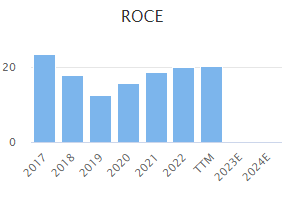

Teqnion has been a fantastic capital allocator over the last 5 years with consistently high returns on capital:

This can be attributed to their acquisition strategy, which follows these criteria:

Skilled management who is motivated to continue developing the business and the organization.

Companies that operate in a clearly defined industry niche and over the years have built deep moats that are difficult to penetrate by competitors.

Long-term and good relationships with employees, customers, and suppliers.

Profitability with profit that can withstand development and integration.

Sustainable future prospects.

Stable turnover of SEK 25–150 million.

Profitability is above their financial target.

Strong cash flows.

Decentralization

For Teqnion to be a successful serial acquirer they rely on entrepreneurs wanting to sell their business. For many family-owned businesses, it can be hard to sell their company to a large corporation. Teqnion has a focus on keeping the entrepreneur on the team by utilizing a decentralized business model, similar to how Berkshire Hathaway operates. From interviews with their CEO and CXO, it’s apparent that they draw inspiration from Warren and Charlie. The decentralized approach has several benefits:

It makes it easier for the entrepreneur to sell their business to Teqnion

It keeps the entrepreneur on the team, which often is a big reason for the business’ success in the first place

It makes sure that managers that know the ins and outs of the business are making key business decisions

Organic growth expansion

Teqnions second vehicle is to expand organic growth from its existing businesses. They let the management teams of the businesses run themselves and are incentivized to perform. Teqnion will assist its businesses with:

Strategic decisions

Problem-solving

Financial resources

Develop policies, processes, and working methods

From 2021 to 2022, Teqnion grew by 44%, where 20% was organic growth. This shows their ability to develop the businesses they acquire.

Management

Looking at the Teqnion management team, specifically the CEO and CXO, these have the most important roles in terms of investment decisions for the business.

Johan Steene is the CEO and co-founded Teqnion in 2009.

Shares owned: 941.776 - valued at 159,5 Million SEK

Johan has built Teqnion from the ground up. Having an owner-operator with skin in the game like Johan has several benefits:

Low risk of fraud

Alignment with shareholders

Owner-operators tend to outperform

Johan is also an ultra-marathon runner, which means he has persistence like no one else. For some reason, I really like that.

Daniel Zhang is the CXO of Teqnion. He has previously worked at McKinsey and Bain & Co, which is a quality stamp of approval—as especially McKinsey is known for only hiring the best of the best.

Shares owned: 35.000 - valued at 5.9 Million SEK. Daniel has mentioned in podcasts he has attended, that he is aggressively buying Teqnion stock with all his personal free cash flows. All of Daniel’s purchases are made in the open market.

Daniel is a Buffett nerd and often refers to Berkshire in terms of its philosophy. In my mind, Daniel wants to turn Teqnion into the Swedish equivalent of Berkshire Hathaway.

If you want to get to know Daniel and Teqnion better, I recommend this video:

Analyzing the insider activity, we can see what prices the insiders are buying and selling the stock at. Daniel Zhang last bought Teqnion stock in November 2022 for 134SEK. Berggren (Chairman of the board) sold at 180 and 195 SEK.

I can not find any evidence that suggests Johan or Daniel has sold any Teqnion stock, which I like. It reflects long-term-ism which is a key trait in successful management.

Stockopedia is offering Invest In Quality readers 25% off using my link: Stockopedia

You can try the service for 14 days for free, and you have a 30-day money-back guarantee if you don’t find it useful. I for one have been using it for a while, and it simplifies my investing process and saves me a bunch of time.

The fundamentals

ROCE 5Y: 18.1%

Gross Margin: 42.6%

Operating Margin: 10%

Cash Conversion: 88%

Interest coverage: 13.4x

Capex/Sales: 0.5%

Capex/Operating Cash Flow: 7.15%

FCF Yield: 3.56%

The fundamentals are solid, and it’s also worth noting that Teqnion invests all free cash flows into new acquisitions to compound the business.

The Stock

Teqnion stock went public in 2019, and since then it has seen a CAGR of 48.3%. The stock is rather volatile, as it is a small Swedish company with somewhat limited volume.

The Growth (5-Year CAGR)

Revenue: 46.4%

Operating profit: 51.5%

Earnings per share: 22.5%

Book Value: 24.4%

Financial Summary:

Sustainable competitive advantage

Decentralized model

Teqnion has a decentralized business model similar to other successful serial acquirers like Lifco, Constellation Software, and Roper Technologies. The competitive advantage does not come from their business model, but more from how they are able to attract micro/small cap businesses that are founder-led/family-owned.

Why would entrepreneurs rather sell their business to Teqnion than other Swedish serial acquirers? I believe their management team and cultural fit play a big role in this:

Culture & Management

Culture starts at the top. Johan and Teqnion promote values like: i) Be kind, ii) be happy, iii) make other people happy, and iv) making mistakes is OK.

It is prominent when you read the company’s 10Ks, and 10Qs and watch interviews with the CEO, that Teqnion is a different kind of company. Johan has successfully created a warm, welcoming culture that takes care of its employees and attracts like-minded entrepreneurs to work with Teqnion. This has led to the company picking up some great deals, resulting in a rapid stock price increase.

Stock price comparison between Teqnion and some other Swedish Serial Acquirers:

Stock performance is not the best proxy for showcasing a competitive advantage, but Teqnion has grown its revenues and EPS at a rapid rate both organically and inorganically through acquisitions. Far outpacing its peers.

Why own Teqnion?

Strong Management with a proven track record and skin in the game

Focus on owning dominant niche businesses with skin in the game at a fair price

Exposure to Scandinavia and Europe’s Micro and Small cap markets

Strong future growth prospects

A unique company culture that creates a competitive edge in acquisitions

Soundly leveraged with a debt/EBITDA at ~1.

High returns on capital and reinvestment opportunity

Great capital allocation

The Risk

Outgrowing the micro/small cap scene, and having to compete with larger serial acquirers like Lifco, Addtech, and Lagercrantz

Valuation risk: Teqnion has become popular in the investing community, this poses a valuation risk as the stock is getting a premium vs. other Swedish serial acquirers of similar quality

The core of Teqnion’s moat is its management team, if something would happen to the CEO, we don’t know how the company would perform.

Cyclicality: Although most of Teqnion’s businesses are resilient and stable, they do have some exposure to Swedish construction, which has proven to be rather cyclical.

At what price would I buy Teqnion?

Let’s run the numbers.

TTM FCF: 97.400

TTM Net income: 110.300

Market cap: 2.9 Billion SEK

FCF Yield: 3.35%

Earnings Yield: 3.8%

Risk-free-rate: 3.7%

My 3 scenarioes for Teqnion:

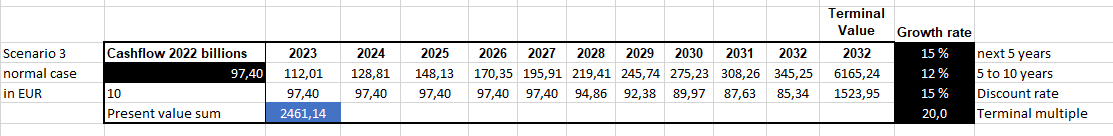

Normal scenario: FCF growth of 15% for the next 5 years, then 12% for the following 5 years, and is valued at a P/FCF of 20 at the end of the period

Best case scenario: 18%, then 15%, valued at 22 times FCF.

Worst case scenario: 10%, then 8%, valued at 15 times FCF.

My intrinsic value estimate is 3.27 billion SEK for Teqnion. Suggesting a ~13% discount from current levels.

For Teqnion to meet my 15% annual requirement, I’d have to purchase the business at 2.46 Billion SEK, a 15% discount from today’s price. My purchase price is around 150 SEK.

Notes: I might be grossly underestimating Teqnion’s growth, as they have shown rapid revenue and EPS growth since its inception in 2019. This growth came out of a small base, and I expect growth to slow down. However, a harder economic environment with inflation and higher rates is both a plus and a minus for Teqnion. On the positive side, they can pick up high-quality niche businesses at discount prices. On the negative side, debt is more expensive, and their businesses feel the inflation pressure.

Conclusion

Teqnion is a great company, with competent management that has shown a track record of shrewd investing and capital allocation. There is no doubt that management is 100% aligned with shareholders, as they own big stakes in the business.

Their cultural edge and decentralized business model make them more likely to get economically favorable deals with small European niche companies. I believe this also gives them an edge in picking up family-owned and owner-operator businesses, that tend to do better than the market.

There are plenty of good reasons to own Teqnion, but investors should also consider the risks, and understand what kind of company Teqnion is. It is hopefully a compound that can continue to compound at 15-20% annual rates.

The valuation of Teqnion is fair, considering their growth profile, and how they have executed over the last 5 years. However, investors should be wary of the law of large numbers.

All in all, I really like this business, the management, and the future prospects, and it is something I want to be a part of. I’m looking to add to my position if the business hits my target of around 150SEK.

Disclosure: I’m long Teqnion since Q1 23.

Curious about Stockopedia? Try it for 14 days for free. Using my link will get you 25% off: Stockopedia