A Boring, Decentralized, Steady Serial Acquierer that focuses on Asset-Light Niche Market Leaders with Strong Free Cash Flow

Winners keep on winning.

Roper Technologies ROP 0.00%↑

Table of content:

Business overview

Dividends

Stock Development

Financial Overview

Competitive Advantage

Ownership

Discounted Cash Flow Analysis

Conclusion

Business Overview

Roper, a well-diversified technology firm. It operates three segments: application software, network software and systems, and technology-enabled products. The company acquires asset-light, cash-generative businesses, a strategic approach that has proved quite successful.

The business is almost almost a 200 bagger since its inception in 1992. Roper reinvests its excess cash in ventures that yield incrementally higher rates of return. The company has a disciplined approach to capital allocation, and are currently transitioning their businesses towards reoccuring revenue and vertical software and Saas businesses. Roper has provided stellar shareholder value for 3 decades, and plan to do so in the future.

Roper’s management has been very upfront over the years about their desire to continue to transform the businesses toward higher-margin recurring revenue with lower capital intensity and a focus on niche businesses with higher barriers to entry.

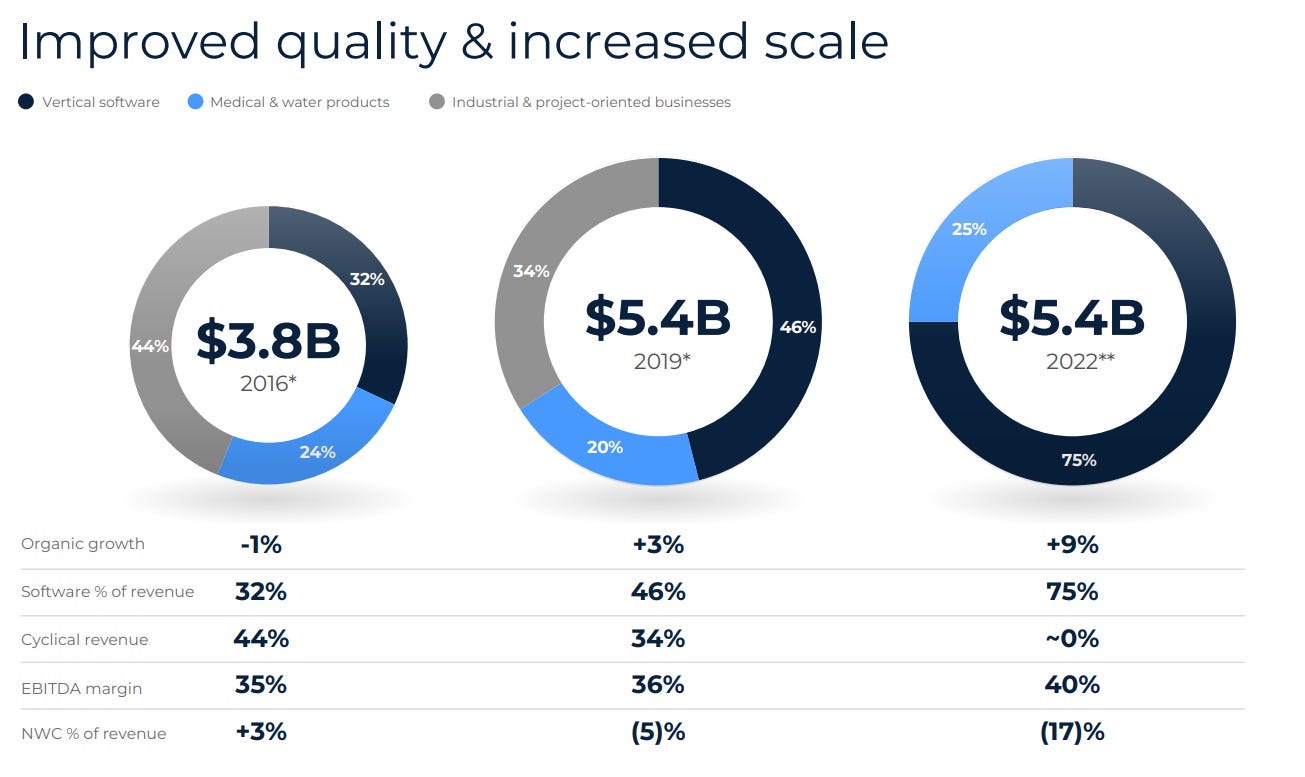

This is something the business has been successful with, increasing their organic growth, transitioning out of cyclical businesses into niche software businesses. By doing so, they have increased their margins, and is much more asset light then previously:

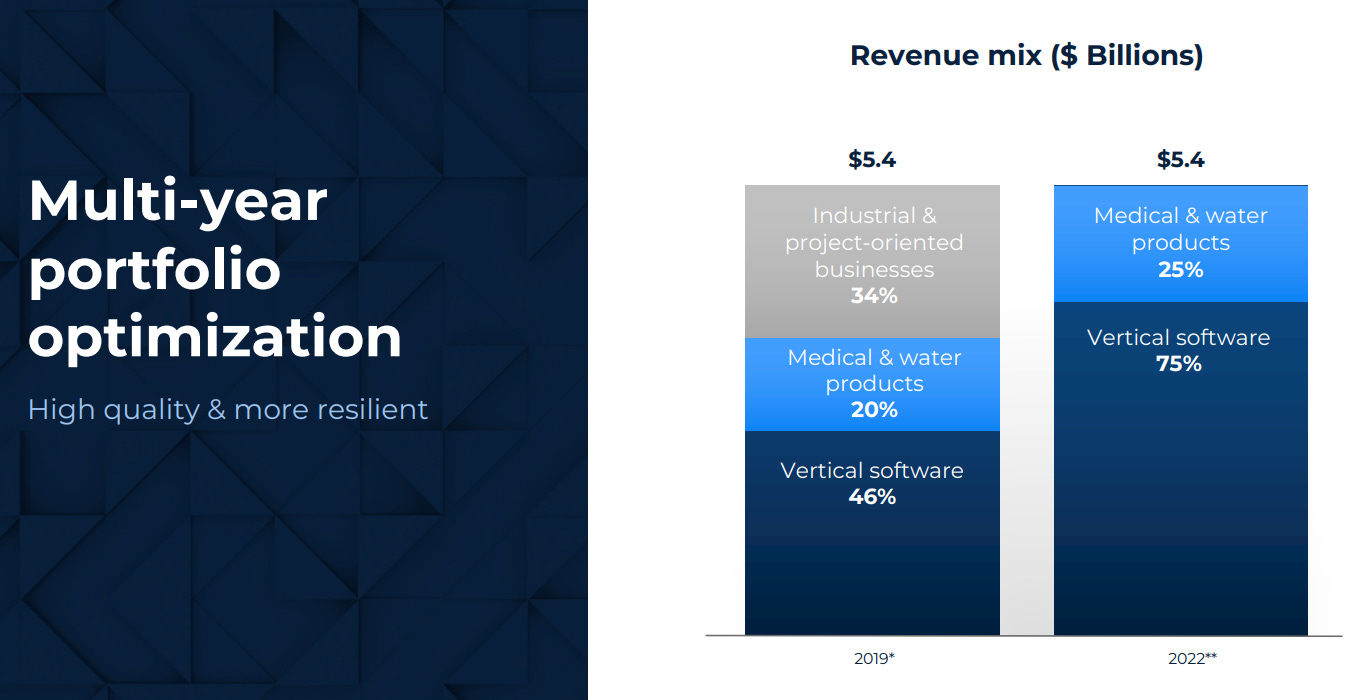

Roper has been optimizing their portfolio for the last few years. They have transitioned out of industrial, project-oriented businesses, which in 2019 was 34% of their revenues. In 2022 0% revenue comes from industrials, while 25% comes from Medical & Water products, and 75% from Vertical software, in line with their vision.

The revenue from vertical software is of high quality, it is resilient, and highly reoccurring. As of 2022, more than 70% of their revenue is recurring. For their vertical software businesses, around 80% is reoccurring revenue (Investor Presentation, 2022).

Performance in 5-year increments has been stellar. Continuous compounding of FCF, capital deployment into new high-quality businesses, and an expanding FCF margin have left Roper Technologies as a high-quality serial acquirer of niche software businesses.

Dividends

Roper has steadily increased their dividends over the last decade with a CAGR of 17,4%.

Stock development

Since its inception in 1992, Roper Technologies has compounded annually by 18,6% not including dividends. In the last decade, the business has beaten the S&P 500 by ~100%. A steady compounder with a winning investment strategy.

Financial Overview

Operational

ROIC: 22%

ROIC5Y: 11%

Gross margin: 70%

Operating margin: 28%

Cash conversion 5Y: 109%

Note: Stable and expanding margins. Increase in ROIC last few years.

Valuation

PE: 47

Fwd. PE: 27

PEG: 2

Free cash flow yield: 4.98%

Note: FCF has compounded for ~15% for the last decade. PE misleading.

Growth (CAGR)

Revenue 5Y: 3.12%

Revenue 10Y: 6.02%

Net Income 5Y: 36.14%

Net Income 10Y: 25.12%

Free cash flows 5Y: 15.56%

Free cash flows 10Y: 15%

Notes: Impressive Net Income, EPS and FCF CAGR rates, not impressive top-line growth.

Roper Technologies is improving their business fundamentals by transitioning the business. It’s showing in the return on capital numbers, their GM/OM/FCF margins, and in their organic growth, which is a plus for the business. I’m somewhat conserned about the low top line growth, but if the management can continue to execute on their strategy and keep up organic growth it might end up being higher the coming decade.

This slide shows Roper’s organic and total growth the last few years:

Roper’s expectations for FY2023. “Rule of 40+” Refering to FCF margin + growth being higher than 40%, a popular metric in the software industry.

Competitive advantage

Morningstar considers Roper a wide moat business. This means that the business has some kind of competitive advantage, that is sustainable and protects its earnings from competitors.

“We think Roper remains an improved version of a boring, decentralized, steady compounder that focuses on asset-light niche market leaders with strong free cash flow generation.” - Morningstar 2023

The business has a competitive advantage in switching costs, meaning that it is hard for customers to change to competitors. By focusing on software businesses in the vertical software and Saas space, they seem to be utilizing a similar strategy as Constellation Software. These businesses are often mission critical for their customers, and it is a huge hassle for them to change their supplier.

Roper also has a competitive advantage in terms of its intellectual property. They have been great capital allocators for years. They have a decentralized approach, but plenty of domain specific knowledge for the businesses they acquire. This means they can help these businesses to streamline operations and become more efficient. They are also able to unlock synergies between the acquisitions.

Here is what they look for in their investments/acquisitions:

Ownership

Insiders own 1.44% of the company with a total value of $676.8M. A rather small stake.

Akre Focus Funds is one of the biggest shareholders in the business, which is a big stamp of approval for Roper. Akre added Roper to their portfolio in 2014, and the position is today around 6.5% of the fund.

Discounted Cash Flow Analysis

Inputs:

FCF TTM of $2,338BN

Worst case scenario: FCF growth of 8, then 6 - terminal value of 15

Best case scenario: FCF growth of 14, then 12 - terminal value of 25

Normal case scenario: FCF growth of 10, then 8 - terminal value of 20

Weighted average of $60BN market cap. Current market cap as of this writing is $47BN. Suggesting a ~27% upside from current levels.

My worst case is equal to todays market cap. This means that this is in line with what is expected. A FCF growth of 8%, then 6% and a terminal value of 15, suggesting a 6.67% FCF yield at the end of the decade.

For Roper Technologies to hit my 15% annual requirement, they would have to grow FCF by 10% annually for 5 years, then 9% annually for the next 5. And be valued at 22 times FCF. This sounds plausible.

Conclusion

Roper Technologies is a very high quality serial acquirerer of niche software businesses. Their revenues is mostly reoccuring and has been transitioned into vertical software and Saas business models. They have improved fundamentals by making a strategic shift in their portfolio and investing strategy which shows up in the numbers.

Their fundamentals are great, and their growth is solid. The only concern I have is regarding their top line growth. But if management can continue to execute and deliver high organic growth, this might change my view.

I’ve added Roper to my watchlist as a potential buy. I will evaluate a few more serial acquirerers within software and healthcare in the coming weeks. Stay tuned.

Terminal multiple is the multiple we asign to the FCF at the end of the 10 year period. So after 10 years, given X amount of growth, I assume that the business will be valued at 15-25 times FCF. So yes, it is sort of the PE, but as we use FCF here it is PFCF. If you were to use EPS, it would be the PE of the business at the end of the period.

I usually make an educated, conservative guess on this value

I've been reading a lot of your articles which are really insightful.

With regards to the terminal value, how do you make an educated guess? Your terminal values range from 10 - 35. Why do you go as high as 35 for some businesses?

It would be good to know how you termine this and if you have a caluclation for each business.

Thank you.