🏰5 Quality Buys October

🧠 5 Quality Growth businesses trading at fair valuations

Hi partner! 👋🏻

Welcome to the October edition of Top 5 Buys ✅

In this article, we will discuss our top stock picks for October 2025.

Let’s get into it 👇

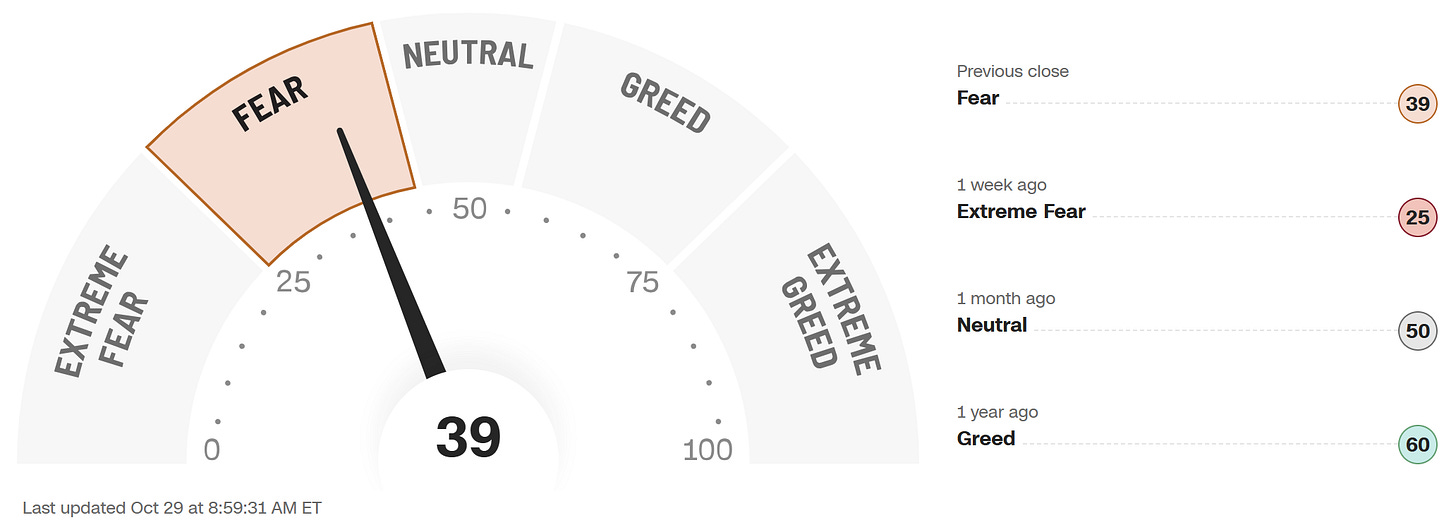

The Market Sentiment: Fear

The market remains volatile. Just one week ago, the market was experiencing “extreme fear”, not that we’ve settled on “fear”. Many businesses struggle in the current environment, but the megacaps led by massive investments in AI infrastructure are carrying the market.

Investor sentiment has cooled from Greed to fear. The market is not panicking, but it is no longer in “euphoria”-mode.

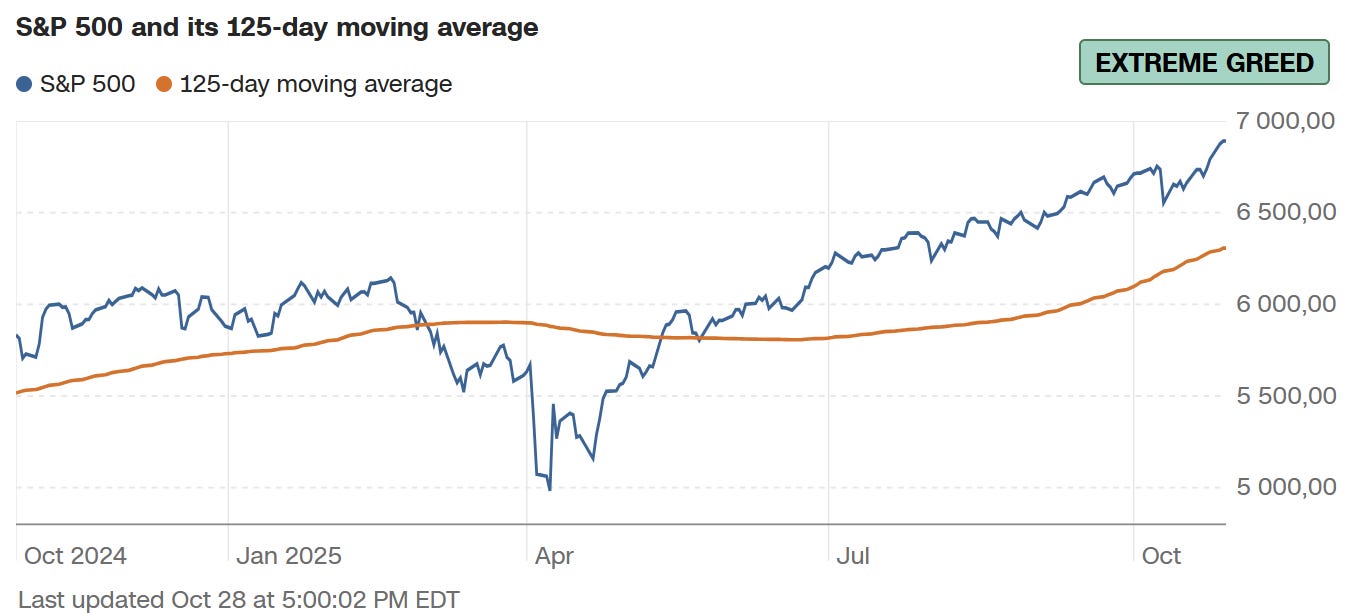

The S&P 500 is pushing well above its 125-day moving average, led by incredible growth in mega caps (Specifically Nvidia).

I can’t predict the future, but I can point to 5 quality growth businesses that continue to compound regardless of market mood.

The businesses we look at continue to grow, have wide moats, great business models, and modest valuation levels.

Here are this month’s Top 5 Buys 👇

Disclaimer: This is not investment advice. Always conduct your due diligence and make your own investment decisions.

Top 5 Quality Buys October 2025 🚀

#1 Booking Holdings BKNG 0.00%↑

Booking is the largest online travel company in the world, offering millions of hotel stays, flights, and rental cars.

The business has made multiple strategic acquisitions and now operates trusted brands such as Booking.com, Priceline, Agoda, Kayak, OpenTable, and Rentalcars.com.

What started as a Dutch hotel-booking website has become a $130 billion global platform processing over $140 billion in annual gross bookings.

Through technology, data, and network effects, Booking has turned the fragmented travel industry into one of the most profitable online ecosystems we know.

The Business Model: Scale, Data, and Network Effects

Booking runs a two-sided marketplace connecting travelers and accommodation providers.

Booking provides the platform where hotels, flight businesses, and car rental services can reach an unparalleled group of consumers.

Key structural advantages:

Global scale: 28+ million accommodation listings across 220 countries.

Demand density: unmatched traffic and conversion from repeat users and SEO strength.

Data-driven optimization: dynamic pricing, AI-based recommendations, and personalized search.

Vertical integration: from search (Kayak) to dining (OpenTable) to stays (Booking.com).

Once travelers and hotels enter the Booking ecosystem, both sides face strong switching costs. Consumers trust it for simplicity and reliability, and hotels rely on it for demand and global reach.

Growth Drivers🚀

After years of post-pandemic recovery, Booking’s next growth phase looks more like a durable compounding story than a cyclical rebound. Key drivers include:

Direct channel strength: +45% of bookings come direct via app. This significantly lowers customer acquisition cost or “CAC”.

Alternative accommodations: apartments and villas now represent more than 35% of total listings, driving higher margins and loyalty.

AI and personalization: proprietary models improve search ranking, pricing, and conversion at a global scale.

Payments and fintech: Booking facilitates transactions end-to-end, capturing higher take rates.

Emerging markets: strong expansion in Asia-Pacific and Latin America as travel digitalization accelerates.

These drivers are set to increase Booking’s top-line growth through expanding business segments, personalization to drive repeat purchases, higher take rates, and expanding emerging markets.

In addition, the direct channel through their app allows them to reduce the cost of acquiring new customers. Increasing the lifetime value of customers while reducing the cost to retain them is a strong combination.

Financial Highlights

Booking Holdings is a high-margin, cash-generating machine:

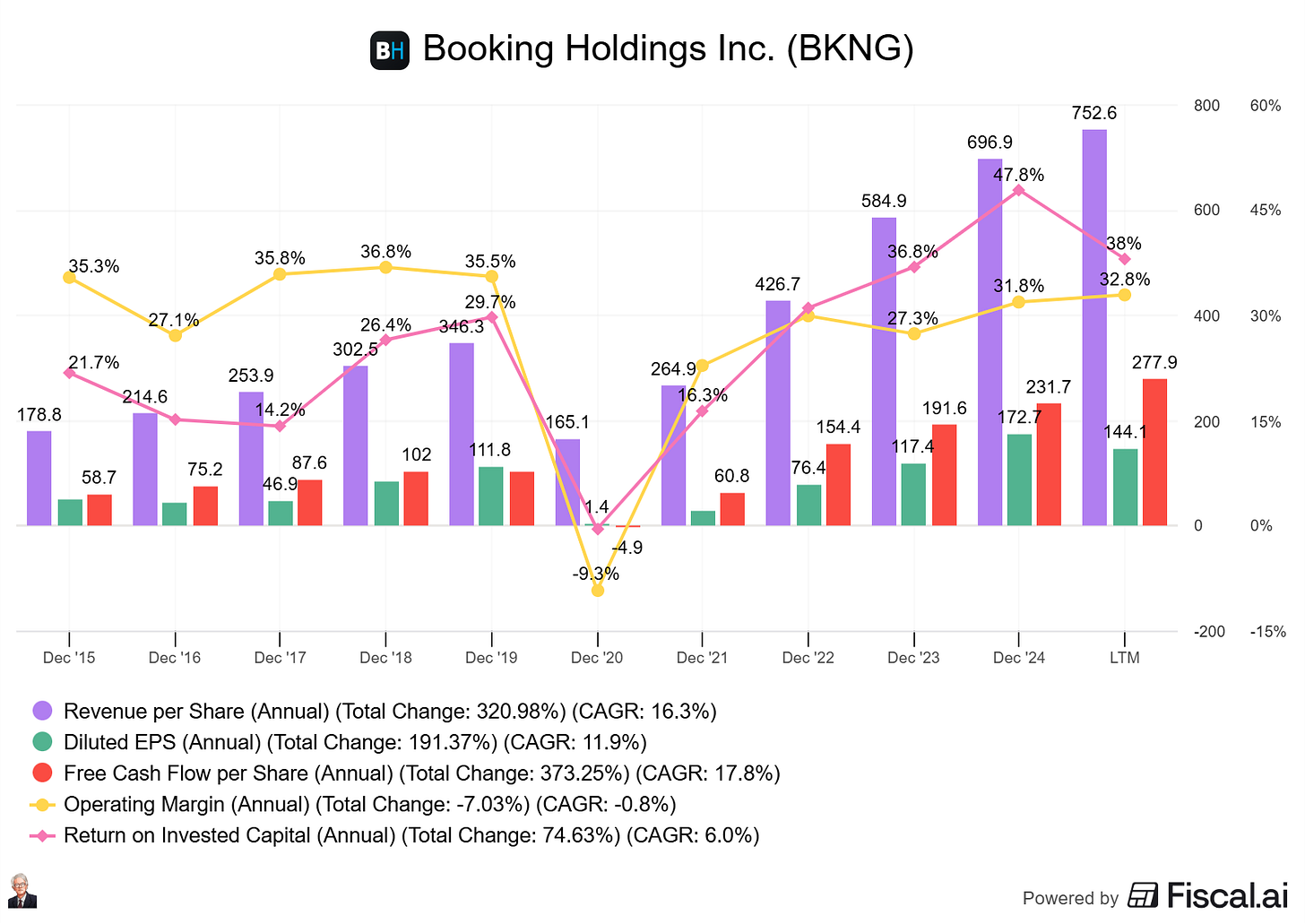

10-year CAGR numbers:

Revenue per share: 16.3%

EPS: 11.9%

Free cash flow per share: 17.8%

Its business model combines the resilience of recurring global travel demand with the scalability of a digital marketplace.

Valuation

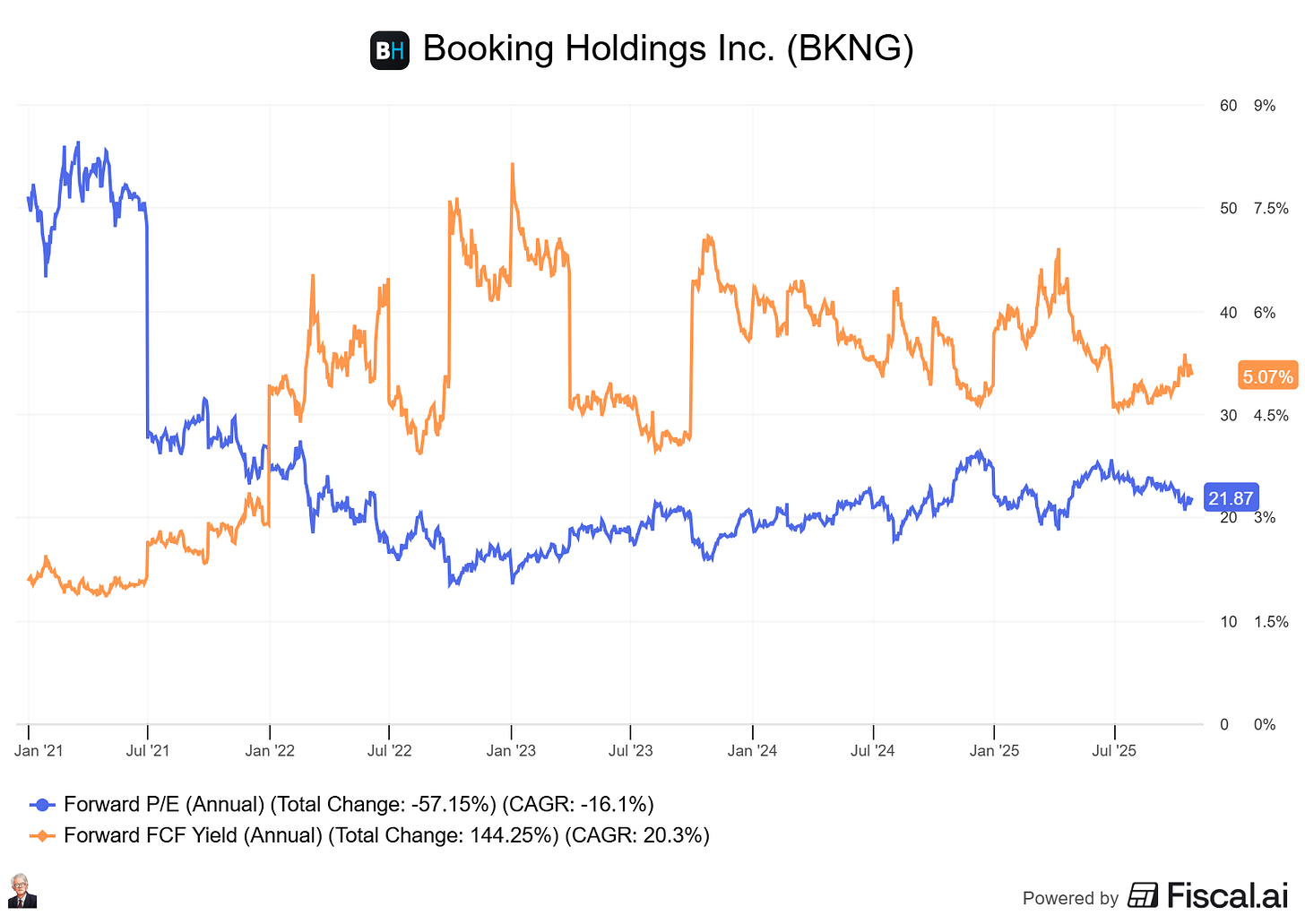

Booking is trading at a fair valuation based on its forward PE and FCF yield:

FCF Yield: 5.07%

PE: 21.87x

With an expected earnings per share growth of 17.2% for the long term, the valuation remains undemanding.

#2 Salesforce CRM 0.00%↑

Salesforce began in 1999 with the idea that software should reside in the cloud, rather than on-premises servers.

What started as a simple CRM system has now evolved into a global platform serving +150,000 businesses and generating +$35 billion in annual revenue.

Salesforce software is built into the backbone of almost every industry we have. They integrate sales, services, marketing, data, and now AI into one ecosystem that makes customer management easier, faster, and more profitable for its clients.

The Business Model: Platform, Not Product

Salesforce’s business model is to offer a suite of products from a cloud-based platform for clients to easily start using.

Low friction, high value for the user if they can use it effectively — a great value proposition with high switching costs once a client is set up.

Core elements of the business model:

Sales Cloud: the original CRM, now powering global sales organizations.

Service & Marketing Cloud: end-to-end customer engagement and support.

Data Cloud & MuleSoft: unified data across systems and apps.

Tableau & Slack: analytics and collaboration seamlessly integrated into workflows.

Einstein AI: embedded intelligence for automation and predictive insight.

The result is a platform that becomes harder to replace with every new integration.

Salesforce is the definition of a sticky software-as-a-service business.

Growth Drivers🚀

Salesforce is making a transition from growth mode to a more mature large business where disciplined acquisitions, cost control, and steady compounding are becoming more important.

Key drivers for the next decade include:

AI-native CRM: Einstein GPT and predictive analytics are embedding AI into every customer interaction.

Data Cloud expansion: Integrating customer data silos is a massive cross-sell opportunity.

Margin focus: efficiency programs and slower headcount growth are lifting operating margins above 30%.

Enterprise stickiness: long contracts and deep integration ensure stable, recurring revenue.

Ecosystem leverage: thousands of third-party apps on AppExchange reinforce network effects.

Despite turning into a mature business, Salesforce still has multiple levers to pull to continue to grow its top and bottom lines.

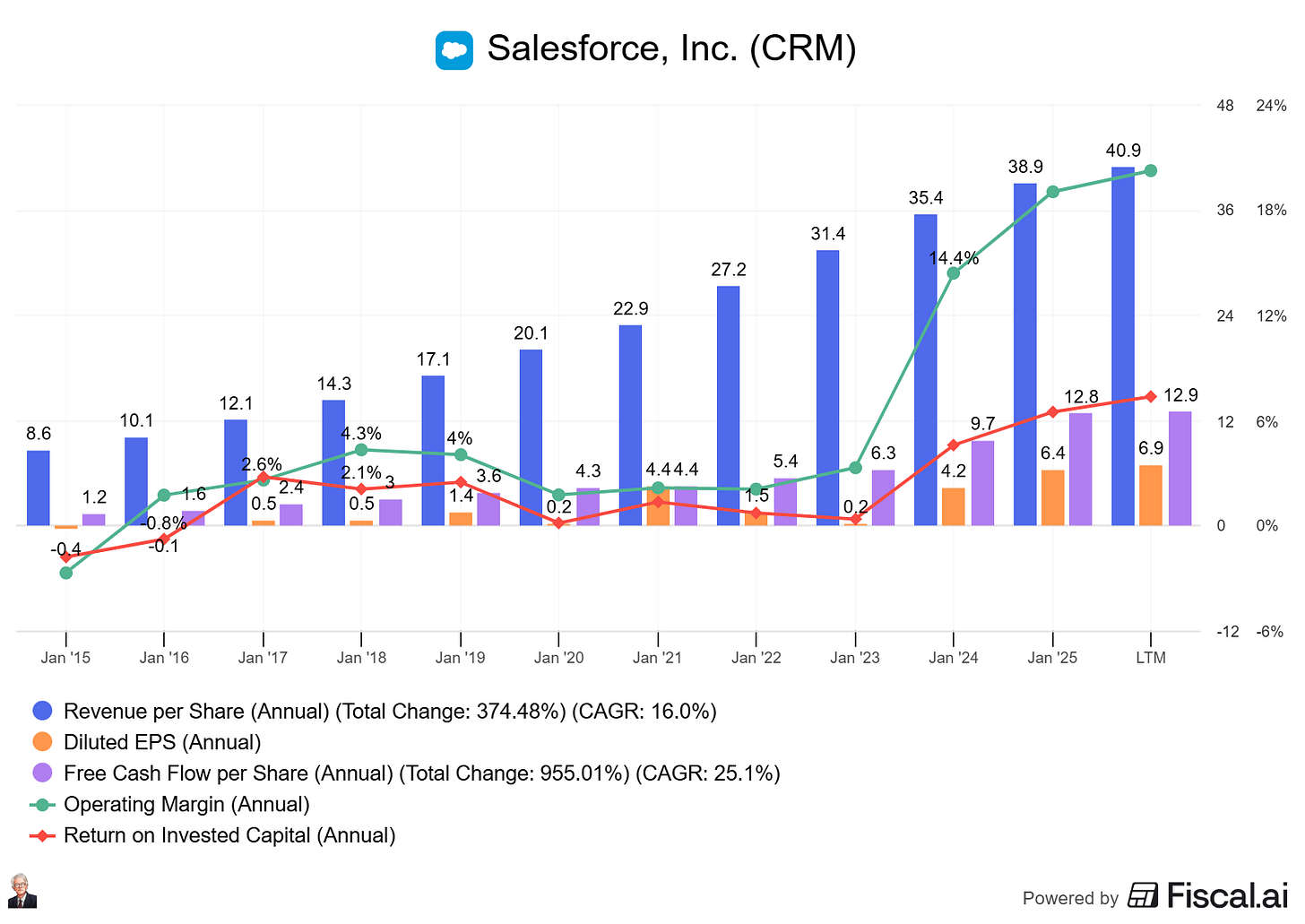

Financial Highlights

Salesforce has made some operational unlocks since 2023 to boost operating margins from ~6% to 20%.

Note: Salesforce’s ROIC is low due to its massive acquisitions.

10-year CAGR:

Revenue per share: +16%

Earnings per share: -$0.4 to $6.9

Free cash flow per share: 25.1%

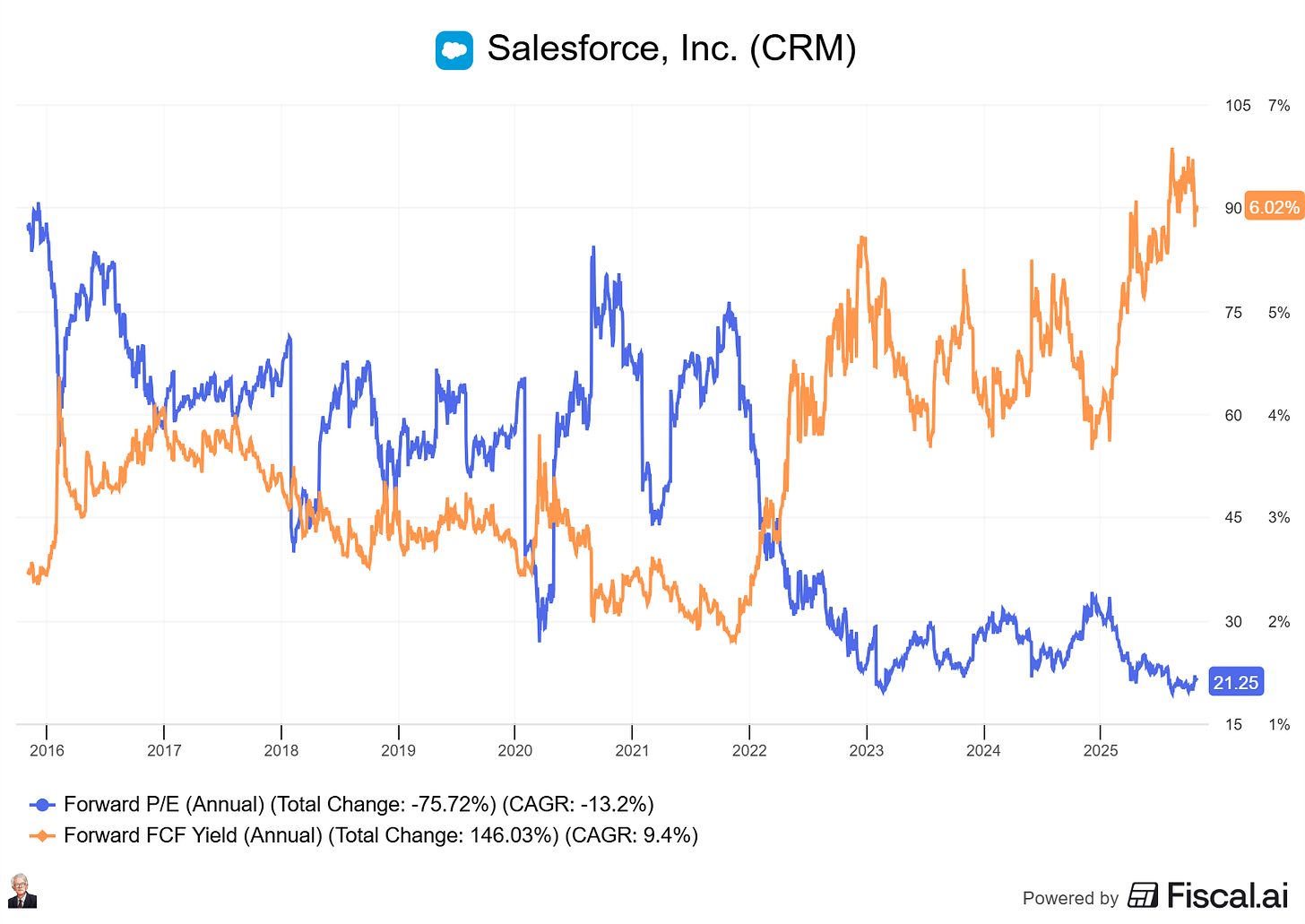

Valuation

Salesforce’s stock price has basically gone nowhere in the last 5 years.

Still, EPS has compounded by 21.6%, and revenues by 15.3%.

This has resulted in the valuation coming down significantly.

Forward PE is down from ~90x to 21x. FCF yield from ~2.5% to 6%.

From a historical perspective, Salesforce is trading at a much more attractive valuation now than in the past 5 years.