💎 19 lessons from 100-bagger stocks

+10,000% returns and common themes from exceptional compounders

Hi investor! 👋

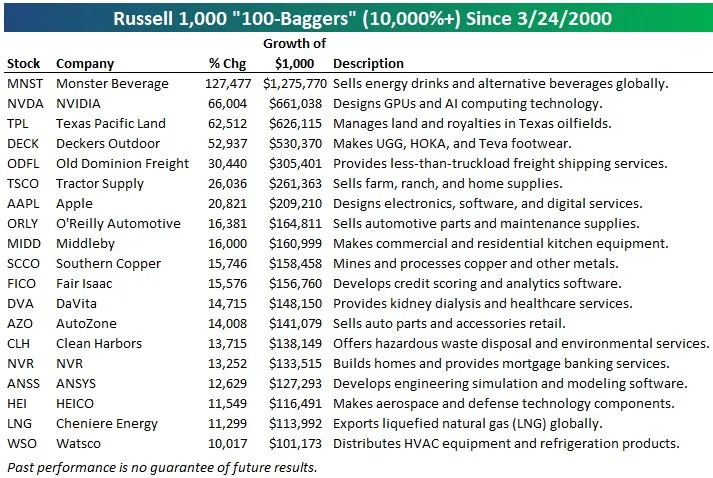

19 companies have achieved 10,000%+ stock market returns since 3/24/2000 from the Russell 1000.

In this article, we’re looking at insights & lessons from each of the 19 companies listed below:

Let’s get into it 👇

🧃 Monster Beverage MNST 0.00%↑

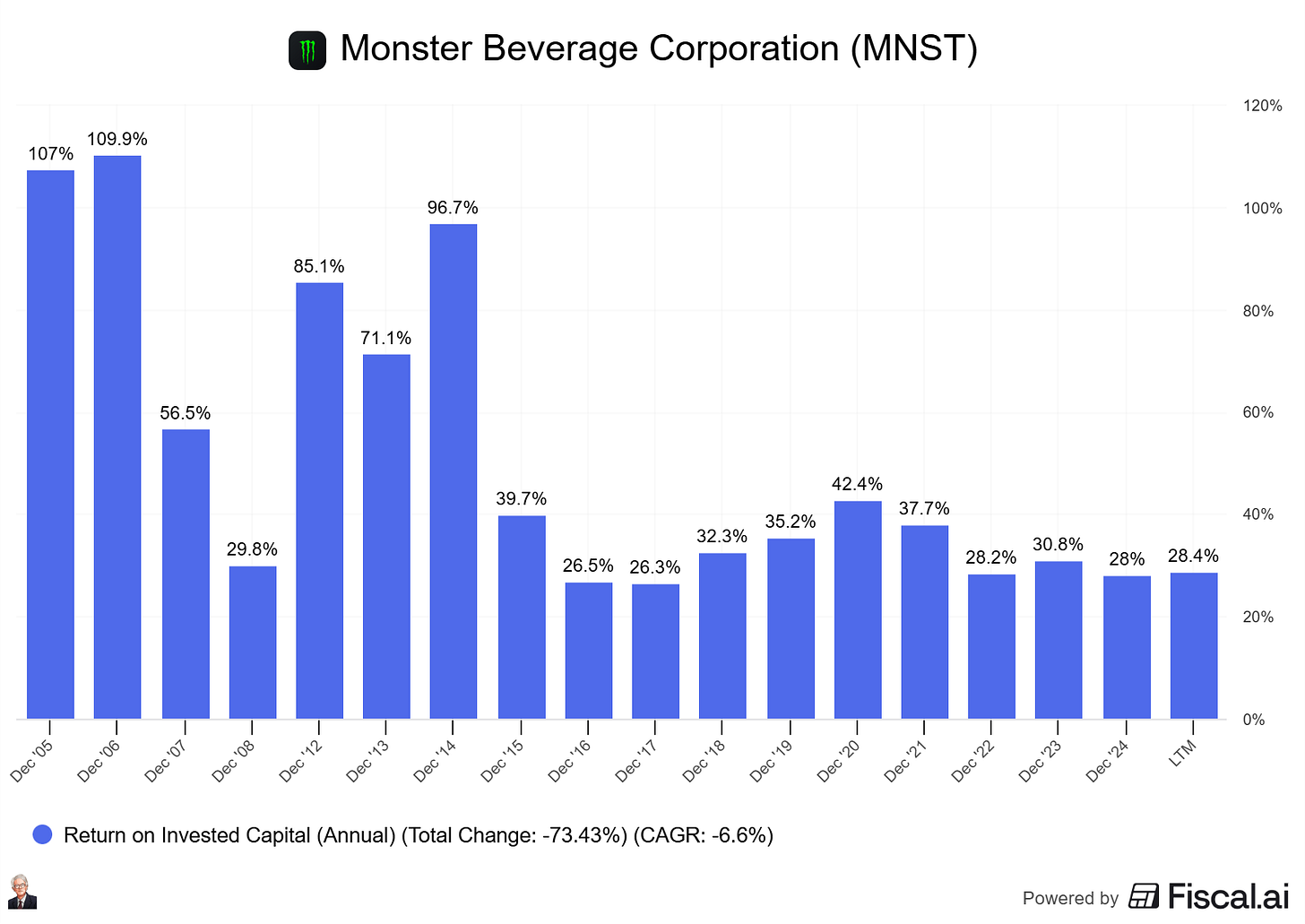

Focused on a single dominant product category (energy drinks) and expanded globally with low capital intensity.

Leveraged brand power and distribution through partnerships (Coca-Cola stake amplified reach).

Maintained asset-light model and high margins through licensing and outsourced production.

Monster had a long runway for growth, coupled with a high return on capital invested. This is the very definition of a compounding machine.

💻 NVIDIA NVDA 0.00%↑

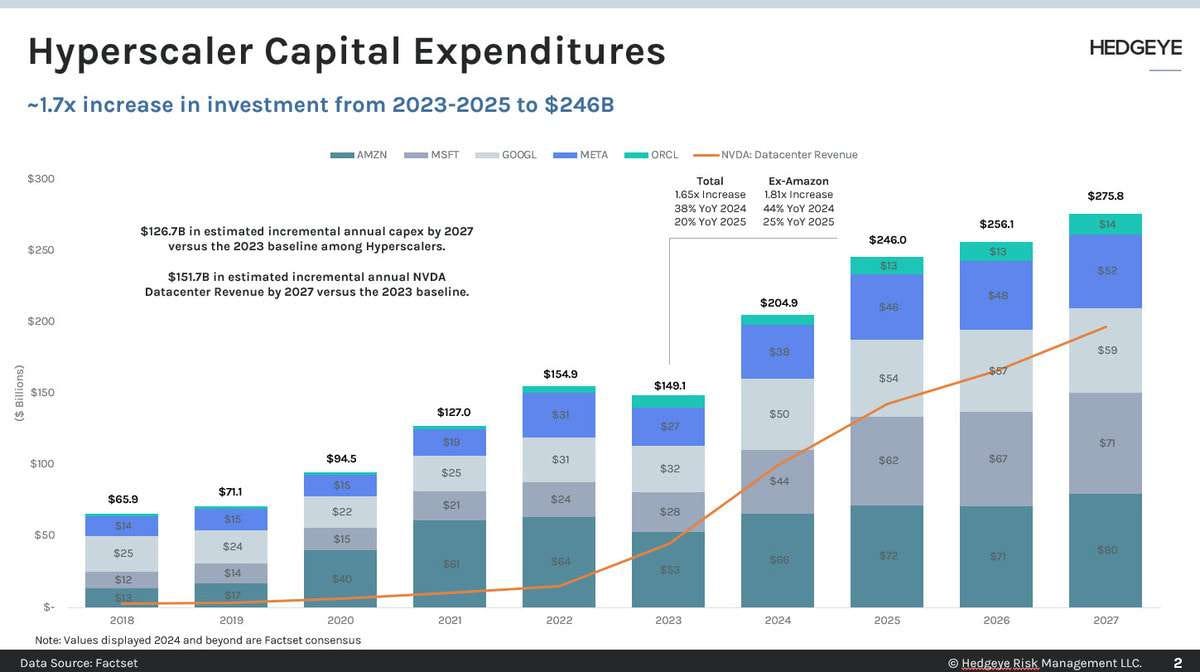

Continuously bet on emerging compute paradigms (graphics → AI → data centers).

Reinvented its core technology stack every decade while keeping a tight software–hardware integration (CUDA moat).

Transitioned from cyclical chipmaker to essential platform for global AI infrastructure.

🛢️ Texas Pacific Land TPL 0.00%↑

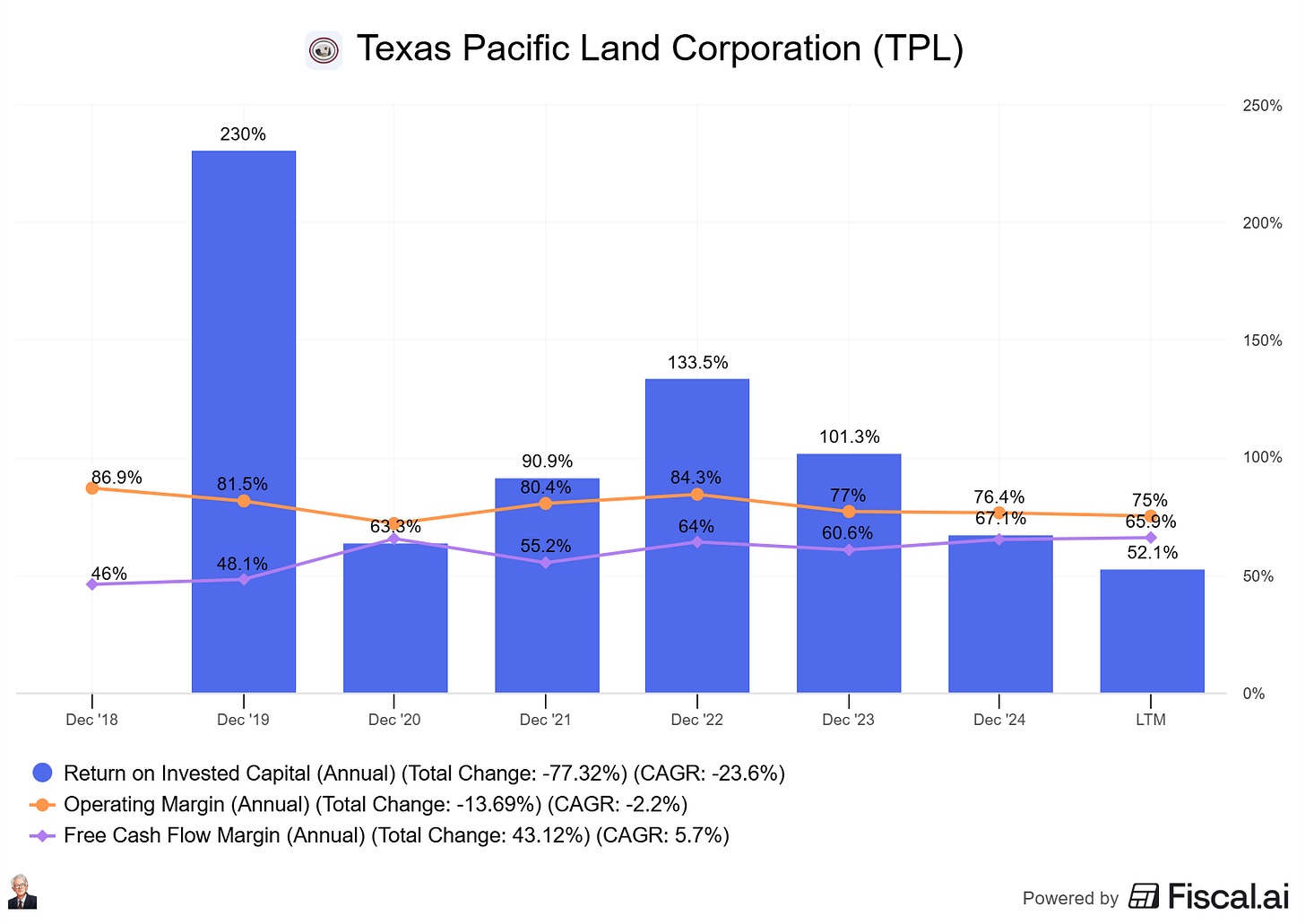

Monetized land ownership through royalties — a capital-light way to benefit from energy demand.

Benefited from structural tailwinds in U.S. shale and energy infrastructure.

Disciplined capital allocation, minimal capital expenditure needs, consistent share buybacks.

TPL has one of the most profitable business models out there (that actually scales), with consistent +50% ROIC and operating and FCF margins north of 65%.

The very definition of a cash-generating machine.

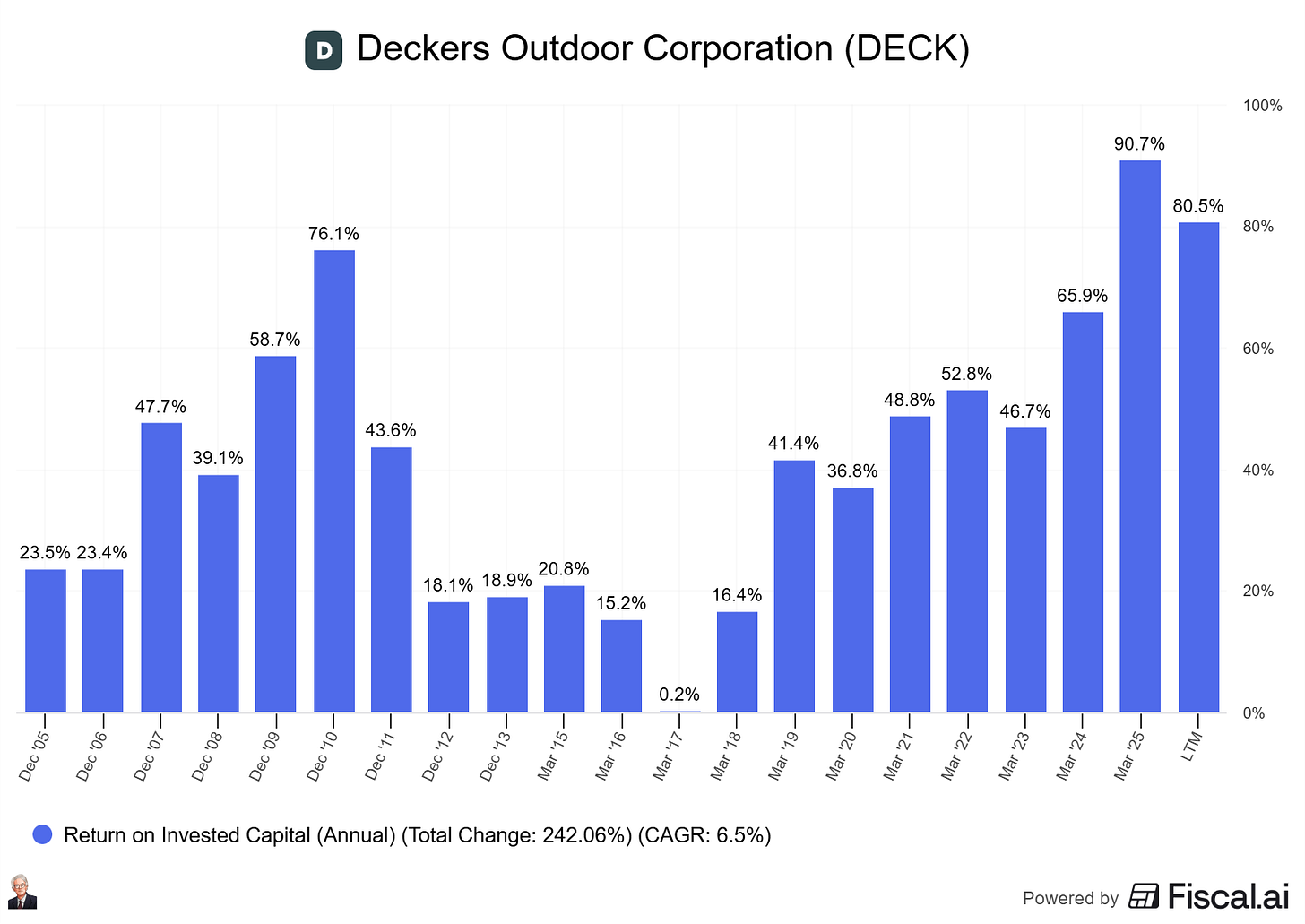

👟 Deckers Outdoor DECK 0.00%↑

Built niche footwear brands (UGG, HOKA) into lifestyle franchises.

HOKA exemplifies “innovation within comfort/performance” with superior unit economics.

Balanced brand expansion with tight cost control and direct-to-consumer growth.

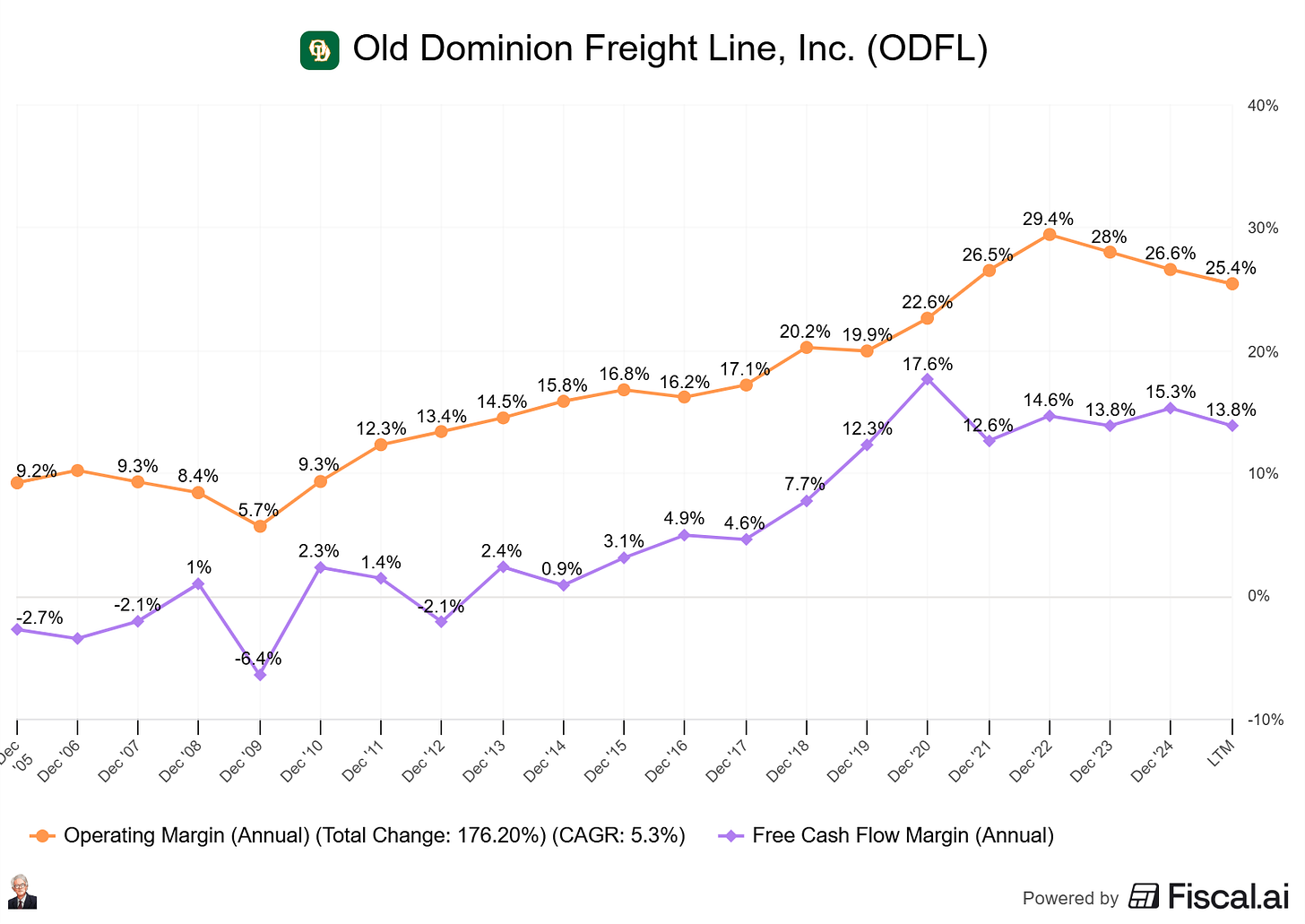

🚚 Old Dominion Freight Line ODFL 0.00%↑

Dominated a boring but vital industry (LTL freight) via operational excellence.

Focused relentlessly on efficiency, reliability, and service quality, not price wars.

Reinvested consistently in terminals, tech, and fleet, compounding returns in a commoditized field.