🚀 3 Small-Cap Stocks to Buy

Fast growing quality stocks in attractive industries

Hello partner 👋

Today we’re looking at three compelling small-cap names worth your attention.

Historically, small caps have delivered stronger returns than their large-cap peers. This “size premium” was first documented by Fama and French (1992), who showed that smaller companies tend to outperform over time—especially when starting from discounted valuations.

U.S. market data going back to 1926 supports this: small caps have posted higher average returns over the long run, though with greater volatility and occasional multi-year lags.

In a market increasingly focused on mega-cap narratives, smaller names offer a fertile ground for long-term compounding—if you know where to look.

With that backdrop, here are three small-cap opportunities to consider: 👇

🧵 Infracom AB – High-Margin Swedish Compounder in Cloud Infrastructure

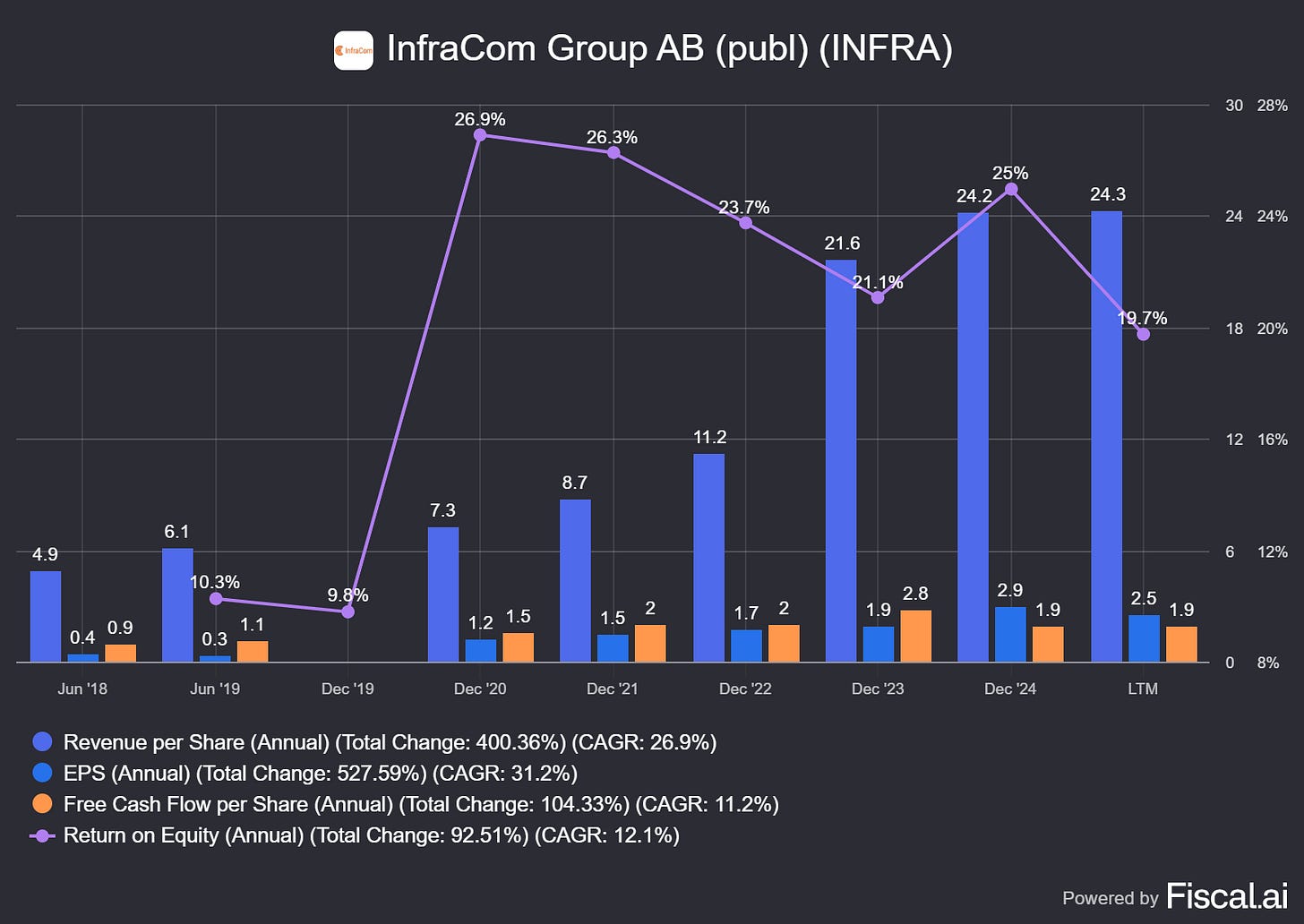

Infracom AB is a Nordic micro-cap that few investors outside Sweden track—but its financial performance suggests they should. With revenue growth of 43% in the last 3 years, +15% ROIC, and earnings compounding at over ~40% CAGR over the past five years, Infracom exemplifies a rare business: a small-cap software and IT services business quietly compounding capital at extraordinary rates.

The stock price has increased 27.2% CAGR in the last 5 years—the underlying business continues to grow profitably, and the PE is around 10 times earnings.

🖥 The Business: Mission-Critical IT Infrastructure for Nordic SMEs

Infracom provides cloud services, IT operations, and telecommunication solutions primarily to small and medium-sized enterprises in Sweden and neighboring markets. Its offerings range from managed hosting and voice-over-IP to secure data center infrastructure and private cloud environments.

Think of it as a vertically integrated, outsourced IT department for smaller businesses—selling stability, availability, and compliance in a box.

How Infracom Makes Money:

Cloud & Hosting Services – Recurring, contract-based revenue from managing clients' servers and private/hybrid cloud infrastructure

Telecom Services – Managed voice solutions and SIP trunking offerings tailored to SME needs

Managed IT & Security – End-to-end IT operations, from device management to firewalls and access control

M&A Flywheel – Infracom grows in part by acquiring smaller regional providers and integrating them into its efficient tech stack

The result is high recurring revenue, low customer churn, and growing wallet share from existing clients.

🏰 Does Infracom Have a Moat?

Yes—and it’s built on switching costs, local network effects, and infrastructure scale:

🧲 Switching Costs – Clients rely on Infracom to run mission-critical applications. Changing providers risks downtime, data loss, or compliance gaps.

🧠 Infrastructure Intangibles – Infracom owns and operates its own secure data centers, ensuring control over quality, uptime, and margin.

🧩 Consolidation Strategy – It consistently acquires and absorbs small regional players, increasing geographic density and achieving operating leverage.

📊 Financial Highlights (5-by Year Averages)

Infracom is compounding earnings significantly faster than the share price suggests—a gap that may eventually close, particularly if investor awareness improves or it uplists.

🧾 Final Takeaway

Infracom isn’t flashy. It doesn’t rely on macrocycles or consumer trends. Instead, it quietly delivers mission-critical IT infrastructure at high margins, reinvests cash flows at attractive returns, and compounds earnings faster than most companies 10x its size.

Despite the muted share price performance in recent times, the fundamentals tell a different story: this is a founder-led compounder with strong capital efficiency and growth in the Nordic small-cap space.