💎3 Quality Compounders (Valuation update)

3 High Quality businesses selling off

Hi partner! 👋

In this newsletter edition, I’ll give you an update on the valuation of interesting quality businesses that have recently sold off or are out of favor for some reason.

Let’s get into it 👇

📈 Copart: Quality Extraordinaré

Copart continues to defy conventional market cycles with a business model that remains very simple: digital auto salvage auctions. But beneath that simplicity lies a wide moat.

Business: Asset-Light, Margin-Rich, Data-Driven

Copart specializes in connecting sellers of totaled or damaged vehicles (mostly insurance companies) with global buyers via online auctions. Think of it as eBay for wrecked cars, but with high efficiency and international reach.

Recent developments:

Volume tailwinds: Rising vehicle complexity and high replacement costs continue to push insurers to total more cars. That’s great for Copart, which makes money on volume and service fees.

Geographic expansion: The company has quietly added capacity across Europe and the Middle East—especially in the U.K., where demand is surging.

AI & logistics upgrades: Copart is investing in smarter yard operations and data analytics to optimize pricing and turnaround, deepening its competitive edge.

While many tech-enabled businesses chase scale with burning cash, Copart posts 37%+ operating margins and maintains zero debt.

Valuation

Copart is trading near its 10-year median forward PE of 28.4x.

This indicates that the business is neither over- nor undervalued based on this metric.

The expectation is that Copart will grow its EPS by +15% long-term.

If Copart can achieve this, I believe Copart is priced attractively at its current $48 price point.

However, I would add that despite the expectations, Coparts’ EPS over the last few years has been steadily declining. From 15.8% growth in 2022, to a meager 5.9% growth in the last twelve months.

With this backdrop, let’s set up a discounted cash flow analysis for Copart:

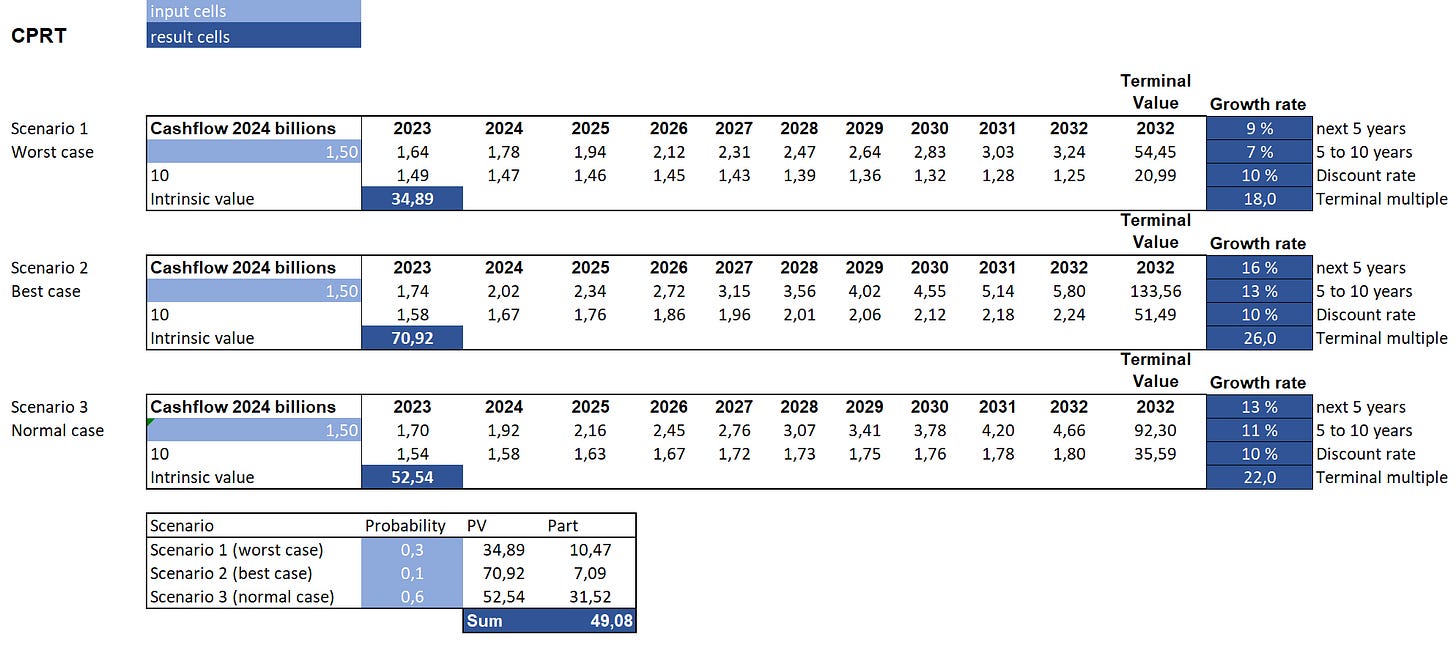

Worst case: 9% growth for 5 years, followed by 7% growth, valued at 18x earnings by the end of the period.

Best case: 16% growth for 5 years, followed by 13% growth, valued at 26x earnings by the end of the period.

Normal case: 13% growth for 5 years, followed by 11% growth, valued at 22x earnings by the end of the period.

Fair value estimate: $49.08

Current price: $48.14

Normal scenario CAGR expectations: 11%

Conclusion: Neutral

Copart is a high-quality compounded company, but the recent deceleration in growth can be a catalyst for re-ratings and downgrades. Therefore, we don’t believe the risk is currently worth the potential upside for Copart.

Investor Takeaway🧠

Copart exemplifies what we like to call a “compounder in camouflage”: not widely discussed in retail circles, rarely flashy, but quietly executing quarter after quarter. It benefits from long-term structural tailwinds (increased auto complexity, digital auctions, insurance logistics), has an impenetrable moat, and operates with ruthless efficiency.

While the market is distracted by AI—Copart is where capital compounds quietly.

Disclosure: We have no position in Copart at the time of writing, but it remains on our high-conviction watchlist for long-duration holdings. If Copart were to continue to fall to sub-$40 levels, we might become interested.

🥤 PepsiCo – Cash Flow Royalty

PepsiCo isn’t just a beverage company. It’s one of the most quietly effective cash compounding machines in global consumer staples—driven by a high-margin snacks empire (Frito-Lay), diversified global exposure, and pricing power that’s proven nearly bulletproof in inflationary conditions.

While it’s never the most exciting name in a portfolio, PepsiCo continues to execute with consistency, and that makes it valuable in a market obsessed with narrative over cash flow.

Business: Diversified, Defensive, Durable

PepsiCo operates across two primary verticals:

Beverages (Pepsi, Gatorade, Mountain Dew, SodaStream)

Convenient Foods (Frito-Lay, Quaker, Doritos, Lay’s)

Unlike Coca-Cola, which is highly beverage-dependent, PepsiCo’s business is balanced almost 50/50, giving it resilience during both consumption spikes and slowdowns.

Recent business developments:

Pricing > volume: In Q1 2025, PepsiCo once again grew revenue primarily through pricing power—proving the brand can hold margins without chasing volume.

Emerging market strength: India and Latin America posted double-digit organic growth, offsetting North American softness.

Productivity push: Ongoing automation in supply chain and distribution is driving mid-single-digit cost savings—expanding operating leverage.

Gross margins are stable at ~55%, with high-teens operating margins and ROIC consistently >15%. Free cash flow yield now sits at ~4.1%, one of the strongest in U.S. consumer defensive