3 stocks I'm buying 🚀

Quality growth companies at fair valuations 💰

Hi partner! 👋🏻

Today we will buy 3 stocks for the quality growth portfolio.

We recently trimmed a few positions, and our cash position is now ~8%. I want to allocate this capital to the best opportunities we currently see.

Let’s get into it 👇🏻

#1 Stock is a dominant quality growth stock well positioned in a niche market with a wide moat - The stock has compounded shareholder capital by +31.3% annually over the last 5 years.

The investment case is compelling:

Fragmented market ready for consolidation

Revenue CAGR of 40.38% in the last 5 years

Attractive business model with high and expanding return on equity

Founder-led business with skin in the game

Disciplined cost controls

#2 Stock is a beaten-down compounder with stellar margins, returns on capital, and growth - The stock has compounded shareholder capital by +23.4% annually over the last 5 years.

The investment case is compelling:

Dominant market leader

Large TAM to grow globally

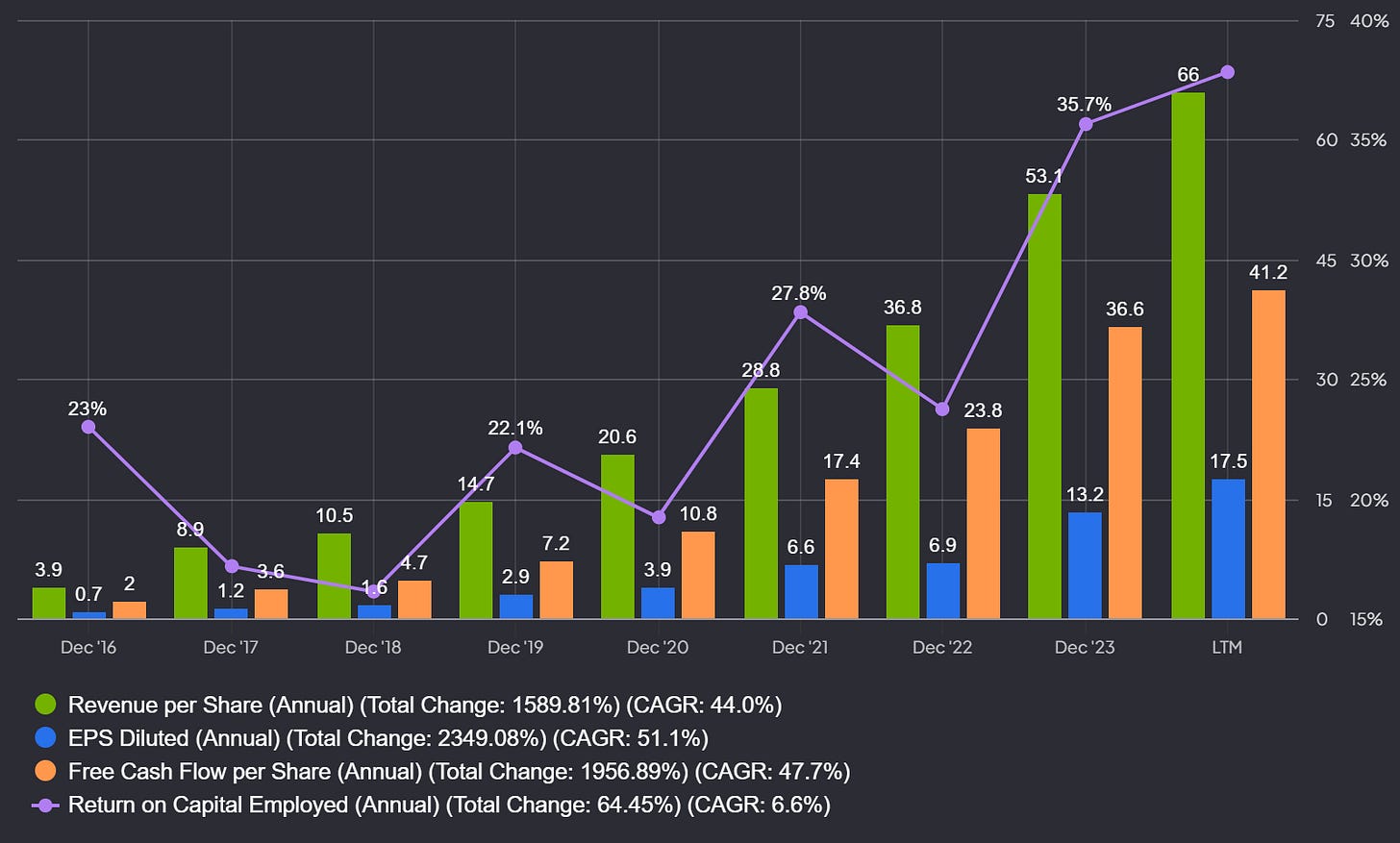

Revenue CAGR of 44.3% in the last 5 years

EPS CAGR of 50.5% in the previous 5 years

Misunderstood business model in a sin industry

Executive team with significant skin in the game

#3 Stock is a market leader well positioned to benefit from the digital transformation in the coming years - The stock has compounded shareholder capital by +23.9% annually over the last 5 years.

The valuation is attractive, and the company is well-positioned to grow, expanding its multiple and EPS over the next 5 years.

The investment case is attractive:

Low relative and absolute valuation

Strong business with a competitive advantage

High future demand for its services

Internationalization strategy to grow and expand

Without further ado, let’s get into the two stocks 👇🏻