A High-Quality Market Leader with Competent Management and Great Asset Allocation

Unsexy industry, high margins, great return on capital, has a net cash position, high amounts of free cash flow generations and management is aligned with shareholders & has a proven track record

Introduction

Copart has done very well over the last decade. It as has more than doubled the return of Nasdaq and 4x’ed the returns of the S&P over the last 10 years. The company operates in an unsexy and boring industry and won’t be compared to high-growing “hot stocks”. This is a good thing for investors as it means the business probably won’t be unreasonably priced and provide an opportunity to make a good investment.

Copart operates an online auction platform and several scrapyards worldwide. Let’s take a look at the business.

Business Overview

Copart operates an online car auction website. It is the largest platform in the market with approximately 265k vehicles in total.

The business operates several scrap yards in metropolitan areas where it salvages car parts from cars that are not worth repairing. One important advantage Copart has is that it owns the real estate on which its salvage yards operate. This gives them better margins than their competitors that rent the land.

Copart has built relationships and trusts with several of the biggest insurance companies. In practice, this means that when an insurer gets a case with a crashed car, Copart will provide an estimate of the cost of repairs and will buy the salvaged car if the repair costs are higher than the cost of salvaging the car.

Business tailwinds

According to IAA, which is Copart’s biggest competitor, the used vehicle market will expand by 2 million vehicles per year.

Cars have increased lifespans and vehicle complexity increases the likelihood of salvaging cars. This is primarily because increased complexity means increased cost of repairing the vehicles. The salvaging number has gone from 8.5% in 2010 to 20% in 2020 reflecting the increased complexity.

Competition

Copart is the market leader and has a market share of 40%. The second largest player is IAA. IAA is set to merge with Ritchie Brothers. This merger is questionable from investors, as it increases Ritchie Brothers’ leverage, and the synergy is questionable. The increased leverage at this point in the economic cycle is considered a higher risk than it would’ve been if the merger was done in 2018-2021 due to lower interest rates and low inflation levels.

Management

The founder of Copart, Willis Johnson owns ~7% of the company. Johnson has stepped down as CEO, but his family continues to run it. The current CEO is Jay Adair. Adair is Johnson’s son-in-law and is married to his daughter. Adair began his career in 1989 and was promoted to CEO in 2010. He owns around ~4% of the company. The CEO has a salary of $1 plus equity, this means that management and shareholder values are aligned. As we know, owner-operator businesses and businesses where the management has skin in the game provide superior returns for shareholders.

The management is also a long-term thinker. Adair talks about the next 40 years, as opposed to the next 1-3 quarters, which is the focus of Wall Street. This is also a trait to look for when evaluating management.

The results speak for themselves, Adair has outperformed both Nasdaq and S&P500 since he took over as CEO and he will continue to do so in the future. The management performance is reflected in their return on capital numbers:

ROC numbers from 2007-2022. Source: Roic.ai

Buybacks and Capital Allocation

Another sign of great management is capital allocation. Knowing when to buy back stocks, when to pay dividends, do M&A or pay down debt is a key management skill that translates into shareholder value.

Copart has bought back shares in times when the business has been a buy. When they determine that the stock is cheap compared to the future outlooks and current valuations, the management buys back huge quantities of the stock.

In 2011 Copart bought back 29% of shares outstanding - Copart had a PE of 0.6 vs. the S&P in 2011.

In 2016 Copart bought back 12% of shares outstanding - Copart had a PE of 0.4 vs. the S&P in 2016.

These two buyback sequences have been an amazing investment for Copart and show management competency.

Balance sheet and financial health

Copart has a very healthy balance sheet, they won’t go bankrupt in the foreseeable future. Their net cash position of ~$1.4BN and high levels of free cash flows can support the business for years. Copart’s debt to free cash flow is 1.09, meaning that Copart could pay off all debts with less than 1 year’s worth of free cash flow.

Financials

Market cap: 29.8BN

FPE: 24

Operating Margin: 37%

Gross Margin: 47%

ROE: 28,5%

ROIC: 21.5%

Cash Conversion: 77%

Interest coverage: 93x

Comment: Stellar operating margins, high ROC, solid cash conversion.

Valuation

FCF Yield 2.5%

Risk-free rate: 3.5%

Comment: FCF Yield is 1% below the risk-free, but is growing at a +20% pa rate

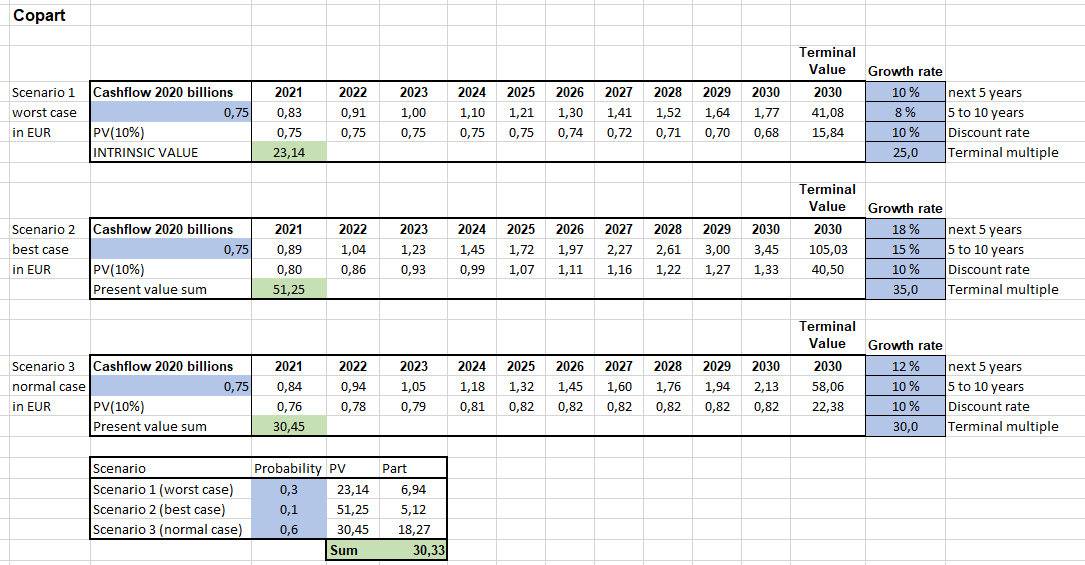

Discounted Cash Flow Analysis

Using the FCF from TTM of $750MN

11% growth is the consensus for the next 5 years.

The 5-year revenue CAGR has been closer to 18.3% pa.

Currently, a small discount to the current valuation of $29,72BN - provides some margin of safety to current levels.

Annual Growth Rates

Comment: Stellar growth rates over the last decade. Revenues have even increased in the last 5 years. Source: Roic.ai

Competitive advantage

Barriers to entry

Scale - You need sufficient scale to compete. To achieve the scale you can build up your reputation over the years as Copart has, or you can try to buy your way into the market - hard to do and likely to fail.

Relationships & Trust - 80% of listings come from insurance companies that Copart has built a relationship with for decades. Trust is an underrated variable in markets.

Real estate - needed near all major metropolitan areas. This will cost a ton to invest in upfront, or it will hurt your margins significantly if you choose to rent the land like IAA.

Intangible assets: Website/Platform

Network effects: The more insurance companies and consumers that use their platform increases the efficiency of the platform. It provides better products for the consumer, and it provides more data points for Copart to increase the effectiveness of the platform.

Conclusion

Copart is a High-quality business with a great management team that is aligned with its shareholders to provide value. The management has a proven track record of being great capital allocators, they hold a high level of the shares, they have managed Copart into a market leader with a 40% market share and a strong market position, and they talk 40 years in the future. All signs of a great management team.

The business is in a boring and unsexy industry, which is just the type of business that will be overlooked by wall street.

The business has a wide moat in barriers to entry, intangible assets, and network effects. The main competitor IAA is unlikely to provide much trouble for Copart as it has merged with Ritchie Brothers. It is expected that the merger will give the company plenty of hurdles to overcome and a company with a split focus might not pose a big threat in the years to come.

Copart is currently trading at a decent valuation and is expected to return ~10% annually from current levels given a conservative 11% annual growth rate. Copart is currently sitting high on my watchlist and I might pull the trigger in the weeks/months to come. Amazing business at a fair price.

Great company.hold iaa for months but copart Is the munger winnner